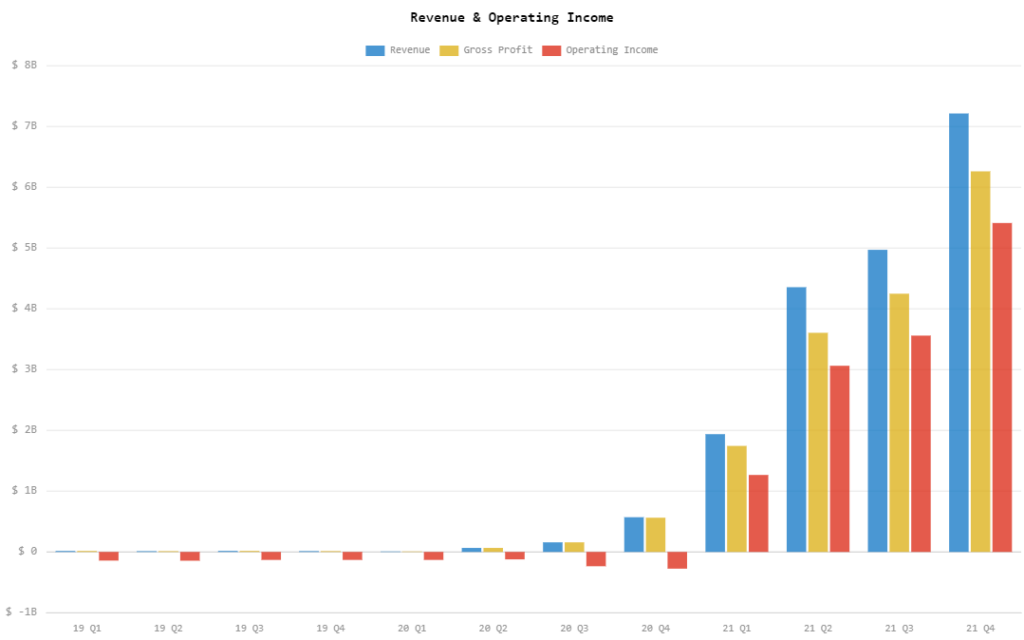

Moderna Inc (Nasdaq: MRNA) announced this morning its Q4 and full-year 2021 earnings. The vaccine manufacturer earned US$7.21 billion in revenue, beating the consensus estimates of US$6.78 billion.

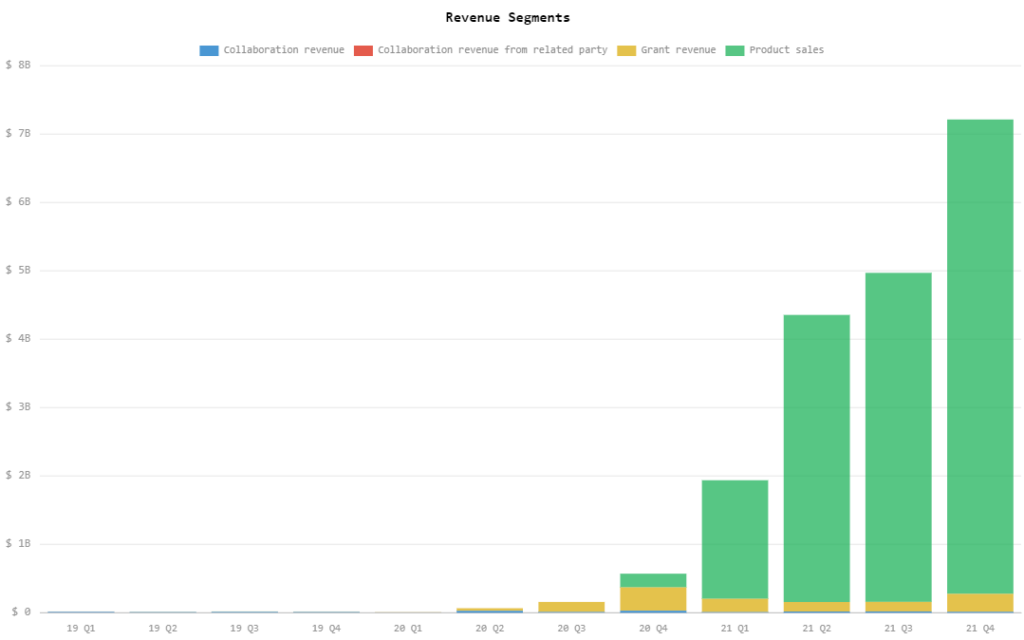

The quarterly revenue was heavily driven by the sale of around 297 million doses of its COVID-19 vaccine. This compares to US$571 million in revenue, including the sale of 13 million doses in the year-ago period.

The firm also recorded a quarterly net income of US$4.87 billion compared to a loss of US$272 million last year. This translates to US$11.29 earnings per diluted share, also beating the estimates of US$9.90 per share.

For 2021, the company recorded US$18.47 billion in revenue, including product sales from 807 million COVID-19 doses. This is an increase from 2020’s US$803 million in revenue. Meanwhile, net income for the year came in at US$12.20 billion compared to last year’s loss of US$747 million.

The company added that the “record product sales” started during the year after being granted an emergency use authorization for its vaccine from US FDA and Health Canada.

While the biotech firm previously estimated US$17 billion in product sales in 2022, it announced today a total of US$19 billion in signed advanced purchase agreements for the year–while still currently in active discussions for additional orders.

The company also plans to launch a share buyback program of around US$3 billion in total. Its previous US$1 billion program announced in August 2021 has already been fully subscribed by January 2022, according to the company.

Following the company’s release, shares have gone up as much as 5% pre-market.

In an interview with CNBC, CEO Stephane Bancel believes that COVID-19 has “a high probability” of moving into an endemic phase.

“There’s an 80% chance that as omicron evolves or SarsCov-2 virus evolves, we are going to see less and less virulent viruses,” said Bancel. Inversely, there’s a “20% scenario where we see a next mutation which is more virulent than omicron.”

The company also mentioned that its COVID-19 vaccine Spikevax has already recorded “firm orders” from the United Kingdom, Canada, Taiwan, and Kuwait in 2023.

Last week, the firm announced its plans to expand its manufacturing into Spain and to establish subsidiaries in Hong Kong, Taiwan, Singapore, and Malaysia.

Moderna last traded at $135.73 on the Nasdaq.

Information for this briefing was found via CNBC and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.