As the silver price continues its strength, The Deep Dive is bringing you a broad look at various types of asset classes that investors use to invest in silver, with examples. However, here’s your reminder that the following is not investment advice.

The most direct way to gain exposure to the silver price is to just buy some at the local coin dealer (shout out Vancouver Bullion and Currency Exchange, who always deal square, and didn’t pay us for this plug). The second most direct way is to hold exchange-traded silver products. These have the advantage of a bit more liquidity, and there’s nothing to bury in the back yard. The iShares Silver Trust (NYSEAMERICAN: SLV) has been at this for a long time, and tracks the silver price just fine. The Sprott Physical Gold and Silver Trust (TSX: CEF), formerly the Central Fund of Canada, keeps a gold-heavy mix, and a generalist will appreciate the balance.

Purist Silver Guys frown on ownership by proxy, and they have good reason. Anyone buying precious metals as a hedge against the collapse of the monetary system is going to feel pretty stupid holding a stock when it happens. Those planning for the apocalypse should be sure to get some 1 oz denominations, because nobody is going to be able to make change for a 1 kg bar while they’re busy fighting off zombies.

Numismatics

We aren’t sure what point zerohedge was trying to make with the above tweet, but silver coins trading at a premium to the spot price is the norm. Maybe Tyler is new to this. Coins have collector value, and are graded based on the scarcity of the minting and whether or not they’ve been circulated, and form their price out of the broader demand those things create. Investors who want to make a hobby out of their metals investment and chase down rare US buffalo $50 dollar pieces like they’re records or baseball cards can keep up with the latest on coinnews.net.

Mining Equities

There is less direct exposure to the silver price available through mining equities, which come in various different classes and are a different financial instrument all together. Mining businesses are subject to the same risks and challenges as any other businesses. The headwinds and tailwinds of the metals market are with them at all times, and the way those forces affect the companies (and their equities) are often a function of how the people running them have built and maintained them. Some are built for max exposure, others for safety, but they’re all generally considered a higher risk play than physical metals. To understand them, it’s best to start with a bit of metallurgical background.

Royalty & Streaming Companies

Metals are almost never mined alone. Deposits contain metals of primary, secondary, and tertiary interest to their operators, and processing circuits are set up to recover as much as possible, in order of interest, with the least amount of handling. Silver-primary mines exist, and the companies operating them have public equities that make moves directly proportional to the silver price, and do better or worse according to how much free cash flow, they generate, whether they pay dividends, etc.

But silver is a fairly common secondary metal in deposits being mined primarily for gold, copper or zinc. Regular readers will remember a February post about Metalla Royalty and Streaming (TSXV: MTA), in which we mentioned that Wheaton Precious Metals (TSX: WPM) practically invented silver streaming. The company is seeing a predictably strong price trend right now, keeping good pace with precious metals prices. Wheaton at an all-time high of $71.93 has a $32 billion market cap, is trading at almost 200x earnings, and 26x sales, and 4.5x its book value. That’s a bit on the rich side, but the volume explosion through the sustained price lift makes a good case for those valuations as an accepted baseline in this environment. WPM reports August 12th, and are in a position to reap the cost-controlled benefits they’ve so carefully sown.

Small and mid-tier producers

Better and improving silver prices are a fine time to look at well-run operations that have been taking a beating for lack of margin.

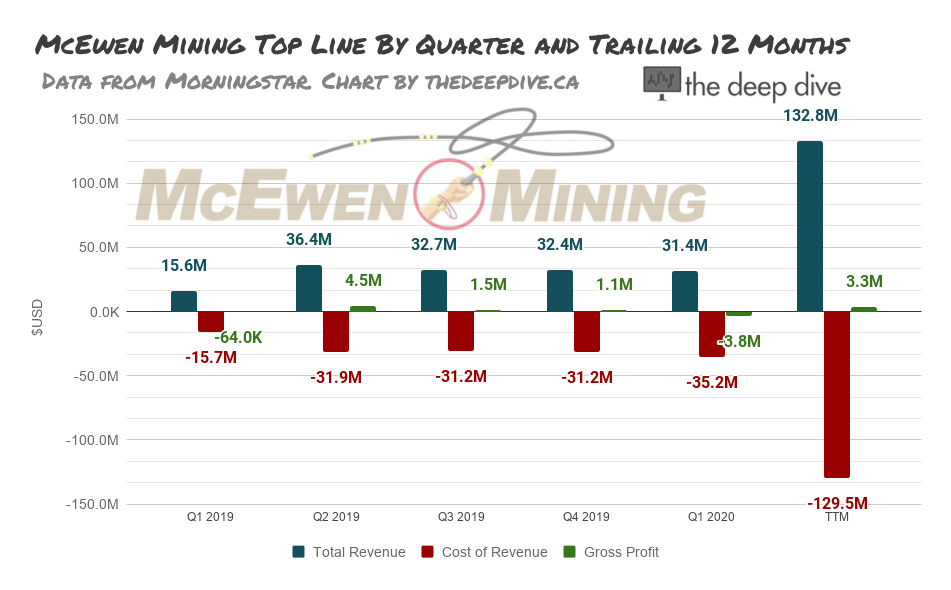

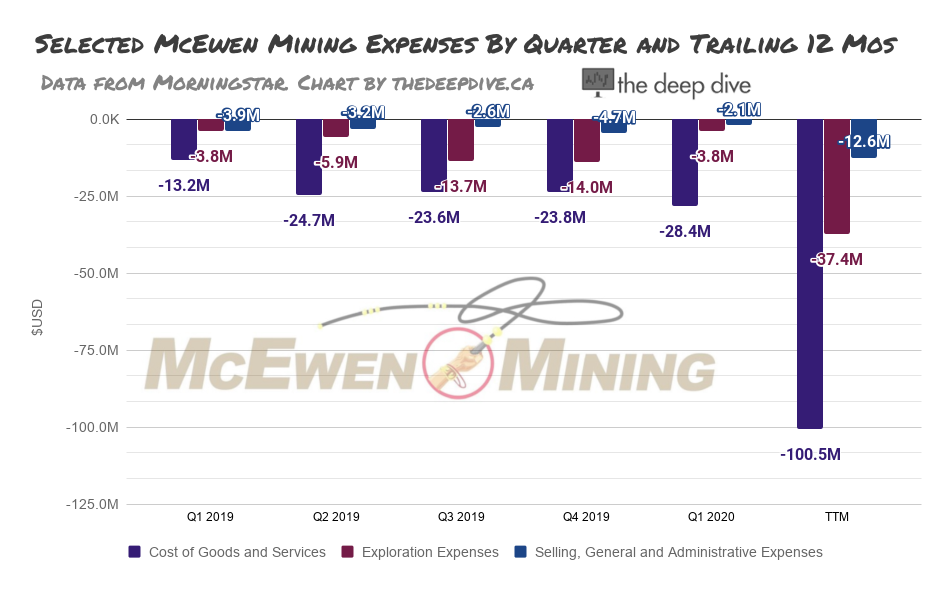

McEwen Mining Inc. (TSX: MUX) has been a perennial under-performer for as long as anyone can remember. It took an $83.8M impairment charge on the chin last quarter, as mineralized resources outside of its mine plan at the Gold Bar mine in Nevada failed to meet the asset impairment test. McEwen doesn’t turn a bottom line profit, largely because of a struggle on its top-line. The company has only recently ironed out cost control and debt issues.

If this top line belonged to a widget factory, it would be fair to suggest they make something else. But a consistent cost profile and a lack of hedging or forward sales means that it’s in a position to finally deliver.

Those exploration expenses are kind of like this widget company’s product development / R&D budget, and that investment stands to pay off, because the price of widgets is on the climb.

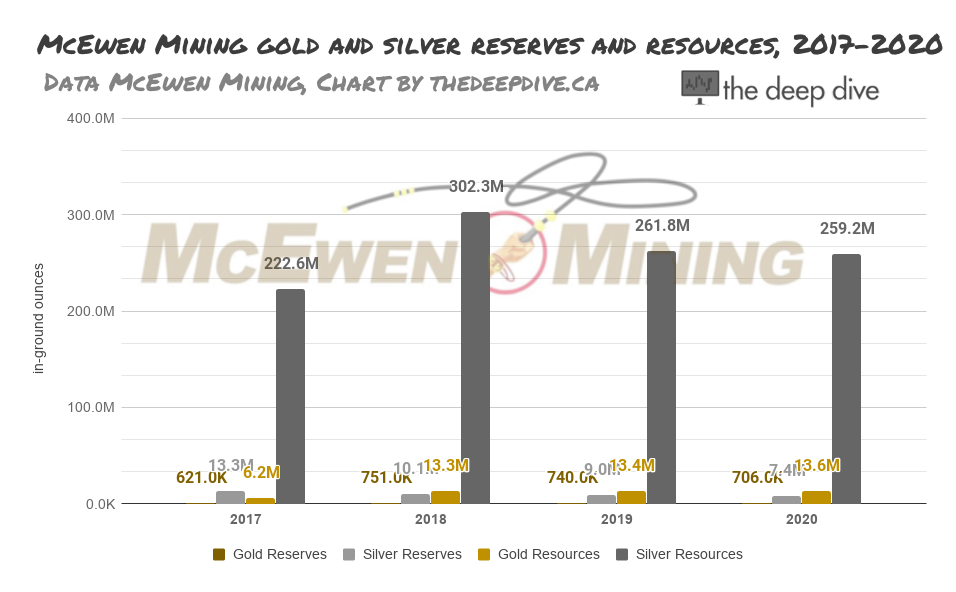

McEwen produced 359,400 ounces of silver last quarter in a COVID-shortened period, from its consolidated operations. It’s been doing enough drilling to replace its reserve base, so the in-ground assets have stayed relatively flat over time, by mass.

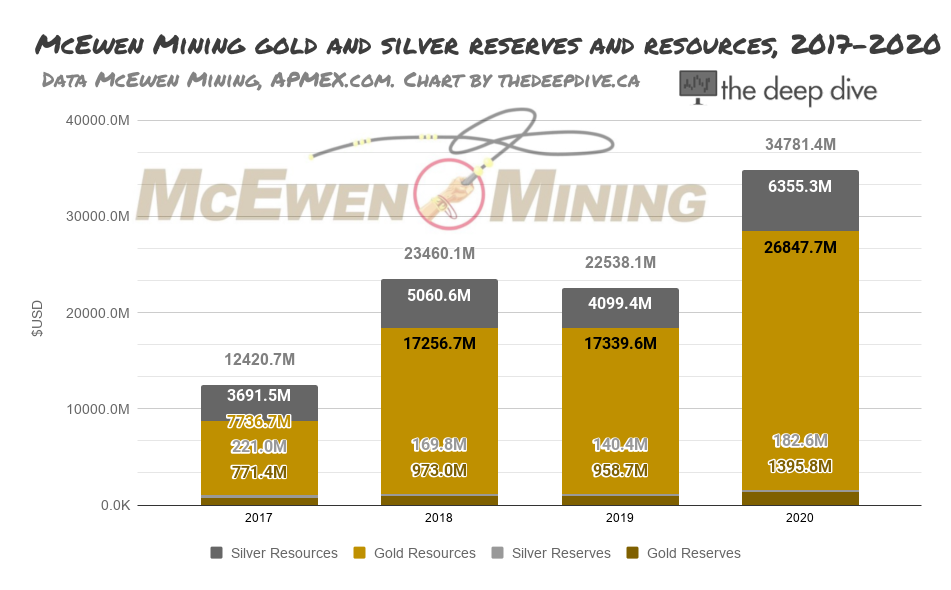

But the silver and gold that the company’s reserves are built around has seen a boom in dollar terms. These metals prices have MUX in a better position on the balance sheet, and the uninspiring top line will surely improve proportionally.

Silver accountes for about 18% of its gold equivalent ounces at current prices. Expect McEwen to open the production throttle and make the most of this environment for as long as it lasts.

Longtime shareholders are surely glad to see it up of the mat, above its moving averages. McEwen trades at a $738.8 million market cap, which is 3.8x sales, and 1.35x its book value. It does not have a PE, because it loses money.

Full disclosure: the author has been stuck in traffic behind an ox cart of a position in MUX for longer than he cares to admit.

Exploration and development companies

With the silver price on a tear, we expected to see all manner of silver developers in the volume and dollar-weighted volume leaders of the materials-heavy TSX Venture, but they’re scarce. That either means the move hasn’t come yet, or that venture money hasn’t wanted anything to do with silver for quite some time. The one silver fixture with consistent action is Discovery Metals (TSXV: DSV), whose raison d’etre is drilling off the Cordero silver project in Mexico. It’s a silver-lead-zinc deposit that the company bills as “one of the world’s largest undeveloped silver resources.”

They make the resource so far at 1.5 billion ounces of silver equivalent. The total resource size depends on what cutoff grade is used but, for the time-being, the company is busying itself with drilling it all out.

Discovery had $20 million in cash at the end of March, no debt, and just anounced another $35 million raise from their core backers. The release places Eric Sprott’s total holdings in DSV, pre-dilution at 27% of the total. Our research had him at a 28% interest fully diluted, before the placement. UK-based Merian Gold and Silver Fund, run by Jupiter Asset Management owns 34.2 million shares, a 13% stake.

Between March of 2019 and March of 2020, Discovery’s cap table inflated from 65 million shares to 211 million shares, a reflection of the cash-intensive process of de-risking a deposit to the point that a major mining company will one day be interested. These institutions know exactly what they’re building. The best-case-scenario for both institutional and retail shareholders is that the market for replacement reserves melt up with metals prices, as we described in last week in our guide to juniors.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities (other than mentioned above) or affiliations related to these organizations. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.