Lucid Group, Inc. (NASDAQ: LCID) stock has been a standout performer over the last few weeks, rising ~54% in a down and increasingly cautious stock market. The chief reasons for the strong performance appear to be a constructive September 16 U.S. Environmental Protection Agency (EPA) announcement regarding the driving range of its flagship Lucid Air model, and a bullish research report written by Bank of America Securities (BofA) published on the same day.

First, the Dream Edition R, Dream Edition P, and the Grand Touring models all achieved driving range ratings of around 500 miles, well above the ranges of other electric vehicles (EVs), including Tesla’s model S.

Second, the BofA report conjectured that the Lucid Air Dream Edition will ultimately be deemed a “combination of Tesla and Ferrari.” In turn, the firm assigned a US$30 per share price target to the stock. (We note that earlier in the week a Morgan Stanley analyst initiated Lucid coverage with a US$12 a share price target.)

The difficulty in adopting a bullish take on Lucid is its giant valuation. According to its own projections (which it has not updated in some time and could be subject to reductions), Lucid will not turn EBITDA positive or free cash flow positive until 2024 and 2025, respectively. By 2025 and 2026, the company hopes to realize gross margins of 22-23%.

In 2026, the company hopes to generate US$2.9 billion of EBITDA and US$1.5 billion of free cash flow. So, even based on estimated 2026 EBITDA, Lucid’s current implied enterprise value-to-2026E EBITDA ratio is nearly 12x, a high figure for any growth company. Alphabet Inc. (NASDAQ: GOOG) trades at around a 20x enterprise value/EBITDA ratio based on current EBITDA.

Lucid’s short interest is 44.14 million shares (as of August 31, 2021), a high absolute number which suggests the possibility of a meme stock-like short squeeze. However, the 44.14 million shares shorted represents only about 2.7% of total shares outstanding of 1.62 billion, and just 2.6 times Lucid’s average daily trading volume. Several other start-up EV manufacturers have a larger proportional short interest, which in turn equates to a larger multiple of average daily trading volume.

On the other hand, there are two short-term positives for Lucid. First, the period during which insiders could sell their shares in the open market has passed, in theory relieving some selling pressure on the stock. This window closed on September 1. Second, Lucid plans to begin some customer deliveries of the Lucid Air Dream Edition (at a fully equipped price of US$169,000) later this year.

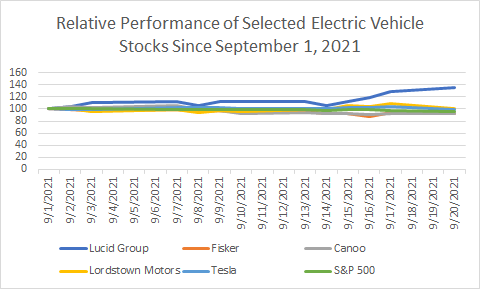

Relative Performance of Lucid — White Hot Over Last Three Weeks

Since September 1, Lucid stock has dramatically outperformed the typical EV stock and the overall market, rising about 54%. Lordstown Motors Corp. and Tesla, Inc. are approximately flat over this time frame, while Fisker Inc., Canoo Inc. and the S&P 500 all are lower. In the figure below, the S&P 500 and each of the stock prices are presented in index form where 100 is the uniform starting point.

The EPA’s driving range estimates for Lucid’s flagship vehicle and the bullish BofA stock call are clearly positive factors for the company. However, Lucid stock’s reaction to the news seems too aggressive, particularly given the sluggish performance of other EV stocks. In addition, Lucid’s enterprise value-to-2026E valuation continues to look stretched.

Lucid Group, Inc. last traded at US$24.92 on the NASDAQ.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.