In early March, Lithium Americas (TSX: LAC) reported its fourth quarter and full year 2020 earnings. The company’s 4Q 2020 operating loss and cash flow deficit were US$8.1 million and US$7.1 million, respectively, approximately in line with figures reported for each of the first three quarters of 2020.

The most noteworthy part of the earnings release was Lithium America’s delaying the expected start date of production at its Cauchari-Olaroz lithium brine project in Argentina by about six months until mid-2022. Since October 2020, the company had projected construction to be complete by the end of 2021, and for production to commence in early 2022.

No specific reason was given for the delay, as the company said that the Cauchari-Olaroz construction schedule assumes a “reduced workforce at site in accordance with COVID-19 protocols,” virtually the same language it used in the 3Q 2020 when it affirmed the projected early 2022 production start date.

| (in thousands of US $, except for shares outstanding) | 4Q 2020 | 3Q 2020 | 2Q 2020 | 1Q 2020 | 4Q 2019 |

| Operating Income | ($8,065) | ($5,743) | ($6,494) | ($10,312) | $11,073 |

| Operating Cash Flow | ($7,108) | ($7,204) | ($8,355) | ($8,214) | ($4,094) |

| Cash – Period End | $148,070 | $71,888 | $49,719 | $82,122 | $83,614 |

| Debt – Period End | $121,221 | $122,294 | $151,371 | $150,076 | $114,999 |

| Shares Outstanding (Millions) | 101.1 | 91.4 | 90.6 | 90.0 | 89.8 |

Lithium Americas owns 49% of the Argentine project. China’s largest lithium company, Ganfeng Lithium, owns the balance. Cauchari-Olaroz is forecasted to produce 40,000 tonnes of battery-grade lithium carbonate annually for 40 years. Offtake agreements are in place for 90%+ of production. Total construction costs should be around US$565 million. About US$388 million of those expenditures were incurred through December 31, 2020, up from US$347 million as of September 30, 2020.

Successful Equity Offering

In January 2021, Lithium Americas raised a net US$377 million by selling 18.2 million shares of common stock at US$22 per share in an underwritten public offering. The company will utilize this sum, together with the US$148 million of cash on its balance sheet and US$184 million of undrawn credit facilities, to fund the construction of Cauchari-Olaroz and its 100%-owned Thacker Pass battery-grade lithium carbonate project in Nevada. (It is also possible that Lithium Americas could bring in a joint venture partner into the Thacker Pass project.)

Thacker Pass may produce 60,000 tonnes of battery-grade lithium carbonate for an even longer period than Cauchari-Olaroz, 46 years. Phase 1 Thacker Pass construction costs are projected to be US$581 million. In January 2021, the U.S. Bureau of Land Management (BLM) gave final approval, termed the Record of Decision, to construct and operate the project.

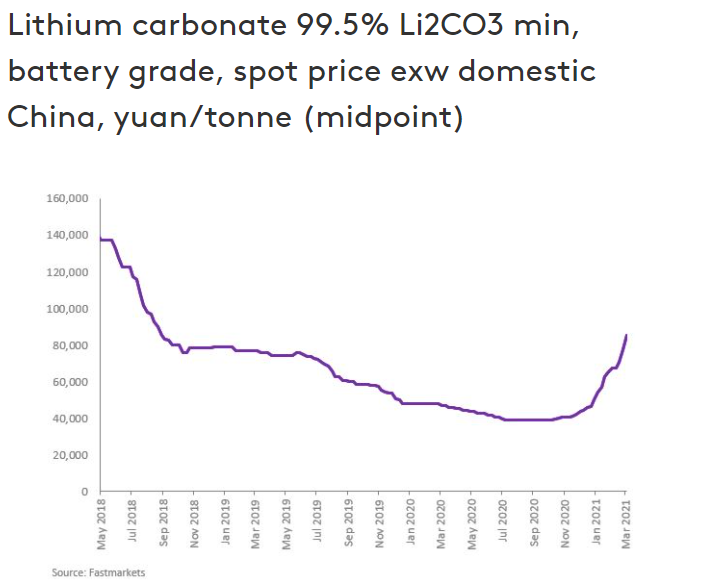

Lithium Prices Have More Than Doubled Over the Past Six Months

Battery-quality lithium carbonate prices continue to rise on almost a daily basis, reflecting the rapidly growing demand for electric vehicles (EVs). After bottoming at about 40,000 Chinese yuan (about US$6,200) per tonne in late summer 2020, per-tonne prices reached about 60,000 yuan (US$9,250) in mid-January, and 90,000 yuan (US$13,800) in early March.

The delay in the start-up of production at Lithium Americas’ Argentine lithium project is disappointing. Nevertheless, the company still owns major stakes in two potentially globally significant mines (in Thacker Pass’ case, a 100% stake) that will produce a material which promises to be in great demand. The rapid appreciation in battery-grade lithium carbonate prices is reflective of the metal’s strong fundamentals.

Lithium Americas is trading at $18.33 on the TSX Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.