Today Nemaska Lithium (TSXV: NMX, NMX.W, OTCMKTS: NMKEF) announced in a news release the following:

Based on the CAD 1.1B financing package announced on May 30, 2018, and based on the past eight (8) months of construction, the Corporation currently estimates that additional net funds of about CAD 375M would be required to enable the Corporation to complete construction and meet the drawdown conditions provided in the streaming agreement with Orion Mine Finance and the senior secured bonds closed on April 12 and May 30, 2018 respectively.

In case you missed that, the company raised over $1B less than a year ago. And has now realized, it wasn’t enough. They will need an additional $375M to complete their project to start producing lithium hydroxide at scale. The stock had a rough morning hitting a low of 27c down over 50% from yesterday’s close and has recovered somewhat since closing the day out at 35.5c (down only 36%).

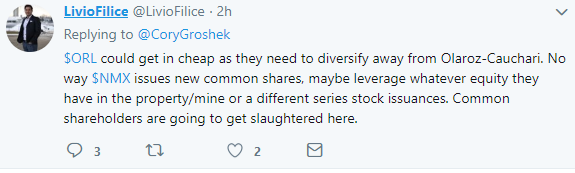

What does this mean for shareholders? Lithium thought leader and overall good guy, Livio Filice suggested the following on Twitter today,

This is somewhat concerning for everyone who is invested in lithium juniors in Canada, as Nemaska was supposed to be the first lithium production success story since, well, never. Of course, we can all remember Canada Lithium (later named RB Energy), which is now controlled by CATL (after a failed attempt at an IPO). This property through its various reincarnations has raised over $100M and now looks to producing spodumene concentrate, for what could turn into the largest battery manufacturer in the world.

This is not the end for Nemaska Lithium and for those of who have strong hopes for a lithium industry in Canada, let us hope this is a mere roadblock. Nemaska has a huge plan to take hardrock and convert it into lithium hydroxide, which appears to be the near future preferred compound of lithium for Electric Vehicles. A successful Nemaska at scale means that Quebec would be proven as a chemical producer for an industry going through a massive growth cycle in demand.

Perhaps this means that a brine producer sees an opportunity to jump in after a great deal of the common shareholders bail. Or perhaps, Nemaska already has a relatively attractive financing setup that won’t crush common shareholders. Is this an attractive entry point? That depends on how much you believe management that this next $375M raise will be it; a risk investors need to put a great deal of thought into.

Information for this briefing was found via Nemaska Lithium. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.