An adage in politics is that laws are like sausages; it is best not to see either being made.

Sausage-making was evident in at least one aspect of the U.S. debt ceiling compromise reached over the weekend by President Biden and House Speaker Kevin McCarthy.

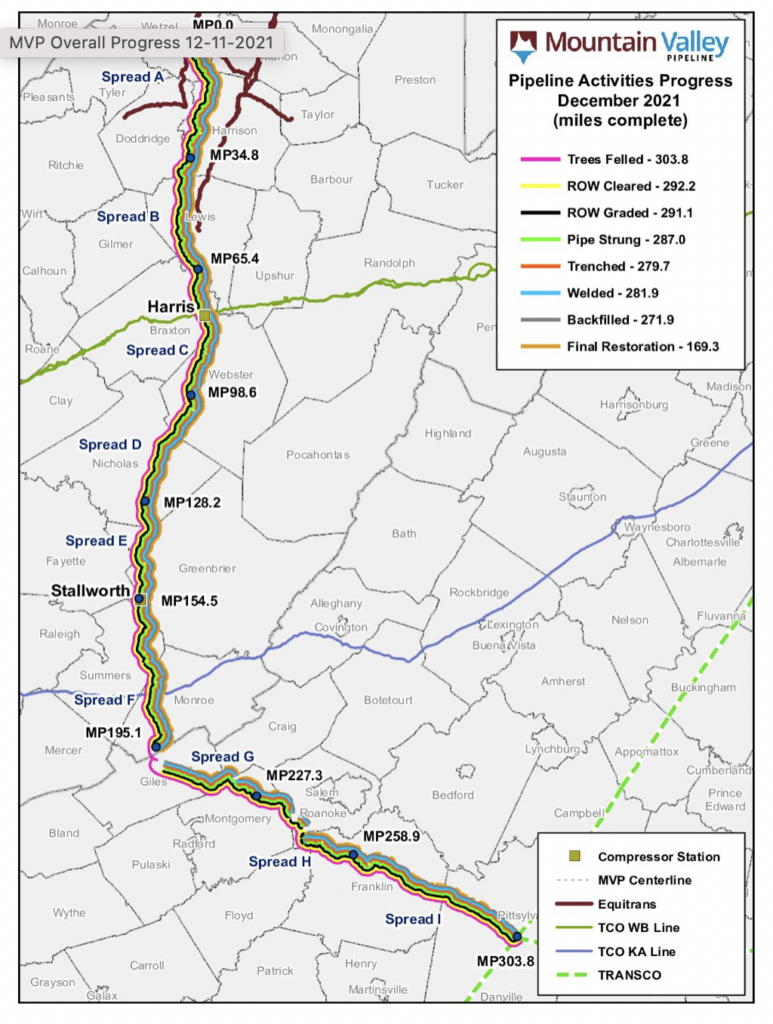

The bill includes a provision that would approve all remaining permits for the stalled, dramatically over-budget Mountain Valley Pipeline (MVP) that runs from northwestern West Virginia to southern Virginia, allowing natural gas from shale production in the Marcellus and Utica Basins to reach the U.S. Southeast. Not coincidentally, a completed pipeline would represent a significant accomplishment for West Virginia Senators Joe Manchin (Democrat) and Shelly Moore Caputo (Republican).

Originally proposed in 2014, the 303-mile, 2 billion cubic feet per day (Bcf/d) MVP pipeline has faced tenacious legal opposition from environmental groups. Such groups have fought the project every step of the way. In the process, estimated construction costs have ballooned to US$6.6 billion (from the original US$3.7 billion), equivalent to nearly US$22 million per mile, with a potential in-service date of 2H 2023. Construction began in February 2018; so, 5+ years have passed, yet work is reportedly only 94% complete thanks to the unending legal delays.

To put the time frame and budget of MVP into perspective, consider the following: the 2.1 Bcf/d, 430-mile, natural gas Permian Highway Pipeline in Texas, which entered service on January 1, 2021, took about 2 ¼ years to build and had a price tag of about US$2 billion, or US$4.7 million per mile.

The biggest beneficiary of the very favorable treatment of MVP in the debt ceiling bill is Equitrans Midstream Corporation (NYSE: ETRN), which owns about a 48% stake in the project and will be its operator. Other major owners include NextEra Energy, Inc. (NYSE: NEE) and Consolidated Edison, Inc. (NYSE: ED).

On May 30, ETRN stock rallied more than US$2, or 35%, on the surprise news. However, the shares are still down 60% from mid-2019 when the delays/higher costs on the MVP pipeline began to make headlines. ETRN is a heavily shorted stock; the 16.6 million shares sold short as of mid-May 2023 represent about 6% of its float.

Of course, it is still possible that Speaker McCarthy will be unable to gain 218 votes in the narrowly divided House of Representatives to pass the debt ceiling legislation. Hard liners on both the Republican and Democratic sides have proclaimed the compromise bill is a giveaway to the other side. If the House cannot pass the bill — with the MVP language intact — the fate of the pipeline will revert to uncertain.

Equitrans Midstream Corporation last traded at US$8.20 on the NYSE.

Information for this briefing was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.