On February 19, Nevada Copper Corp. (TSX: NCU) announced that commercial production has begun to ramp up at the underground mine portion of its Pumpkin Hollow copper project in Nevada. However, as is the case with many mine start-ups, the company has experienced initial operating issues.

The average rate of copper ore hoisted to the surface in February 2021 has averaged about 1,600 tons per day, below the company’s daily target of around 3,000 tons. Mechanical issues have been the primary culprit. Management expects retrofitting work will be completed in a few weeks that will allow ore production to reach plan levels.

This retrofitting, coupled with ongoing installation of underground power and ventilation upgrades and the deployment of further underground fleet equipment, likely means that Nevada Copper will not reach its target of 5,000 tons per day of steady-state underground ore production until sometime in the third quarter of 2021. The company had initially hoped to reach this milestone by mid-year 2021.

A pre-feasibility study, which was updated in early 2019, projects that the underground mine should generate an average of US$80 million of free cash flow per year in its first five years of operation. According to this study, the underground mine alone has a net present value (based on a 5% discount rate) of just over $300 million. We note these figures are based on a copper price of US$1.86 per pound, far below current prices (see below).

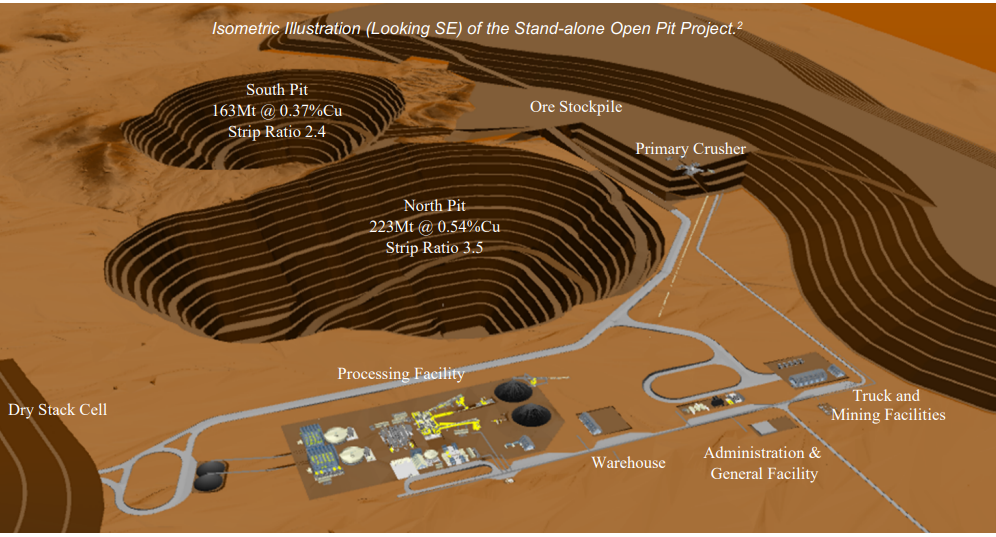

In time, Nevada Copper hopes to develop other areas of Pumpkin Hollow, including an open pit mine. A companion pre-feasibility study projects the open pit mine at Pumpkin Hollow has a net present value of $829 million, based on a 7.5% discount rate. It could generate $180 million of free cash annually over a 17-year period.

Separately, Nevada Copper announced it has resolved long-standing disputes with two contractors. Nevada Copper will pay them an aggregate $1 million in cash and issue them $2 million in Nevada Copper shares (which could grow to a total of $4 million if certain performance measures are achieved). On the positive side, the accords will improve the firms working capital position by $16 million, including a reduction in amounts payable by $4.7 million compared with the company’s previous estimates.

Copper Prices Continue to Climb

On February 19, copper breached the US$4 per pound level, reaching its highest price since September 2011. The base metal, which is used in many construction materials like electric wires and water pipes and which is viewed as a reliable leading indicator of economic health (“Dr. Copper”), has risen almost a full US dollar per pound since November 2020. Many industry observers believe that US President Biden’s plans to invest heavily in infrastructure, plus similar and ongoing plans in China, will put further upward pressure on copper prices.

Substantial Debt on Balance Sheet

As of September 30, 2020, Nevada Copper has nearly US$160 million of net debt, noticeably more than many junior miners. However, the company bolstered its balance sheet by issuing $21.5 million of common stock and warrants in January 2021.

The company’s operating cash flow deficit has averaged just over US$2 million per quarter over the last five quarters. Cash flow should improve quite significantly beginning in 1Q 2021 and especially in 2Q 2021 due to the start of commercial production at the underground mine. As the company begins to develop the open pit mine, the company will likely require additional debt and/or equity financing.

| (in thousands of US dollars, except for shares outstanding) | 3Q 2020 | 2Q 2020 | 1Q 2020 | 4Q 2019 | 3Q 2019 |

| Operating Income | ($922) | ($4,900) | ($2,032) | ($2,689) | ($794) |

| Operating Cash Flow | $491 | ($4,686) | ($2,282) | ($1,328) | ($1,930) |

| Cash, Including Restricted Cash | $7,867 | $7,492 | $12,378 | $3,096 | $16,254 |

| Debt – Period End | $166,170 | $207,128 | $190,138 | $170,963 | $130,617 |

| Shares Outstanding (Millions) | 761.9 | 761.9 | 761.9 | 761.9 | 761.9 |

Reaching steady-state production could of course take longer to achieve than Nevada Copper expects. A delay would likely reduce the company’s 2021 cash flow versus the budgeted amount and could prompt another near-term equity offering to bridge the difference. In addition, a pronounced downturn in copper prices could pressure Nevada Copper’s stock price.

Despite a solid month-to-date performance so far in February 2021, Nevada Copper shares have significantly underperformed the stocks of a number of other pre-revenue junior copper miners since the start of 2020. As commercial production at the underground mine builds, Nevada Copper’s stock could continue to perform well, particularly if the underlying price of copper can hold onto decade-high levels.

Nevada Copper is trading at $0.19 on the TSX Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.