Investors in Lucid Group, Inc. (NASDAQ: LCID) stock seem to continue to emphasize hope over that of an evenhanded assessment of opportunities and risks. On October 25, Lucid shares rose 11.4% on two pieces of news: a company Tweet on October 24 showing a car trailer carrying six covered Lucid Air models; and the rental car company Hertz’s October 25 announcement that it planned to order 100,000 Tesla models by the end of 2022.

Neither is, in our judgment, particularly material for Lucid.

First, in a September 28 press release, Lucid announced that it will begin delivering Lucid Air Dream Edition models in late October. So, the non-captioned car carrier picture issued by Lucid should not have been considered “news.” Indeed, the only development that would have been especially noteworthy would have been Lucid’s missing a self-imposed late October commencement delivery target issued less than a month ago.

Second, Hertz’s decision to order 100,000 Teslas over the next 14 months represents a further validation of the mainstream role that electric vehicles (EVs) play in the automotive sector. However, it is difficult to see how that news could be more than a tangential positive for Lucid. After all, Hertz ordered Tesla models, not Lucid models.

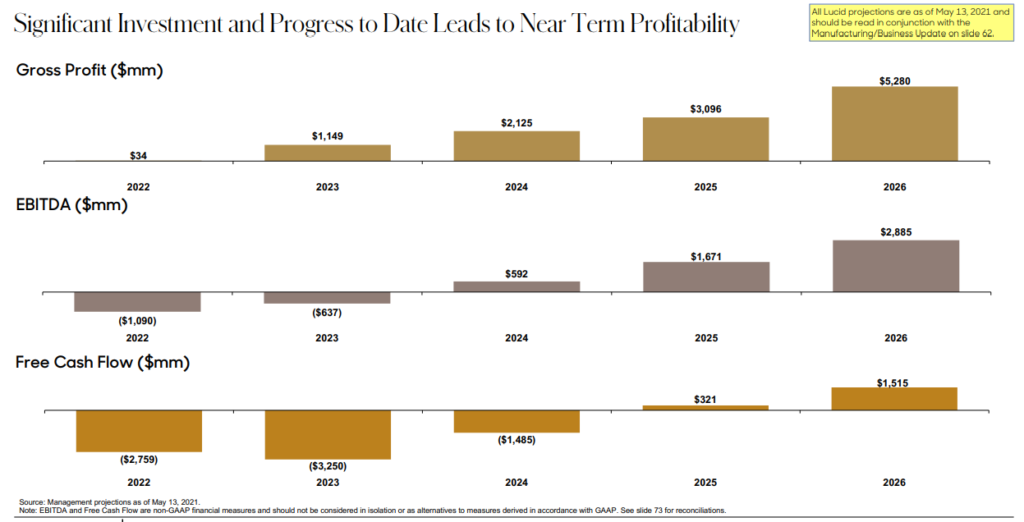

Lucid’s elevated valuation is the most problematic issue for investors. According to its own projections (which it has not updated in some time and could be subject to reductions), Lucid will not turn EBITDA positive or free cash flow positive until 2024 and 2025, respectively.

By 2025 and 2026, the company hopes to realize gross margins of 22% – 23%. In 2026, the company hopes to generate US$2.9 billion of EBITDA and US$1.5 billion of free cash flow. So, even based on estimated 2026 EBITDA, Lucid’s current implied enterprise value-to-2026E EBITDA ratio is around 14x, a high figure for any growth company. Alphabet Inc. (NASDAQ: GOOG) trades at around a 20x enterprise value/EBITDA ratio based on current EBITDA.

As of September 30, 2021, Lucid’s short interest was 53.1 million shares, a high absolute number, which at first glance could suggest the possibility of a meme stock-like short squeeze. However, the 53.1 million shares shorted represents only about 3.3% of total shares outstanding of 1.62 billion, and just 1.0 times Lucid’s average daily trading volume. Several other start-up EV manufacturers have a larger proportional short interest, which in turn equates to a larger multiple of average daily trading volume.

On the other hand, unsubstantiated rumors on Twitter that the sovereign wealth fund of Saudi Arabia could increase its investment in Lucid would, if true, be a positive for Lucid. The fund’s current stake in the company is worth more than US$20 billion, almost all of which is profit. However, there has been no confirmation that the rumors are anything more than just that.

Lucid stock’s +11.4% reaction to the car carrier photo and to the Hertz-Tesla news seems far too aggressive. Indeed, that share price move boosted Lucid’s stock market value by US$4.4 billion. Most importantly, and factoring in this stock price move, Lucid’s enterprise value-to-2026E valuation continues to look quite stretched.

Lucid Group, Inc. last traded at US$27.30 on the NASDAQ.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.