Lordstown Motors, the company that once aimed to revolutionize the electric truck market with its Endurance EV, is now on the brink of complete and utter failure.

Today we’re going to walk through how the company, which was worth almost $5.5 billion only three years ago, is now warning that without additional funding, it will be forced to declare bankruptcy.

Lordstown’s beginnings

Let’s start the story in the small town of Lordstown, Ohio. A small town with a population of only 3,300, it’s one of those places with a single elementary and high school.

But this town use to have quite the economic engine. The village housed a massive 6.2 million-square-foot production facility where General Motors used to build cars; in the 1990’s the plant employed north of 10,000 people. Throughout the 2010s, General Motors built the Chevrolet Cruze at the plant, which at one point was one of their best selling vehicles.

But over the years, the Cruze lost its luster and in late 2018 GM announced they would stop production of the Cruze, citing changing consumer preferences and a shift to electric vehicles. Which nearly 5 years later, still has us wondering where all their EVs are.

The closure made headlines, with State and local officials voicing their distaste for the move, even going as far as looking into clawing back $60 million dollars in subsidies General Motors had received over the previous eight years.

It even got the attention of then-President, Donald Trump, who tweeted, “Very disappointed with General Motors and their CEO, Mary Barra, for closing plants in Ohio …. We are now looking at cutting all GM subsidies.”

Very disappointed with General Motors and their CEO, Mary Barra, for closing plants in Ohio, Michigan and Maryland. Nothing being closed in Mexico & China. The U.S. saved General Motors, and this is the THANKS we get! We are now looking at cutting all @GM subsidies, including….

— Donald J. Trump (@realDonaldTrump) November 27, 2018

When when the plant finally closed in 2019, Trump again went to Twitter to say, “ I am not happy that it is closed when everything else in our Country is BOOMING.” He then went on to ask Mary Barra to sell the plant to someone who would use it.

Lordstown’s early days

And, then came General Motor’s savouir, Steve Burns, the founder of EV startup Lordstown Motors. Burns was a traveling capital markets salesman, and a guy with quite the reputation for starting things and not finishing them.

Fresh off his tenure from one of his many ventures, Workhorse Group, Burns was looking to continue the development of an EV platform initially established by his former company known as the Workhorse W-15. His new startup, Lordstown, would license this tech from Workhorse for $12 million and a 10% stake in the company, rebranding the vehicle as the Endurance EV.

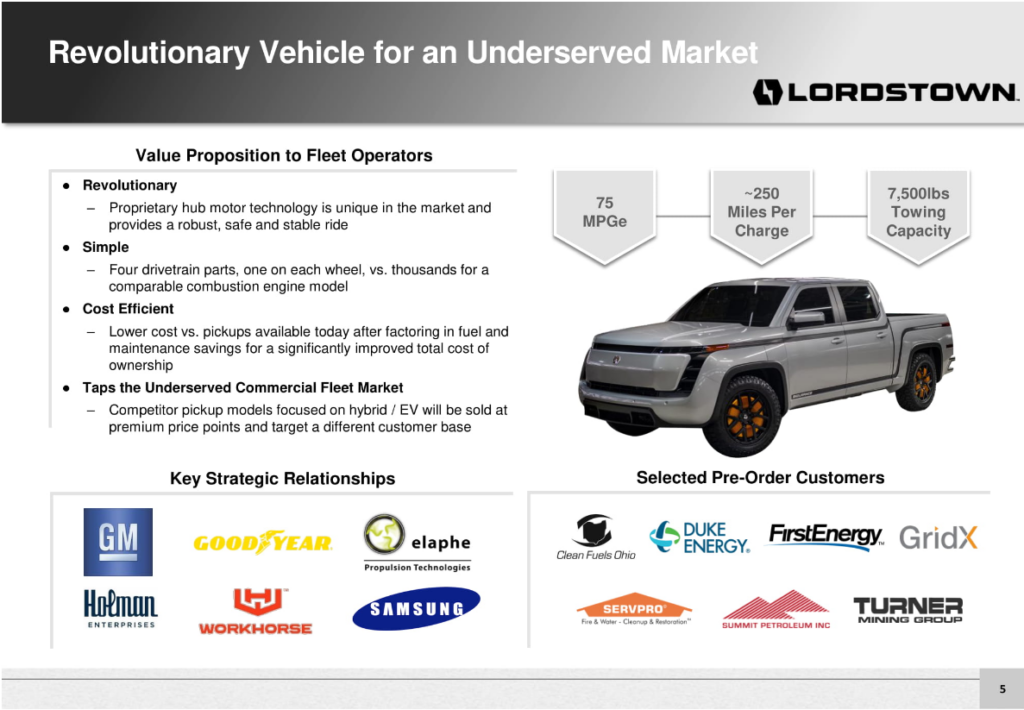

Lordstown had an ambitious plan. They would produce the Endurance and sell it for $52,500 per truck. Claiming a 250-mile range on a single charge, the Endurance was marketed as having significantly lower maintenance costs compared to traditional pickup trucks.

To manufacture this new concept for a pickup truck, Lordstown, purchased the facility in the town it was named after. The company acquired the facility from GM for $20 million, with GM loaning an extra $40 million for retooling.

Despite the optimism surrounding Lordstown and its flagship vehicle, the company faced significant challenges that would soon come to light.

The SPAC presentation

In clear need of capital, the company looked to take similar action as many startups that needed big cash. They would look to raise money in the hot SPAC market.

Now, in order to lure in investors, the company presented itself with ambitious production estimates and financial projections. The August 2020 presentation highlighted the production complex’s capacity to output 600,000 vehicles annually, positioning Lordstown as a first-mover in the full-sized electric pickup market.

Around this time, the company put together a promotional video, where Burns rallied the story around the hard working people from Lordstown Ohio, and how this truck would be for the hard working man.

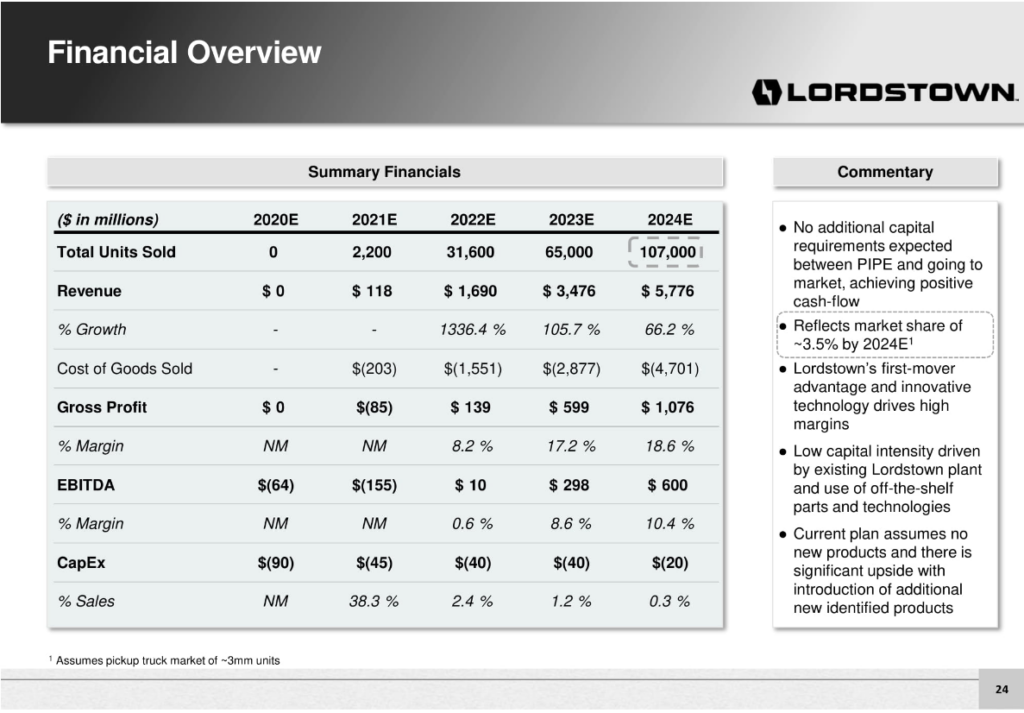

Burns indicated that $450 million was needed to get the Endurance into production by mid-2021. And with COVID stimulus checks flying, investors lined up. The company raised $500 million in a private financing, including a notable $75 million investment by General Motors.

With this funding secured, Lordstown set production targets of 2,200 vehicles in 2021, telling investors the production would grow to over 100,000 just one year later.

Even President Donald Trump was on board.

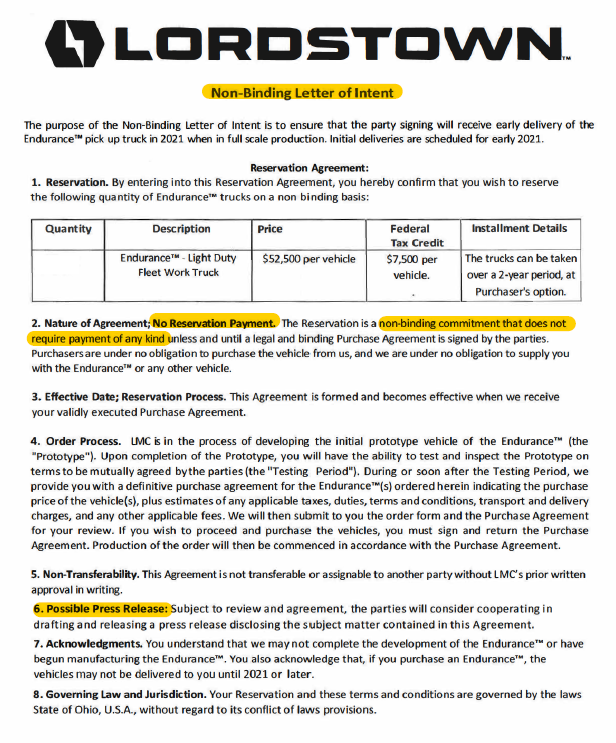

Part of the intrigue from investors, was a preorder list of 100,000 trucks. Of course, details on where these orders came from were fuzzy.

Lordstown, led by Steve Burns, was pounding his chest that this company would be a leader in the electric truck market.

Burned by the shorts

However, the company’s projections soon came under scrutiny. Some people had seen this picture before, but of course waited for the disaster to develop until finally speaking up.

In March 2021, Hindenburg Research, led by Nate Anderson, released a damaging report on the company.

The report alleged that the company’s pre-orders were largely fictitious, used as a prop to raise capital. Lordstown had consistently pointed to its book of 100,000 pre-orders upon its go-public as proof of deep demand for the Endurance.

However, Hindenburg’s investigation revealed that some of these orders came from non-existent or non-committal customers. For example, one order of 1,000 trucks worth $52.5 million came from a 2-person startup that acknowledged it wouldn’t actually order any vehicles, while another 14,000-truck deal supposedly representing $735 million in sales came from a residential apartment in Texas.

The report also claimed that Lordstown Motors had paid a consulting group, Climb2Glory, to generate pre-orders. The consulting firm received $50 per pre-order, which was effectively paying people to sign non-binding letters of intent, which didn’t even require a deposit.

The Hindenburg report also alleged that Lordstown’s founder, Steve Burns, was pushed out of Workhorse by the board due to his inability to focus and execute projects. Saying that Burns wasted R&D money and missed deadlines, leading the board to lose confidence in his ability to lead the company.

Economic fallout

Following the fallout from the Hindenburg report, Burns and CFO Julio Rodriguez resigned on June 14, 2021. Though no formal reason was given, the resignation happened right after Lordstown Motors announced the results of their own internal investigation from a special committee.

But before Burns resigned, he went on to CNBC, wielding a hardhat and Lordstown branded vest, to respond to the short report. And less than 30 seconds into the interview, Mr. Burns “cleared up” what pre-orders meant to him. He then continued to deflect from answering Hindenburg’s main claim.

While the investigation concluded by saying Hindenburg’s claims were “false and misleading,” it did admit that the board identified “issues regarding the accuracy of certain statements regarding the Company’s pre-orders.”

This did not stop both the United States Department of Justice and the SEC from opening up their own probes into the accusations put forth.

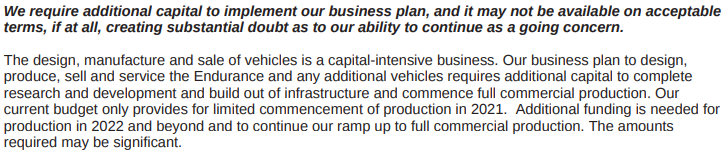

In the midst of all this, Lordstown amended its annual report, stating that the company did not have enough money to begin commercial production of its vehicle and was at risk of bankruptcy.

The Foxconn deal

To help address these challenges, Lordstown entered into an in-principle agreement in September 2021 to sell its massive assembly plant to electronics contract manufacturer Foxconn for $230 million. Under the deal, Foxxconn, known for assembling Apple’s iPhones, would assemble the Endurance EV, allowing Lordstown to leverage Foxconn’s supply chain and manufacturing expertise.

The idea was that Foxconn would also purchase a nearly 20% stake in the company for up to $170 million. They initially invested $52 million into Lordstown, giving the company a much-needed capital infusion, with the remainder to be invested following government approvals and certain milestones being met.

Eight months later the deal was finalized, leading to the creation of a new joint venture to develop and produce a line of EVs. Despite these developments, Lordstown continued to face production delays and financial challenges, admitting in August they would need to raise “substantially more capital” to produce their initial goal of 500 vehicles.

2023 decline

But the problems didn’t stop there.

In early 2023, the company halted production and shipments of Endurance electric trucks to address quality issues. They also issued a voluntary recall for 19 of their 37 pickups delivered to date, due to a specific electrical connection issue.

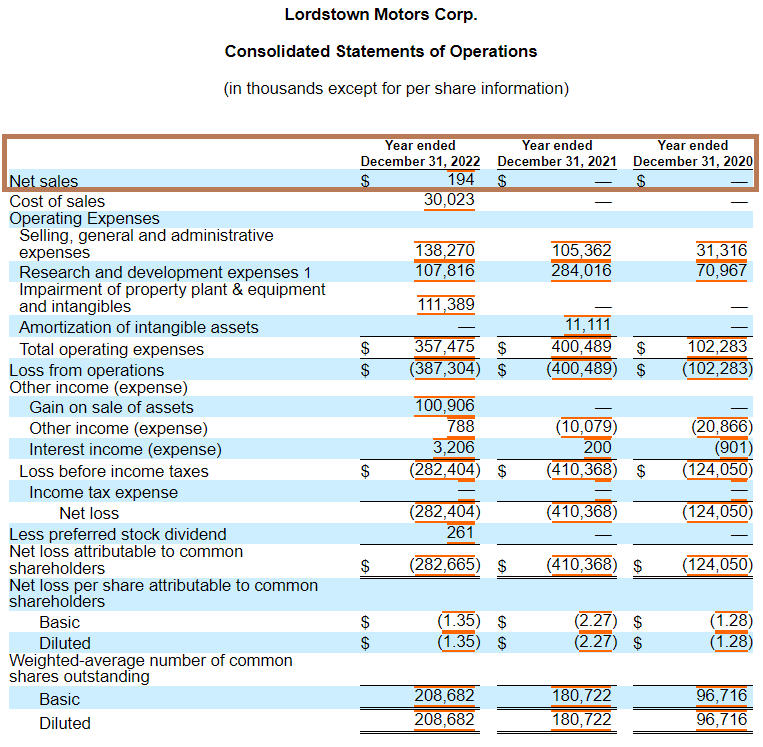

While original estimates had called for 2022 top line revenue to exceed $1.7 billion, the reality was the company saw a paltry $194,000 in sales that full year.

Further kicking them when they’re down, Foxconn then issued a letter to Lordstown indicating that the startup had breached the terms of its investment based on its share price falling below $1.00 for a period of thirty trading days, which triggered a delisting notice from the Nasdaq. Weeks later Foxconn threatened to walk away from their additional funding commitments.

In conclusion

Let’s wrap it up.

You know, producing cars is hard. It takes a lot of money, experience and strategic wisdom to get to the finish line for any company trying to take on the task of mass producing vehicles.

In fact, Lordstown isn’t the only EV startup that raised tremendous amounts of money now facing potential bankruptcy.

When you think about it, what Tesla accomplished is truly remarkable. Love Elon or hate him, what Tesla accomplished is about as rare as seeing a unicorn driving a DeLorean. Now, it’s important to understand investors love the idea of being early on a company like Tesla.

From 10 years ago, to all time highs, Tesla was a 75 bagger. And today has a rabid fan base that has propelled nobody’s who championed the stock into fame like Cathie Wood, Meet Kevin and Ross Gerber.

Balancing ambition with realistic expectations is crucial. But more importantly, and I keep saying it in many of these videos, the difference a zero interest rate environment, filled with government stimulus, verses one where interest rates are in the mid single digits, requires capital allocators to take less risk. Substantially less.

Where would the company sit today if the US 10 year was still at 55 basis points? I don’t know. They may have been able to keep raising capital, and bring in stronger management. But without capital, it’s nothing more than a pipe dream.

The difference between Tesla and all these other EV SPACs from the early 2020s, is that Tesla started out small, and then scaled. They didn’t go straight for scale.

Lordstown serves as a cautionary tale for other electric vehicle startups, and more specifically retail investors. EV startups are a really risk bet. And Lordstown serves as a reminder keep your eyes on the road and be careful while dreaming too big.

Information for this briefing was found via Reuters, Bloomberg, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

3 Responses

Pretty much the “bear” side of the story. No mention of the Endurance up for Truck of the Year. No mention of the FTD’s every single day on a microcap stock for almost two years. No mention of the short daily % being over 50% for over a year and over 60% in recent months. All of the bear arguments for past 2 years have been proven false. Are you saying that every truck made by Lordstown Motors won’t sell? With massive demand for full size EV trucks and inability to fill it for years? Ford bashed hub motors but was secretyly filing a patent for them? The only knock on them now is lack of capital and that is b/c they have been relentlessly attacked and shorted. Level II data doesn’t lie, so your thorough story seems like another paid article to bash an American EV startup in Ohio. Lots of institutions have loaded up on shares recently. Will see how it plays out.

Hilarious how you delete all the critical comments btw

this is trash reporting even for Jay. how are you not even going to mention Edward Hightower? Very suspect. Steve hasn’t worked there in two years and the stock was $12.50. He had passion was 10X better than Ed or Dan who ran this company into the ground