2017 feels like it happened on another planet, and those of us who were there remember the smallcap world’s various attempts at promotions based around the loosely defined false alchemy known as “artificial intelligence” or “machine learning.”

The principle here, that a computer can be taught to do a task and adapt to that that task based on inputs isn’t a new one. It’s algo-driven software with a better name, packaged to become a medium for the capital markets. Retail shareholder favorite Namaste (TSXV: N)‘s $12M cash and stock purchase of Findify – a dressed up version of the Amazon algo that tells shoppers what they “might also like” – in May of 2018 makes a good enough expiry date for the smallcap public market prospects of AI companies. It was an effective spin-in of a private deal that didn’t have a prayer on its own.

But, through it all, Datametrex (TSXV: DM) stayed true to its AI story. The company spent 2018 and 2019 steadily making deals that could open up and demonstrate new use cases for its AI products and, to the very limited success of their listed equity, the company started to make it work.

DM’s news feed is populated at regular intervals with announcements about having re-purposed it’s AI to “unlock valuable insights and analysis” from various different types of operations, including the fine art of investor relations in February of 2018, but the company was unable to make any of it stick as a lasting stream of revenue.

This time last year, Datametrex was excited to have closed a deal with Korean grocery chain Homeplus, who were interested in what DM’s predictive analytics could do for their sales. The day before, it announced that the same AI would be used in a Fake News filtration exercise by the Korean Press foundation. The company’s wire plodded along like that for twelve months, a solution looking for a problem as it bounced between $0.01 and $0.04.

A division called “Nexalogy,” which appears to be some sort of social media tool and #FakeNews identifier, got its foot in the door at various government agencies, including the Department of National Defense, and some larger corporations. The Oct. 3 press release announcing the DND contract was the first one in more than a year that failed to carry a tout for “investee company” Graph Blockchain (CSE: GBLC) in the footer.

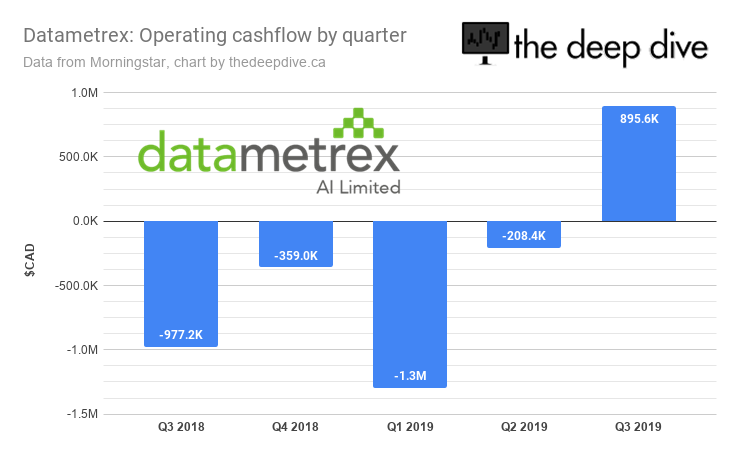

As Datametrex continued to bounce along the bottom through a shares-for-debt deal in December of 2019 and a few new contracts kicking off 2020, it started to look like it was worth taking seriously. It was losing money, sure, but the September 2019 quarterlies quietly marked the company’s first quarter of positive operational cash flow. The news releases about new contracts and new prospects kept coming in. It was steady-as-she-goes until March 30th when DM excited the market with news that it was pitching various US Government agencies on how its social media monitoring “AI” might help them fight the COVID epidemic.

A 12 million share volume day took the company from $0.02 to $0.03, and the attention-starved company appeared to have found their niche.

If the market wanted a COVID story, Datamatrex was going to give it a COVID story.

DM jumped to life like a frog in a dynamite pond on the news that it has 1) acquired the rights to import COVID-19 tests to Canada from South Korea, 2) has applied to Health Canada to have those tests approved, and 3) would also retain the rights to market and sell the kits to other countries, including the United States.

Datamatrex shares opened at $0.10 on April 16th, following the April 15th announcement, closed at $0.19, and just kept on trading in the days that followed. The stock finally slowed down to do its first day under 20 million shares in volume on April 22nd, closing at $0.145 on 12 million shares.

Advisory board member Jeff Stevens managed to get some face time on Global News where he told reporters that the kits were “similar to” the Korean roadside tests while sounding frustrated at the Health Canada approval process, next to Spartan Bioscience (private), who has managed to make their COVID test kit, “the Cube”, one of 52 that Health Canada has already approved.

The issue has traded its entire outstanding share count over the past four days, effectively setting itself a new baseline, despite having provided very little information about the actual tests submitted for approval by Health Canada. DM’s update release April 21st tips that it has represented to Health Canada that it will be able to deliver 200,000 test kits to start, then 100,000 per week after that, and that they’ve got not one but two doctors on the file, but not much else which, from a story perspective, seems wise.

DM may elect to let the market know about the lead time on these particular tests, their relative accuracy, cost to produce, and potential margin to tide it over while it waits for a release about approval. This isn’t DM’s first rodeo.

Meanwhile, Graph Blockchain was quick to congratulate its keystone shareholder Datametrex on their application to import COVID-19 tests on April 17th. It did 10.8 million shares worth of volume in the days that followed (a long way above its average) before being halted on April 22nd at $0.035, with no explanation.

Information for this briefing was found via Sedar, Graph Blockchain and Datametrex AI. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.