The trouble with social media, is that it’s a big game of telephone. One individual may go on a platform – such as Twitter – and report a recent news event. But because of either the freshness of the information resulting in insufficient sourcing, the general lack of ability to independently fact check, or even a desire to believe something to fit a narrative, the data, somewhere, goes awry.

Take for instance the latest “scandal” plaguing Twitter, Facebook, and the general internet this weekend. The latest report is that Moderna Inc (NASDAQ: MRNA) CEO Stephane Bancel has suddenly dumped $400 million worth of shares in the company and that he has deleted his Twitter account as a result.

Moderna CEO Just Dumped $400 Million in Stock and Deleted His Twitter Account https://t.co/AKegbWxTjw via @realnewspunch

— Internet Tour Guide 🇨🇦 🇺🇸 (@Gunblaze69) February 13, 2022

Given the role Moderna has played in the pandemic, there is a subset of persons that want to believe this is true. That want to take it for face value to fit a narrative. And that lack the extremely basic ability to fact check this information – despite a segment of those sharing the data allegedly being investors.

What in particular set off this chain of events?

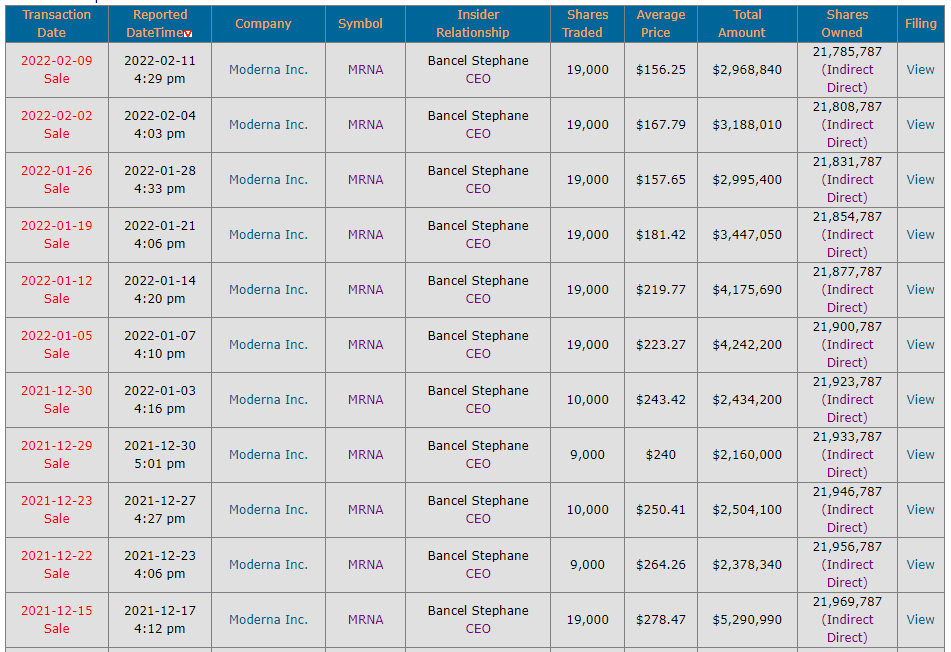

From what we can tell, its the latest Form 4 filed by Bancel, which was filed on Friday. But despite claims that he sold $400 million worth of shares in recent weeks, the simple fact is that he disposed of just 19,000 shares for gross proceeds of about $2.97 million. Here’s the Form 4 filed by Bancel with the Securities and Exchange Commission.

If you’re new around here, a Form 4 is a “Statement of Change in Beneficial Ownership,” and is required to be filed by named insiders to a public company for any transaction conducted by the individuals with shares they own either directly or indirectly in the company. In layman terms, this means the entire executive team must file with the SEC what they’re doing with the shares they own in the company.

The shares that were sold were sold at prices between $154.26 and $158.05 per each, with sales conducted on February 9 and February 10. Lets get a bit more specific now.

Here’s the breakdown for how the transactions went, as per what is provided in the Form 4.

- 9,000 shares directly owned by Bancel were sold on February 9, at an average price of $154.26 per share. The shares were sold under a trading plan (referred to as a Rule 10b5-1 trading plan if you want to be specific) first implemented on December 28, 2018, which was then modified on May 21, 2020.

- 4,000 shares directly owned by Bancel were gifted as a bona fide charitable gift on February 9. The shares were gifted under a trading plan implemented May 21, 2020. The plan was then modified on May 13, 2021.

- 10,000 shares indirectly owned by Bancel were sold on February 10, at an average price of $158.05 per share. They were sold under a trading plan implemented on December 18, 2018, which was later modified on September 16, 2019.

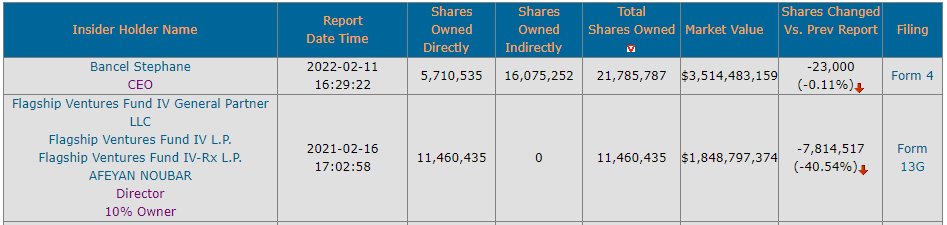

For those that are new to stocks or equity, there’s likely some unclear bits there so lets work through it. First, direct ownership means that the shares are held in Stephane Bancel’s name at a personal level. He currently owners 5,710,535 shares personally as per the Form 4 filed on Friday.

Second, indirect ownership means that the shares are not held in Bancel’s name, but he has some level of control over them still – which typically means they are held by a corporation which he has control over, such as a holding corporation that was used for tax purposes. The shares sold on February 10 are held by OCHA LLC, which Bancel is a majority equity unit holder of, and the sole managing member. OCHA LLC, as per the Form 4, currently holds 7,024,880 shares. Finally, Bancel also indirectly holds 9,050,372 shares of Moderna through Boston Biotech Ventures, LLC, which he is the sole managing member of and the majority equity unit holder.

Collectively, between these direct and indirect holdings, Stephane Bancel has exposure to 21,785,787 shares of Moderna, and based on the most recent price of $161.32, they are worth about $3,514,483,158.84. Yes, that is $3.5 billion – meaning he is still extremely invested in Moderna.

In short, Bancel is still extremely long Moderna’s equity, and no he didn’t *just* dump $400 million in equity of the company like much of social media is currently claiming.

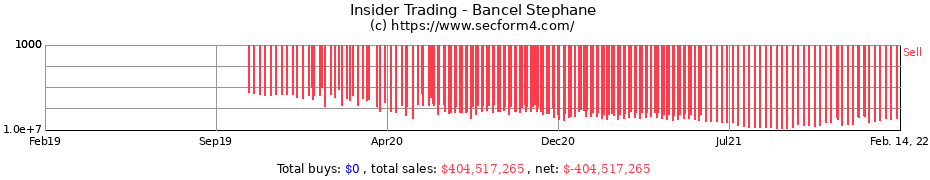

That being said, he has sold a sizable amount of shares since 2019, which is where some of the data related to the rumour is believed to have originated. Here’s a chart, courtesy of SECForm4.com, that provides a visualization of the timing of Bancel’s share sales, and the cumulative figure of $404,517,265, or $404.5 million, that have been sold since Fall 2019.

And here’s some further data from the same source, showing the frequency of the share sales in greater detail.

Again, as can be seen, Bancel did not suddenly dump $400 million in shares.

Moving on, as far as the details of Bancel’s departure from Twitter, that bit is unclear. Yes, he has deleted his Twitter. When, specifically, however remains unclear. The Wayback Machine last recorded the page on February 11, which displays that the account is gone.

Prior to February 11, the last time the page was cached by the Wayback Machine was November 11, which displays the account as being active, with a total of 6,396 followers. It’s difficult to say when specifically the account was deleted between those two dates. Regardless, the page was not particularly active, with the most recent tweet being a retweet from April 3, 2019.

As for the sometimes quoted claim that the firms co-founder and chairman Afeyan Noubar is unloading the stock, the last time he sold shares in the company either directly or indirectly was March 29, 2021. He also remains one of the largest holders in the company, after the firms CEO, via direct and indirect ownership.

And that’s the trouble with social media.

Information for this briefing was found via Edgar, SECForm4.com, Twitter, Facebook and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

19 Responses

The article literally concedes that HE DID sell over $400M worth of stock. Their argument that he didn’t do it *suddenly* is called gaslighting. It is propaganda. He dumped as much as he could as fast as he could despite the tanking share price.

What? If you cant tell the difference between the sale of stock over three years, and the sale of stock over a few days, I’m not sure what to tell you. He holds $3.5 billion in stock still. Hardly dumping as you claim.

What other CEO is in the business of offloading their shares weekly since Nov 2019? Leading a company holding a US patent #9587003 for a DNA sequence that appears in the virus’ spike protein (https://www.frontiersin.org/articles/10.3389/fviro.2022.834808/full), and started the sell off BEFORE the vaccines were even developed? I’m sorry my friend, the name of the game for these types is increasing their personal net worth not trading it away for cash. This is fishy.

Ok fine, but why did he delete his Twitter account? 🤡🤡🤡

Morons commenting here don’t understand that these guys always have their money at work. Dude probably just needed some cash. $3mil is nothing.

Thank you for this clarification. As a Moderna shareholder, the drop in the share price and social media rumors made me nervous, so I am happy to have read your post. Sorry, that many other comments are negative.

Why are you apologizing for someone else’s posts?

Sorry, I meant to say $2.97 million. My typo.

This still bares watching for whatever is true. The timing should be interesting for anyone to watch. He didn’t move $3.97 million for nothing. He is too intelligent.

Ya because when a stock is up 1000% in two years, only an idiot wouldn’t take some profit. $3m out $3.m is NOT even a drop on the bucket. It’s literally 0.01% of his stock ownership 🤦♂️

Jay Lutz….. in the end you will be held accountable for this article. You are blatantly lying to the public and you know it. Screen shots have been taken and social media will be checked for your picture. You will be billed accountable and this organization responsible for giving you this platform to spread lies.

his account was not deleted, merely deactivated. the account will be deleted in 30days after the deactivation date, unless logged back into and reactivated. you can check that it was only deactivated by attempting to change your username on Twitter to his, it says it is already in use)

Oh because the SEC is such a Secured Protected looking out for the public caring organisation. THE SEC IS A SCUMBAG! The recent Ripple case is showing their true criminal Color!

So it sounds like its particially true…CEO is bailing out and has been bailing out since December-

Lol more canadian news propaganda shitting on any narrative that dosent support the poison huh. Maybe social media did spread false truths…agreed. but facts are facts. He did sell alot of shares regardless. He did delete his Twitter and the stock has plummeted by around 60 percent in less then a year. All due to the waning effects of media outlets like this one brainwashing the people to not question and only believe. Like your such a source of quality information lol. Jokers.

A flat-earther has spoken, thanks “joe smith” or should i say ‘anonymous’

He dumped a lot more. It’s public information. This article could not be more inaccurate and a depiction of how crazy the left side of the political aisle has gotten in this country.

You didn’t actually read the content in the article, did you?

Trump2024, you couldn’t be more wrong. Learn how to read a public SEC filing. Everything in this article is 100% accurate. As a person with a background in investment banking abs equity research from a top 5 global investment bank, I attest to that. Stop spreading nonsense.