On January 10th, Lundin Gold Inc. (TSX: LUG) announced its 2021 full-year production results. The company announced that it produced 428,514 ounces of gold, beating their own high range of guidance, which was 420,000 ounces. The breakdown was 289,499 ounces of concentrate and 139,015 ounces of Doré. The company processed 1,415,634 tonnes this year with an average throughput of 4,121 tonnes per day and a recovery rate of 88.6%.

Lundin Gold currently has 9 analysts covering the stock with an average 12-month price target of C$13.69, or a 36% upside to the current stock price. Out of the 9 analysts, 8 have buy ratings and 1 analyst has a hold rating. The street high sits at C$15.50, or a 54% upside from Stifel-GMP. While the lowest 12-month price target is C$11.75.

In BMO Capital Markets’ note, they reiterated their C$14.00 12-month price target and Outperform rating on Lundin Gold, saying that the company had strong fourth-quarter production.

For the fourth quarter Lundin Gold produced 107,900 ounces, beating BMO’s 104,600 ounces, and they note that the companies throughput and recovery rates have been steadily increasing each quarter in 2021.

Though the full year beat was unexpected by many, BMO believes that this was expected due to the strong production at Fruta del Norte with their throughput increasing 4,200 tonnes per day. Additionally, they expect Lundin Gold to come in at their own guidance for all-in sustaining costs.

Lastly, BMO believes that Fruta del Norte has started to accumulate high-grade stockpiles, which has only started in the last quarter or two. They believe that the building “of modest stockpiles as a positive for the mining operation.”

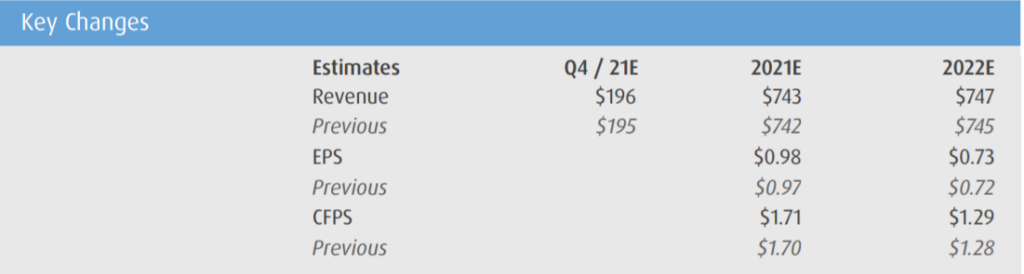

Below you can see BMO’s updated fourth quarter, 2021, and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.