MicroStrategy Inc. (NASDAQ: MSTR), known for its significant investments in Bitcoin, reported notable developments in its Q2 earnings report for the period ending June 30, 2024. Despite robust growth in Bitcoin holdings, the company faced considerable financial challenges, leading to a mixed reception from investors and analysts.

In Q2 2024, MicroStrategy posted a net loss of $102.6 million, translating to a loss of $5.74 per share. This compares unfavorably to a net income of $22.2 million, or $1.52 per diluted share, in the same quarter of the previous year.

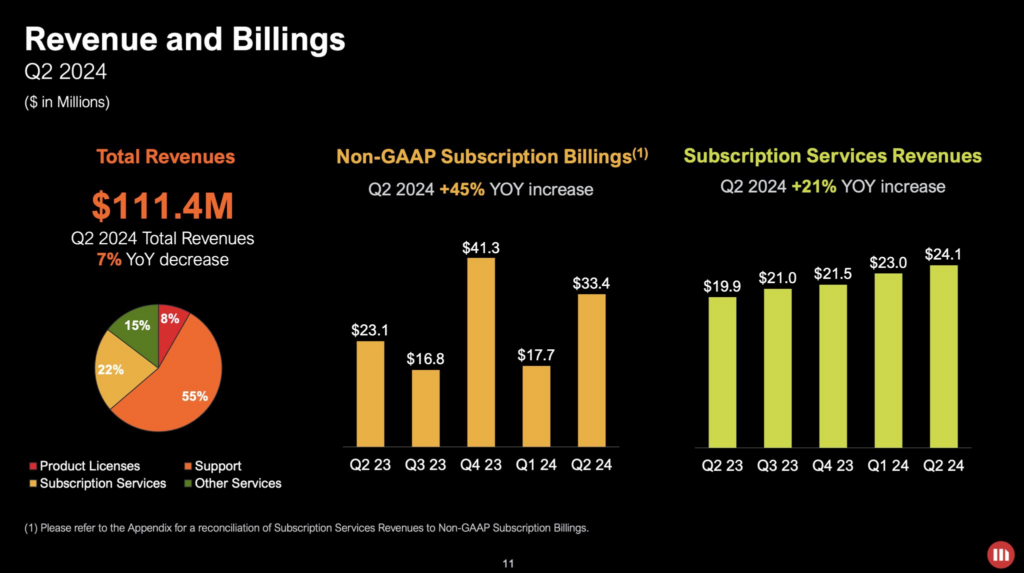

Revenue for Q2 stood at $111.4 million, reflecting a 7.4% year-over-year decrease. The company attributed part of this revenue decline to decreased product licenses and product support revenues.

Analysts had anticipated a loss of $0.78 per share and revenues of $119.3 million, making the actual figures a significant deviation from expectations.

Operating expenses surged by 134% to $280.8 million from $119.9 million in Q2 2023, driven primarily by digital asset impairment losses which totaled $180.1 million, a significant increase from $24.1 million in the previous year. This substantial rise in operating expenses contributed to a loss from operations of $200.3 million, compared to $26.7 million in the same quarter of the previous year.

MicroStrategy’s strategy of accumulating Bitcoin continued aggressively in Q2. The company purchased an additional 12,222 bitcoins, bringing its total holdings to 226,500 bitcoins. As of June 30, 2024, the carrying value of these digital assets was $5.688 billion, reflecting cumulative impairment losses of $2.641 billion. The original cost basis of the bitcoins was $8.329 billion, with a market value of $14.016 billion, translating to an average cost of $36,798 per bitcoin and a market price of $61,927 per bitcoin at the end of the quarter.

Bitcoin yield KPI and $2B equity offering

MicroStrategy introduced a new key performance indicator (KPI) called “Bitcoin Yield,” representing the percentage change in the ratio between the company’s bitcoin holdings and its diluted outstanding shares. This metric is designed to help assess the performance of MicroStrategy’s strategy of acquiring bitcoin in a way that the company believes is accretive to shareholders. Year-to-date, the Bitcoin Yield stood at 12.2%, with a target of 4-8% annually from 2025 to 2027.

Andrew Kang, Chief Financial Officer of MicroStrategy, highlighted the significance of this new metric, stating, “We believe this demonstrates significant bitcoin accretion to shareholders.”

To support its ongoing strategy and manage its equity capital, MicroStrategy announced plans to file a registration statement for a new $2 billion at-the-market equity offering program. The specifics of how this capital will be used were not disclosed, but historically, the company has raised funds to purchase additional Bitcoin.

😂 Saylor running out of rubes willing to give him free cash to keep fueling the $MSTR ponzi via convertible notes…now resorting to directly diluting shareholders https://t.co/sSIExP5MMM

— Rho Rider (@RhoRider) August 1, 2024

In addition to the equity offering, MicroStrategy confirmed a 10-for-1 stock split, which will take effect on August 7, 2024. This stock split aims to make shares more accessible to a broader range of investors.

Following the release of the Q2 earnings report, MicroStrategy’s share price dropped 6.36%, closing at $1,511.81.

Reactions among investors and analysts were varied. Some expressed skepticism about the sustainability of MicroStrategy’s heavy reliance on Bitcoin. For example, Rho Rider commented on social media, suggesting that CEO Michael Saylor is running out of options to sustain the company’s Bitcoin purchases, now resorting to shareholder dilution.

Others viewed the aggressive Bitcoin acquisition strategy as a positive move. Ash Crypto on X referred to the announcement of the new equity offering as “GIGA BULLISH,” indicating strong support from Bitcoin enthusiasts.

Fact pattern:

— Sultan Ameerali (@SultanAmeerali) August 2, 2024

– Company A buys Security B

– The entire value of Company A is tied to Security B, and A actually trades at a large premium to its holdings of B

– B is available, through ETFs, to anyone buying A

Why is anyone buying Company A when they can just buy Security B… https://t.co/iCyrnhPEnb

Outlook

Despite the financial volatility, MicroStrategy remains committed to its Bitcoin-centric strategy. The company’s leadership expressed optimism about the long-term value and adoption of Bitcoin, as well as the increasing support for the cryptocurrency ecosystem from various stakeholders, including institutional investors and bipartisan political figures.

Phong Le, President and CEO of MicroStrategy, emphasized the company’s focus on its Bitcoin strategy and the broader adoption of its cloud-powered business intelligence and artificial intelligence software. He noted the continued double-digit growth in both subscription revenue and subscription billings, reflecting strong performance in these areas.

“After yet another successful quarter for our bitcoin strategy, MicroStrategy today holds 226,500 bitcoins reflecting a current market value 70% higher than our cost basis. We remain laser focused on our Bitcoin development strategy and intend to continue to achieve positive “BTC Yield,” which is a new KPI that we are introducing, targeting 4-8% annually, over each of the next three years,” Le said.

Information for this briefing was found via Coin Telegraph and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.