This morning Cronos Group (TSX: CRON, NASDAQ: CRON) reported their third quarter results. We organized the numbers into quarter over quarter results for the reader:

| Q3 ‘ 19 | Q2 ’19 | % change | |

| Gross Revenue | $13.3M | $10.8M | 24% |

| Gross Profit (Before Bio Adjustments) | $7.4M | $5.5M | 36% |

| Fair Value of Bio Adjustments | $24.6M | -$0.5M | |

| Gross Profit (After Bio Adjustments) | -$19.4M | $5.9M | |

| G&A Expense | $21.3M | $15.2M | 40% |

| Comprehensive Income | $786.9M | $250.9M | 214% |

| Operating Cash Flow | -$26.4M | -$57.4M | -54% |

| Cash Balance | $1,475.5M | $1,579.2M | -7% |

| Receivables | $12.7M | $12.0M | 6% |

| Payables | $57.7M | $30.7M | 88% |

| Kilograms Sold | 3,142 | 1,584 | 98% |

| Adjusted EBITDA | -$23.9M | -$17.8M | 35% |

The quarter saw a 24% gain in top line revenue. As the company saw cannabis sales by weight increase by 98%, but average net selling price of dried cannabis decrease 42.6% from $6.19 to $3.55 per gram. In the MD&A the company highlights the reasoning for the decline in selling price of dried cannabis, as growth in the adult use market, increased wholesale, and lower priced hemp sales.

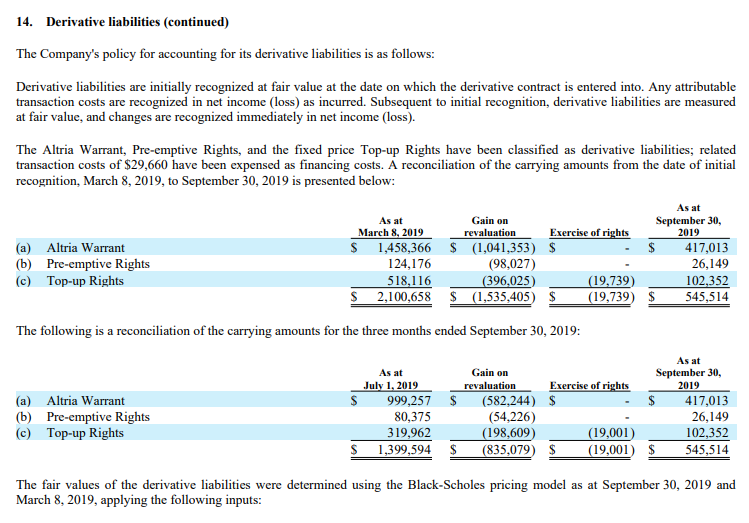

A Large Gain From their Share Price Going Down: Re-evaluation of Derivative Liabilities

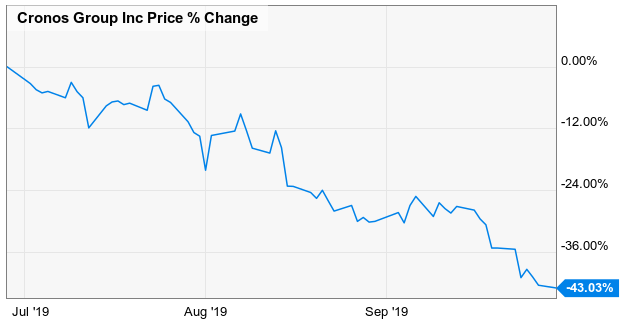

The company saw a non-crystallized gain as a result of the reevaluation of the warrants, pre-preemptive rights, and top up rights from the Altria investment. Effectively resulting in a paper gain for Cronos from their share price declining.

Cronos Share price fell approximately 43% over the quarter largely representing the re-evaluation of the financial derivative, which made up more than the comprehensive income figure.

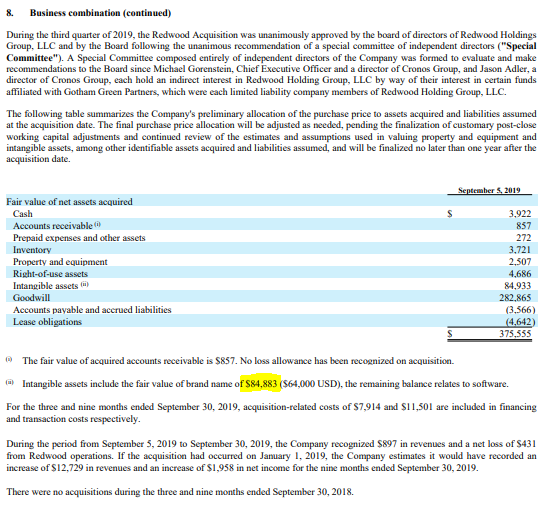

The Lord Jones Acquisition : 98.7% Goodwill Intangible Assets and “Right of Use Assets”

We finally got to see the details from the $375M transaction where Cronos Group took out CBD “giant” Lord Jones. The acquisition consisted of mainly intangible assets including Goodwill, Intangible Assets and Right of Use Assets. Hilariously, they somehow decided the brand name “Lord Jones” is worth $84.9M.

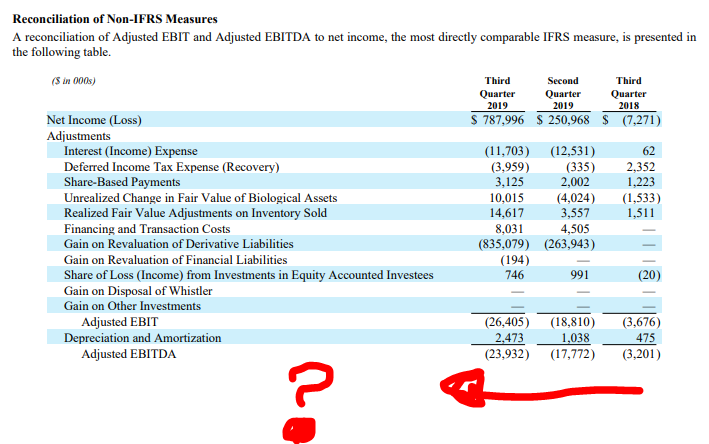

Somehow as Full Rec Keep Rolling, Cronos Keep Losing More in EBITDA

We have completed the third full quarter of recreational cannabis in Canada and somehow Cronos only seems to lose more money each quarter. On an Adjusted EBITDA basis, the company has gone from losing $3.2M per quarter to $23.9M per quarter.

SmallCapSteve’s Final Thoughts

Overall, the quarter looks to me more like financial engineering with no real cash flow to justify the valuation. The argument behind Cronos has always been that the value in the company lies in the investment in Ginkgo Bioworks, a company focused on genetic engineering which could prove to be game changing for cannabis.

From a morning glance at these earnings, it’s hard to justify the current valuation and if I we’re an Altria shareholder I wouldn’t be happy with this investment to date.

Information for this analysis was found via Sedar and Cronos Group. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.