On August 16, Medipharm Labs (TSX: LABS) reported their second quarter financial results. The company reported $5.07 million in revenue, down 7.7% sequentially and down 63.6% year over year. The company had a negative gross profit margin of 152.5% on a negative gross profit of $8 million, which has ballooned from a negative $0.68 million in the first quarter.

MediPharm Labs has 5 analysts covering their name, with an average 12-month price target of $0.60, or a 74% upside. The average is lower than the $0.73 average from last month due to two analysts lowering their price targets after the quarterly results. Out of the 5 analysts, 1 has a strong buy rating, 2 have buys and the other 2 have hold ratings. The street high sits at $0.80 and the lowest comes in at $0.40.

Canaccord Genuity was one of the firms to lower its 12-month price target. They now have a $0.70 price target, down from $0.75, while reiterating their speculative buy rating. They add that the company’s international sales overshadow headwinds on domestic operations.

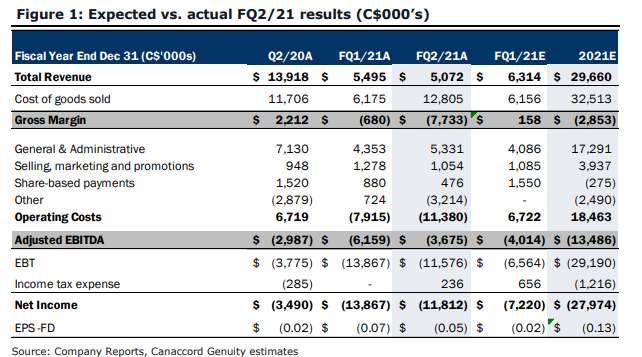

For the quarter, MediPharm Labs basically missed on every estimate other than adjusted EBITDA, which was -$3.675 million compared to the -$4 million estimate. For the segments, MediPharm saw its Canadian adult-use segment lose market share again, as revenue came in at $2.6 million, compared to the $3.4 million in the first quarter.

Canaccord says they are not too surprised by the revenue drop in domestic markets due to the company pivoting to health & wellness offerings which are better suited for international sales than domestic. International sales grew 17% sequentially to $2.5 million due to better sales in Germany. They add, “we believe that H2/21 will see material uplifts in the company’s international cannabis contributions.”

Canaccord also touches on the companies July 14 news release, in which MediPharm received a Drug Establishment License, which allows it to “manufacture any nonsterile drug in finished good or active pharmaceutical ingredient API formats.” Canaccord is generally bullish on the company to be able to make this license accretive in the long term, while in the short term they expect the license to help expedite importation and exportation timelines for the international supply chain.

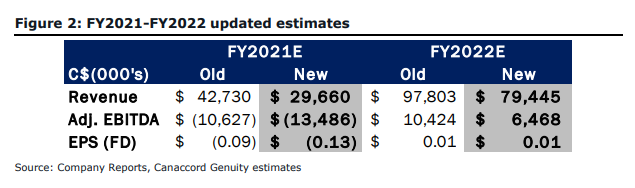

Below you can see Canaccord’s updated full year 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

absolute Junk Stock.