Medmen Enterprises (CSE: MMEN) has finally closed the sale of its Florida operation, albeit at a reduced price. The firm announced yesterday after the bell that the asset had been sold to a private firm referred to as Green Sentry Holdings.

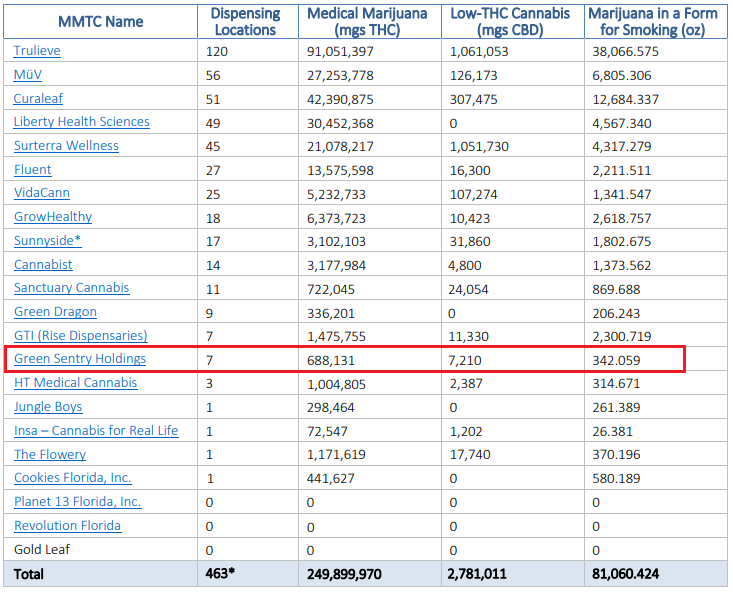

At the time of announcement in February, the asset, which includes the required license as well as seven dispensaries, inventory, and cultivation operations in the state, was to be sold for a total figure of $83 million in cash. The sale also included a licensing agreement for a two year period from the closing of the transaction, which is subject to a quarterly revenue-based fee.

The deal was also expected to be closed in late April or early May, pending the required governmental approvals.

Fast forward several additional months, and the company has now closed the transaction at just $63 million – a $20 million haircut in a matter of months. That haircut came on the condition that Green Sentry, which is partially owned by Brady Cobb and Michael Bondurant as per public Florida records, assume $4.0 million in certain liabilities. Both Cobb and Bondurant previously operated Bluma Wellness in Florida prior to its sale to Cresco Labs.

“The sale of MedMen’s Florida assets marks an important step in the company’s restructuring efforts designed to provide greater financial flexibility and a stronger, leaner operating structure – and ultimately put us on a path to being EBITDA positive,” Medmen CEO Ed Record said of the sale.

Notably, Florida’s Office of Medical Marijuana Use, frequently referred to as OMMU, has already changed ownership details on the license, with the most recent sales update referring to the license as Green Sentry.

Further details were said to be available in an 8-K filed yesterday, although no such filing could be found.

Medmen Enterprises last traded at $0.07 on the CSE.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.