The quadrupling in European natural gas prices over the last 2 ½ months, coupled with a much smaller increase in U.S. gas prices over that period, has created one of the most compelling commodity arbitrage plays in some time. Seemingly daily news of further Russian supply curtailments has prompted European natural gas prices to reach the remarkable level of 339 euros per megawatt-hour, equivalent to approximately US$100 per thousand cubic feet (Mcf).

The arbitrage is to buy natural gas in the U.S. (currently US$9.29 per Mcf at the key Henry Hub distribution point in Louisiana); liquefy it by cooling it to a liquid state at a temperature of negative 260 degrees Fahrenheit, thereby reducing its volume from a gas state by a factor of about 600 times; and ship it to Europe or Asia. On August 22, the landed prices of liquefied natural gas (LNG) in Europe and Asia were US$60 per Mcf and US$61 per Mcf, respectively, according to freightwaves.com. The prices are even higher today.

Per Flex LNG Ltd. (NYSE: FLNG), a shipper can realize a profit of a little more than US$200 million from selling a single shipload of LNG (containing 172,000 cubic meters, or about 6,074 Mcf, of LNG) to Europe or Asia after factoring in all costs, including shipping costs. Shipping costs for a vessel with that LNG capacity are currently around US$120,000 per day.

These rates were as high as US$250,000 per day last winter in anticipation of a potential Russian invasion of Ukraine; they fell to US$60,000 to US$70,000 in June 2022 when the Freeport LNG export facility in Texas exploded. Freeport, which represents about 20% of LNG export capacity in the U.S., is expected to return to partial service in November and full service in March 2023.

READ: Market Movers: Trillion Energy Continues To Climb As Black Sea Gas Drill Program Nears

A natural way to participate in the enormously profitable — and what may be long-lasting if the Russian-Ukraine war persists — LNG trade is through a leading LNG shipper like Cheniere Energy, Inc. (NYSE: LNG). Another way may be through owning a leading owner of LNG ships such as Flex LNG Ltd.

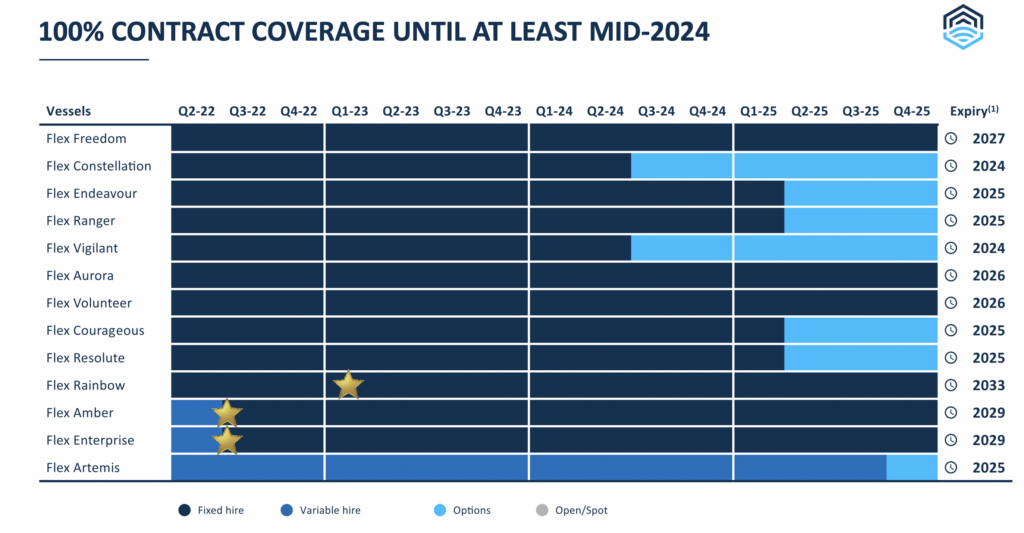

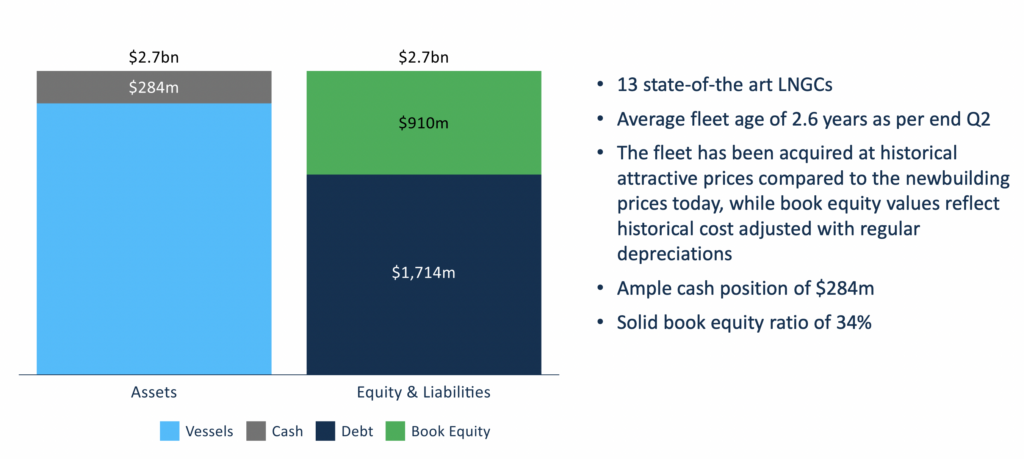

Flex owns 13 LNG ships, all of them contracted through at least mid-2024. The company earned US$2.84 per share in the twelve months ended June 30, 2022 and paid out US$3.50 in dividends (including a US$0.50 special dividend) over that period, equivalent to a dividend yield of just over 10%. Even after paying out these dividends, Flex still has nearly US$300 million of cash which represents around 15% of its stock market capitalization.

Flex stock has rallied about 40% since the June Freeport LNG plant explosion, so clearly the market realizes its strong fundamental position, in turn making it potentially susceptible to a stock market correction. Nevertheless, if European natural prices remain robust for some time, Flex could represent an interesting speculative play.

Flex LNG Ltd. and Cheniere Energy, Inc. last traded at US$34.70 and US$167.76, respectively, on the NYSE.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.