This morning, Max Resource Corp (TSXV: MXR) reported initial results from the currently ongoing study with the University of Science and Technology (AGH) in Krakow, Poland on the Cesar Project. AGH has been conducting a study on the Cesar Project as a result of the similarities with that of the Kupferschiefer project in Eastern Europe, for which the school has spent years studying.

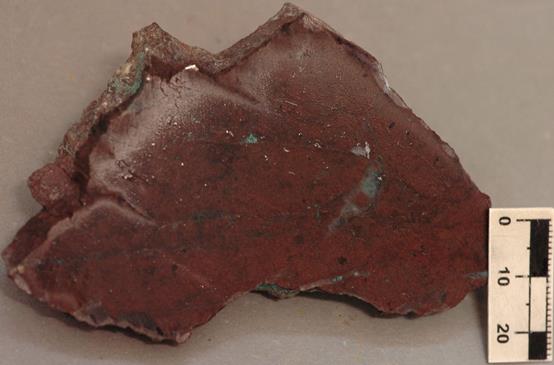

Initial results from petrographic analysis of two samples from AM South at the Cesar project, referred to as samples #612 and #618, have confirmed the presence of native copper, chalcolite, and malachite hosted in siltstone and sandstone. Covellite has also been detected as being present, which has not been detected previously.

The samples were collected from stratabound copper-silver horizons at Cesar, and then shipped to AGH for geochemical and mineralogical studies. The results have confirmed a previous petrographic report obtained from Vancouver Petrographics in January 2020, with the added mineral of covellite, which is a rare copper sulfide mineral.

Sample #612, showing covellite and chalcocite

Sample #618, showing native copper and hermatite

Sample locations within the context of Cesar AM South

It is currently anticipated that the near surface copper oxides will transition to richer chalcocite, which is 80% copper by weight and is a sulfide, and covellite, another copper sulfide, at depth. This is significant, as copper sulfides typically are more profitable to mine as a result of having a higher copper content overall. The copper can also be separated from other minerals much more easily than in copper oxides.

Max Resource Corp last traded at $0.085 on the TSX Venture.

FULL DISCLOSURE: Max Resource Corp is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Max Resource Corp on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.