Homebuyers are backing out of the market as mortgage rates have increased to their highest level in over 13 years, according to a real estate brokerage.

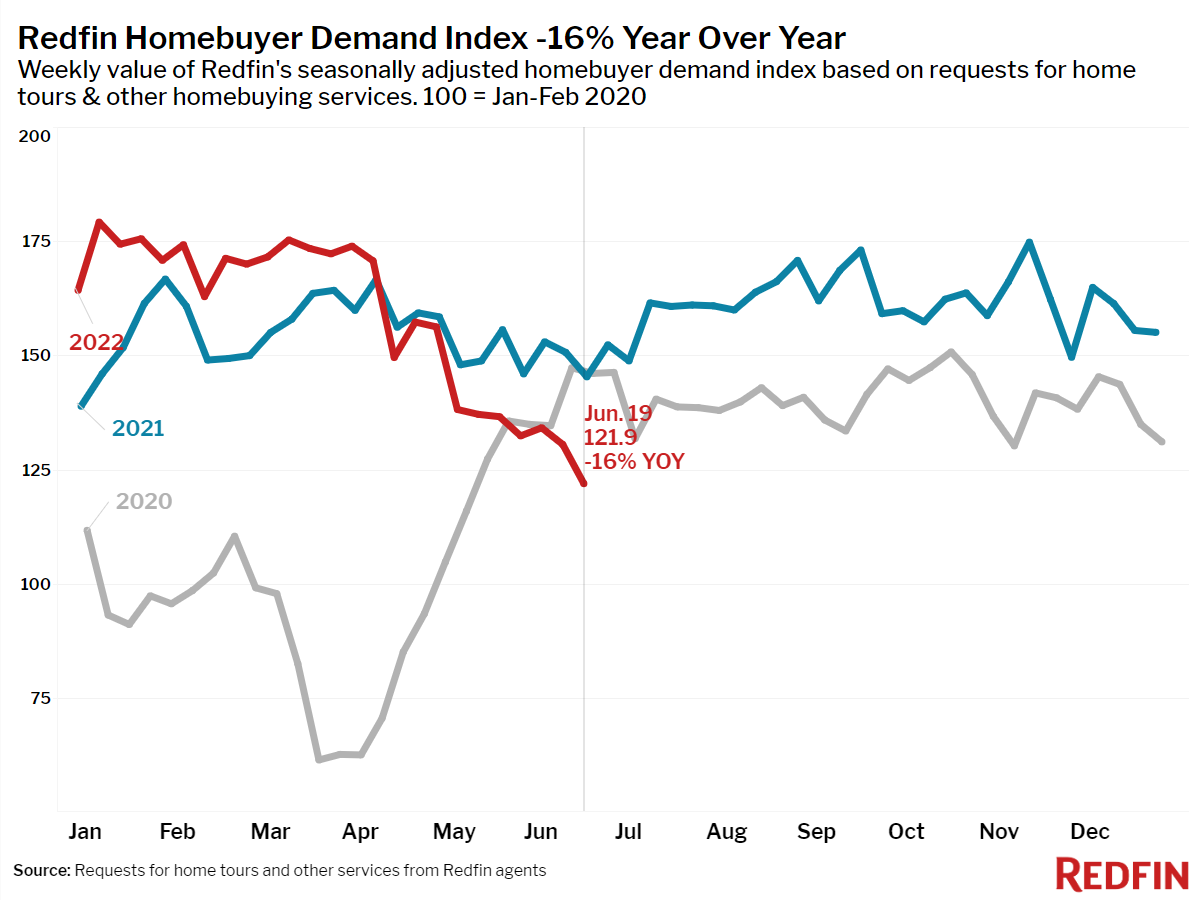

Citing its own report, real estate company Redfin (NASDAQ: RDFN) said that they saw a reduction in homebuying demand. The firm’s seasonally-adjusted Homebuyer Demand Index recorded a 16% decline year-on-year–its largest decrease since April 2020.

“Mortgage rates near 6% have put a big chill on demand for homes,” said Redfin chief economist Daryl Fairweather. “With home prices still at record highs, the affordability crisis has been dialed up to an 11 out of 10.”

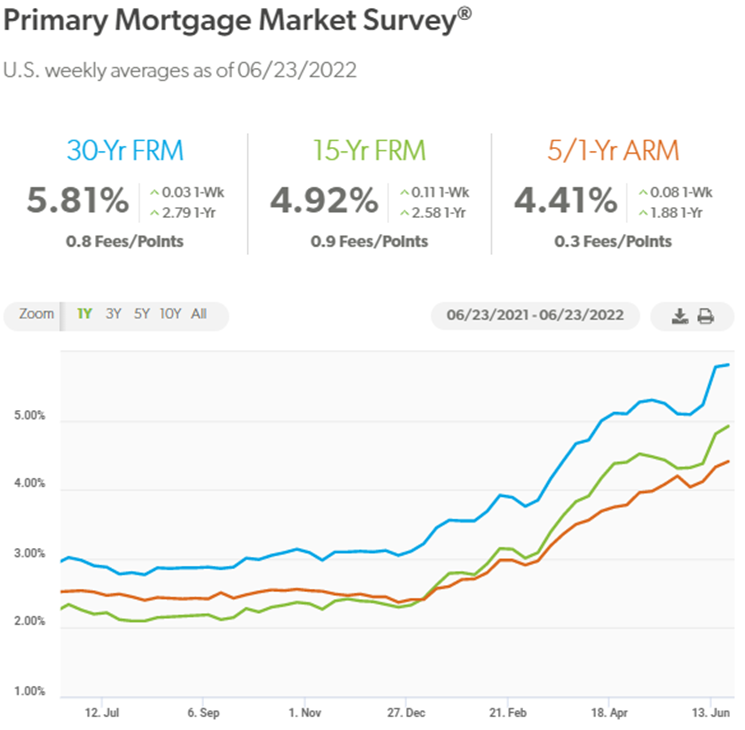

For the week ending June 23, mortgage rates rose by 5.81%, the highest level since November 2008.

Mortgage applications have also gone down 10% from a year ago.

The rising rates have pushed median home sale price up 14% year-on-year, with monthly mortgage payment averaging at US$2,500–up 48% from US$1,693 a year ago.

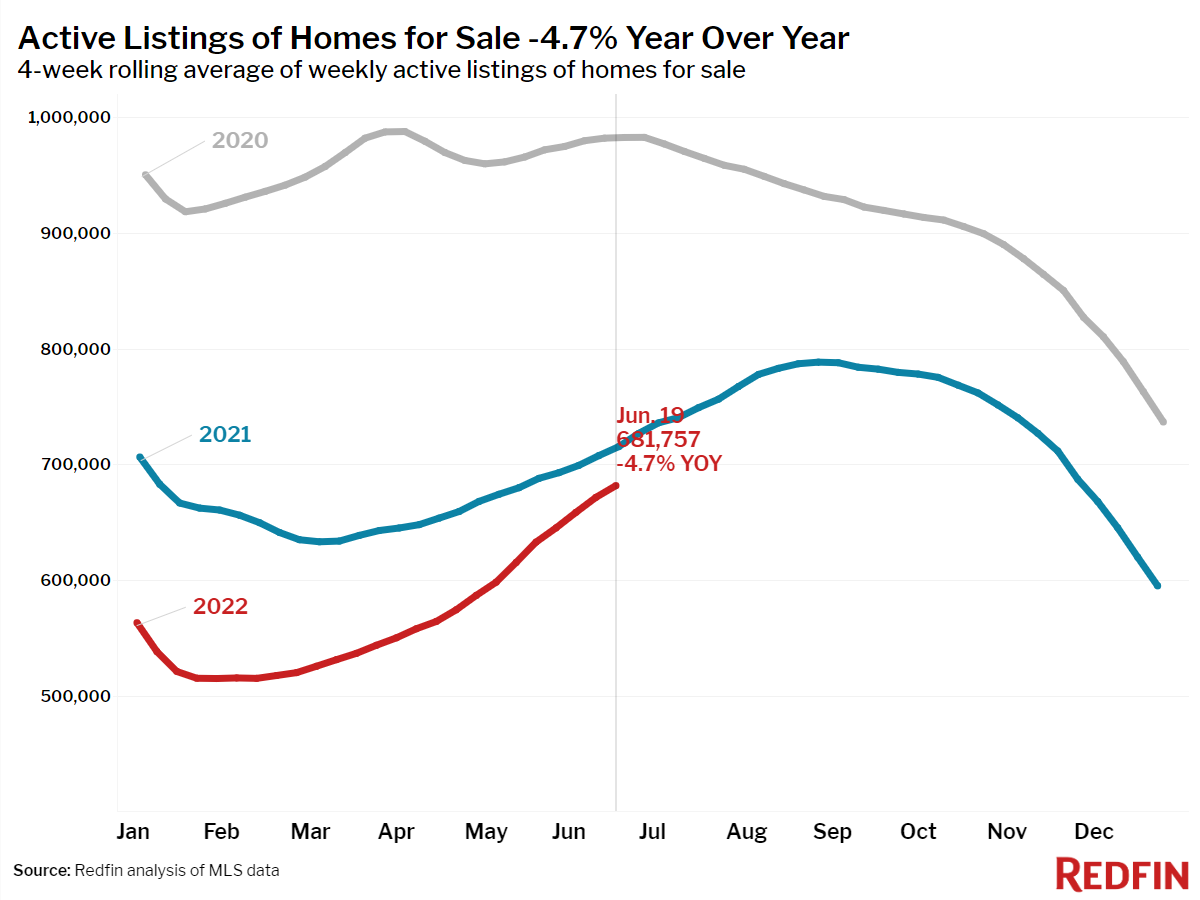

The effect is apparent with the decline in supply in the housing market. Active home listings were down 4.7% year-on-year while new listings we down 2% from a year ago.

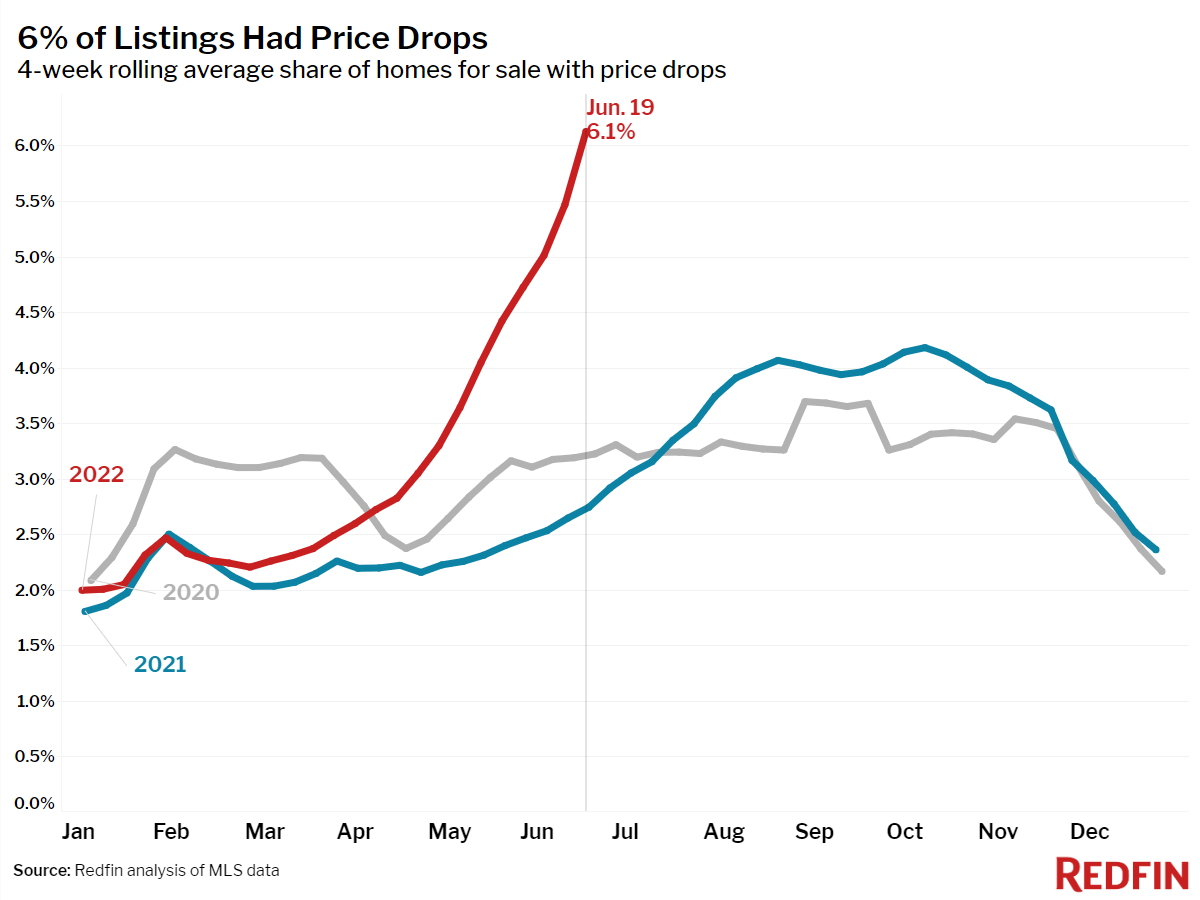

This has also led to a rate of 6.1% of homes dropping their prices, a record high since the firm started monitoring the measure back in 2015.

“High mortgage rates have kicked a lot of buyers right out of the market,” said Boston Redfin real estate agent Robin Spangenberg. “This means sellers need to price their home at whatever they are okay walking away with, because they might only get one or two offers now.”

Redfin has been tracking the real estate market in 88 largest metro areas in the US.

Information for this briefing was found via Redfin. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.