In a rollercoaster post-market session of trading, Lyft, Inc. (Nasdaq: LYFT) witnessed its shares surge by more than 60% on Tuesday, only to retreat sharply later, following a significant error in its quarterly earnings release.

The ride-hailing giant’s stock initially soared to $19.70, the highest price since August 2022, after Lyft reported an optimistic outlook for margin growth in 2024. However, excitement quickly turned to caution as the company corrected the forecast, leading to a more modest gain of about 15%.

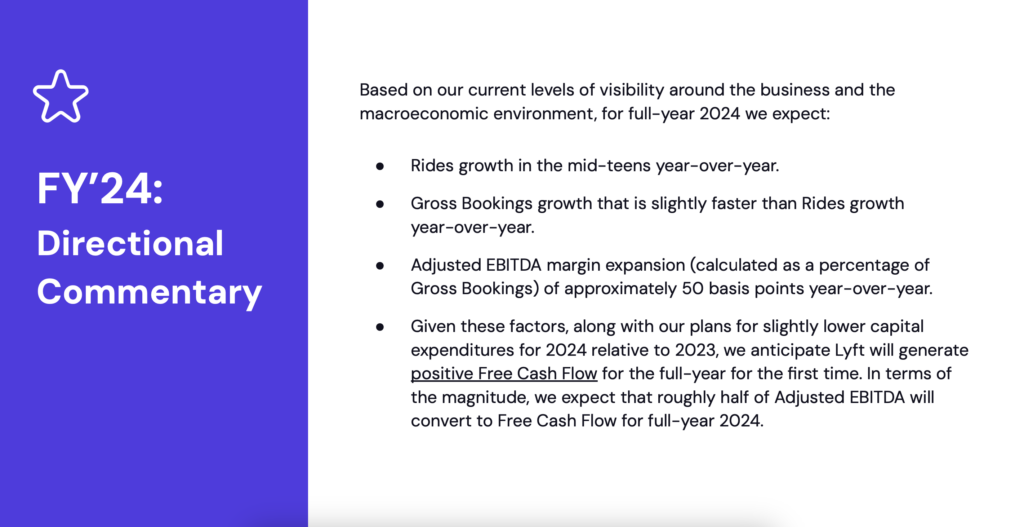

The erroneous forecast indicated a dramatic increase of 500 basis points in adjusted earnings margins for 2024, compared to the previous year. This optimistic projection, however, was swiftly corrected during a call with investors and analysts by Lyft’s chief financial officer, Erin Brewer, who clarified that the actual increase would be a more conservative 50 basis points.

“This is actually a correction from the press release,” Brewer stated, addressing the discrepancy and calming market jitters caused by the initial overestimation.

😵💫 pic.twitter.com/BxozaRZNRF

— Deirdre Bosa (@dee_bosa) February 13, 2024

$LYFT in their release said 500bps of EBITDA margin expansion (as a % of GBV) in 2024 and just said on the call it's actually 50bps

— Thomas Reiner (@treiner5) February 13, 2024

Stock went from +65% to +11% 😂 pic.twitter.com/J42LHtJDfu

The fluctuation in Lyft’s stock value adds to the challenges the company has faced since its initial public offering in 2019, with shares losing approximately 80% of their value since then. Despite this setback, investors initially interpreted the exaggerated forecast as a positive sign of Lyft’s progress under the leadership of CEO David Risher, who assumed the role less than a year ago.

In efforts to challenge its much-larger rival Uber, Lyft has invested heavily in attracting new drivers to its platform. However, it has struggled to significantly narrow the gap with Uber in terms of user numbers. In its latest earnings report, Lyft disclosed a 17% increase in gross bookings to $3.7 billion for the quarter, aligning with analyst expectations. Additionally, the company reported adjusted earnings of 18 cents per share, surpassing analysts’ forecasts of 8 cents per share, while revenue stood at $1.2 billion.

Looking ahead, Lyft provided a forecast for the first quarter of 2024, anticipating gross bookings in the range of $3.5 billion to $3.6 billion and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) between $50 million and $55 million. Notably, Lyft expressed optimism about achieving full-year positive free cash flow for the first time in 2024.

CEO David Risher expressed confidence in the company’s trajectory, stating, “In 2023, the Lyft team set ambitious goals and the results speak for themselves.” He highlighted achievements such as reaching record annual ridership levels, delivering over 700 million rides, and aiding drivers in earning over $8 billion. Risher emphasized Lyft’s commitment to customer satisfaction, asserting that it would drive profitable growth in 2024.

The market’s response to Lyft’s corrected forecast was mixed. Despite the initial surge and subsequent correction in share price, investors focused on Risher’s efforts to streamline operations and reduce costs. Risher’s strategic initiatives, including aggressive restructuring and cost-cutting measures, have already shown promise, with a 36 per cent surge in Lyft’s stock witnessed in 2023.

LYFT just came up with a brilliant way to wipe out millions in shorts haunting your shitty stock: just come up with idiotic guidance that has a few extra zeros, then after the stock erupts higher "oops, we had a typo" but by then all the shorts will be stopped out

— zerohedge (@zerohedge) February 13, 2024

Analysts weighed in on Lyft’s performance, with Jesse Cohen, senior analyst at Investing.com, noting, “The strong outlook indicates the ride-hailing company may finally be coming out of the woods,” while observing a 2% rise in Uber shares following Lyft’s results.

Despite the setback caused by the forecast error, Lyft’s competitive position remains robust, with the company retaining a 29% market share in the fourth quarter, according to market analysis firm YipitData. Lyft’s gross bookings for the fourth quarter grew by 17% to $3.7 billion, surpassing analyst estimates.

As Lyft navigates the competitive landscape of the ride-hailing industry, partnerships with companies like LinkedIn and Starbucks are expected to drive growth in 2024, as highlighted by Risher.

Lyft last traded at $12.13 on the Nasdaq.

Information for this briefing was found via Financial Times, Reuters, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.