Although inflation across the EU slumped into single digits last month, core inflation remains stubbornly resilient, cementing the case for further hawkish intervention by the European Central Bank.

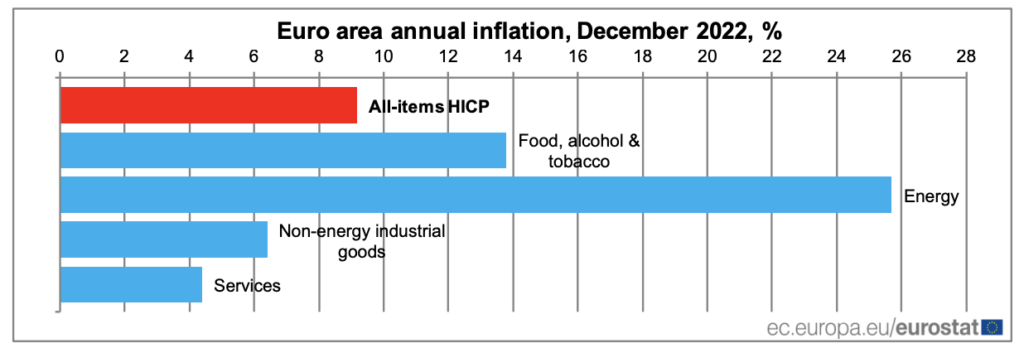

Latest flash estimates from Eurostat show headline inflation is forecast to drop from an annualized 10.1% to 9.2% in December, thanks to an unsuspected drop in energy prices amid unseasonably warmer weather. However, core inflation, which doesn’t account for food and energy components, jumped to a record-high of 5.2% last month, prompting economists to sound the alarm over a potential continuation of the ECB’s restrictive monetary policies throughout 2023.

“The ECB is likely to stick to its hawkish rhetoric in the near term despite the big falls— and likelihood of further sharp declines this year,” Capital Economics senior economist Franziska Palma said to the Financial Times. The ECB last year aggressively hiked borrowing costs from negative 0.5% to 2% within a span of six months. Similarly, ING economist Carsten Brzeski recently told Bloomberg that Europe’s central bank will likely remain on the path of rate hikes well into the second quarter, as policy makers shift “focus away from headline inflation to core inflation and wage growth.”

EU inflation has more than energy problems…Core inflation hits new high! 🤔 https://t.co/QjwElvMmxQ pic.twitter.com/bIaRlJt50R

— Mathan Soma (@Mathan_Soma) January 6, 2023

ECB president Christine Lagarde even hinted at more forthcoming economic pain, warning against focusing on short-term fluctuations in headline inflation, as the succeeding months are expected to bring additional price spikes. “It may well be that the December number… will be a little bit lower. But we have good reasons to believe that January and February, for instance, are likely to be higher. So we cannot be fixated on one single number.” Current ECB forecasts suggest inflation will average 6.3% by the end of 2023, well above the bank’s 2% target rate.

Information for this briefing was found via Eurostat, the ECB, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.