BTU Metals Corp. (TSXV: BTU) was among the top gainers and volume traders on the TSX Venture exchange December 10th, finishing at a 52 week and all-time high of $0.465 per share. Ten consecutive trading sessions with more than 1 million shares in volume marched the smallcap company there from $0.105 on November 26th, a +77% gain, so this one is worth (ahem!) drilling down on.

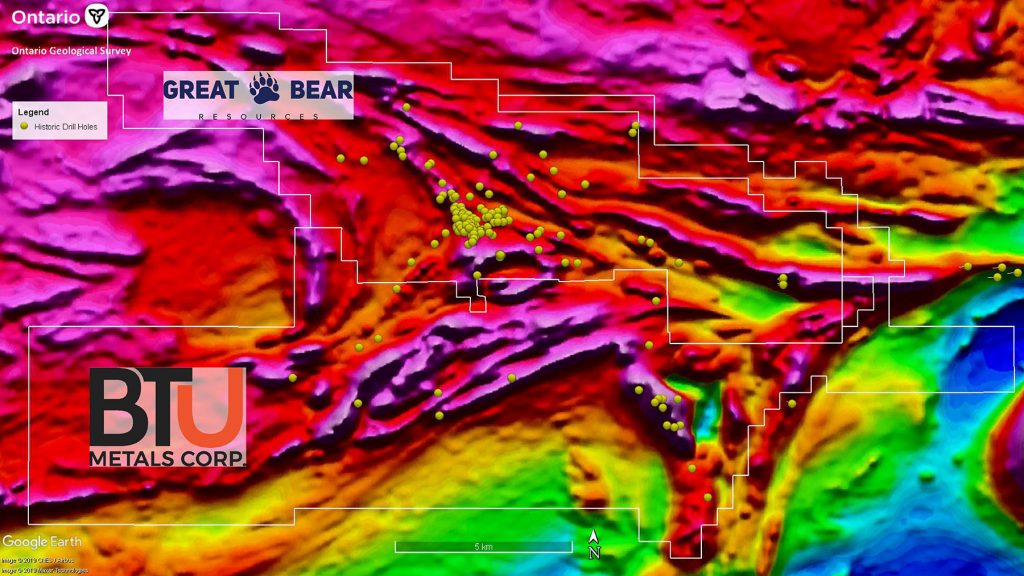

The $31 million company is in the midst of a classic exploration promo, and it appears to be going handsomely so far. This particular story is built on the potential in a drilling campaign that BTU undertook last summer on their Dixie-Halo property in the Red Lake district of Ontario.

The property’s name is an intentionally specific reminder that it exists in close proximity to the Dixie property, where Great Bear Resources (TSXV: GBR) has been actively working on a multi-zone hydrothemral gold project for the better part of two years. Great Bear’s Dixie project attracted the attention of McEwen Mining in 2017, and have since grown to a $336 million market cap and, presently, a $7.64 share price. The Dixie is a quartz-hosted hydrothemal gold deposit on the order of the other mines and deposits in the Red Lake camp, where McEwen’s namesake CEO Rob McEwen cut his teeth as a founder of Goldcorp (TSX: G).

BTU isn’t after the same type of hydrothermal gold mineralization that forms the great gold deposits of the area at Dixie Halo, but rather the Vulcanogenic Massive Sulphide (VMS) mineralization common to the base metals camps of Flin Flon, Manitoba and the Abitibi greenstone belt of Quebec. VMS deposits are typically rich in copper and zinc with associated gold and silver values that can and do run up to the same types of grades that one might expect from the hydrothermal deposits in Red lake. They’re formed by undersea volcanoes venting into high-pressure aqueous environments. Though they can get quite large, VMS deposits are often small deposits that are found in series, sustaining camps in ebbs and flows as exploration discovers new lenses after old ones have been depleted. Mining towns are familiar with the feelings of hope and excitement that come with rigs turning ahead of the zone. BTU has done a fair job of bottling that feeling and selling it to the market.

With the help of IR consultants Proconsul Capital, hired in October, BTU has managed to get excellent market traction out of the very early stages of this exploration program. An extensive news release November 27th detailing the drill program goes into great detail about the areas of the geophysical anomaly that were targeted as part of the summer drilling, the additional geophysics that were done, the fact that stronger anomalies have yet to be drilled, the alteration and mineralization encountered by the drilling… everything but grades and widths which, all things being equal, might as well be left to dream on.

BTU tells us in the first paragraph that they’ve only received partial assay results, and are waiting on the re-assays for samples that returned over-limit values for copper (>1% Cu). The release continues on about alteration consistent with VMS footwall zones, and some excellent copper grades coming out of sulphide samples from both “down-ice” boulders (float pulled away from its source by glaciation), and some more pending samples from angular float on the property (inferred to have not traveled far from its original source, for lack of rounding).

The fact that the induced polarization and time domain electromagnetic geophysical surveys that BTU has conducted lit up with what could be sulphide mineralization is unsurprising. There are usually sulphides where the rocks exhibit alteration. Veterans of the mineral exploration stock market will have learned the hard way that not all sulphide bodies contain ore-grade minerals, but there’s really only one way to find out.

The sulphide mineralization that BTU has sent to the lab is described in this release as “disseminated” and “stringer” sulphides, which isn’t quite the “massive” sulphides that are the namesake of the deposit they’re after, but it puts them in the hunt. If the company is able to follow up the anticipation they’ve created here with decent grades over decent widths, further drilling on the targets they’ve uncovered stands to draw even more attention.

Red lake is not known for its VMS deposits, but they do exist. Skyharbour Resources (TSXV: SYH) is the current owner of the formerly producing South Bay Mine that produced 1.6 million tons of 2.3% copper, 14.5% zinc, and 3.5 oz/ton silver from a VMS deposit in the 1970s and 1980s.

Everyone loves a good discovery story, and this one has at least ten days worth of staying power. $2.60 copper and $1460.00 gold is a fine place to be looking for a VMS deposit, and BTU Metals has shown an ability to make hay while the sun shines. BTU had $1.8 million in the bank at the end of September, with 68 million shares outstanding. Look for them to be raising money soon.

Information for this briefing was found via Sedar and BTU Metals Corp. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Market Moving: The Elements of the Venture Exchange’s Ongoing Resurgence

The TSX Venture Exchange is the largest regulated venture-stage equities exchange in the world. Those...