Montage Gold (TSX: MAU) has growth on their mind. The company this morning indicated that they have entered into an arrangement to acquire the ASX-listed African Gold Limited, which follows an initial investment made in the explorer back in March.

Under the terms of the arrangement, African Gold shareholders are set to receive 0.0628 of a share of Montage for each share of African Gold held, which equates to C$0.49 per share. The figure represents a premium of 54% to the ten day volume weighted average price of African Gold, valuing the explorer at an estimated US$170 million.

That figure excludes the value of the 17.3% stake Montage has already obtained in the company.

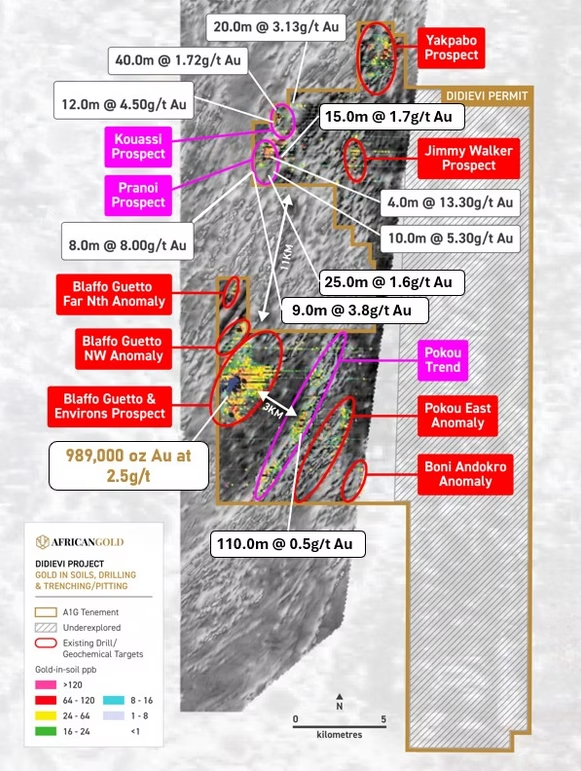

The arrangement is centered on Montage wanting full ownership of the Didievi project in Cote d’Ivoire, which it became operator of in March upon that initial strategic investment being made. The 2025 field season saw Montage begin a 40,000 metre drill program, and in the process expanded the inferred resource from 452,000 ounces of gold at an average grade of 2.9 g/t, to 989,000 ounces of gold at 2.5 g/t.

“As operator of the Didievi project, we have been able to derisk this transaction by conducting further drilling which has resulted in an increase in the Blaffo Guetto deposit resource while confirming mineralization at new targets, in parallel to conducting metallurgical testwork. We have seen the potential for the Didievi project to become a high-quality standalone operation and we look forward to leveraging our highly experienced team to rapidly unlock its full potential,” commented Martino De Ciccio on the project.

“This accretive transaction builds on the momentum generated thus far to advance our strategy of creating a premier African gold producer and delivering value for both Montage and African Gold stakeholders.”

The transaction is expected to result in the issuance of 27.7 million common shares of Montage Gold, with African Gold shareholders expected to own approximately 7.1% of the issuer on a post-transaction basis.

The arrangement remains subject to shareholders and customary regulatory approvals. The transaction is expected to close in April 2026.

Montage Gold last traded at $7.88 on the TSX.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.