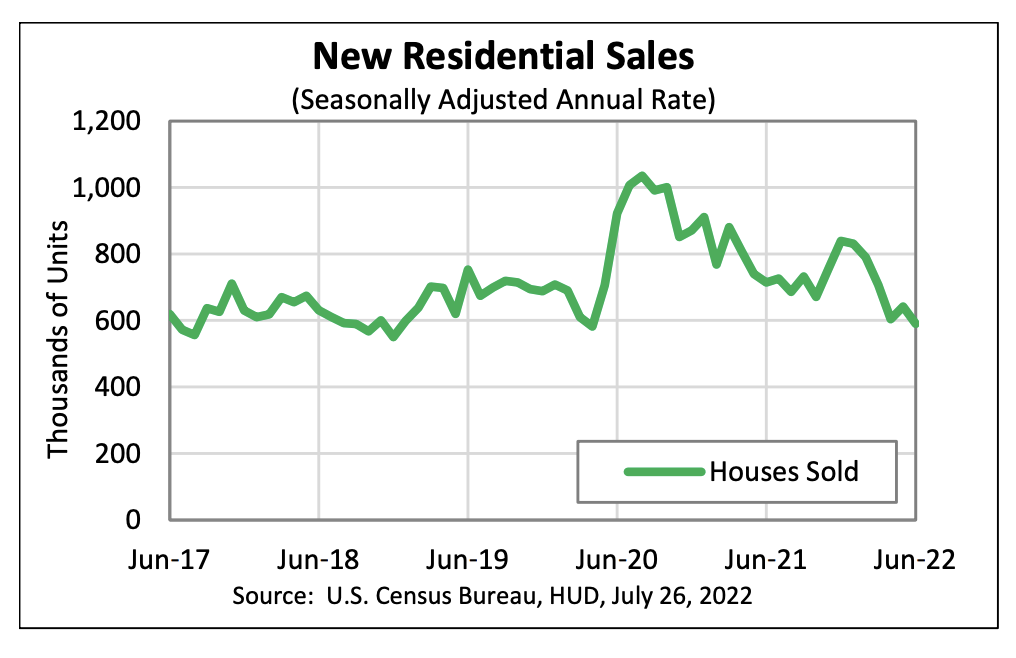

Purchases of new home sales continued to slide in June, as elevated prices and rising mortgage rates sent prospective buyers to the sidelines.

Latest data from the Census Bureau showed that sales of new single-family homes fell 8.1% between May and June to an annual rate of 590,000 units, substantially less than the rate of 655,000 units forecast by economists polled by Bloomberg. The latest figures point to a real estate market that is significantly cooling off from the pandemic highs witnessed over the past two years, as rising mortgage rates and demand-induced elevated home prices are making homeownership increasingly out of reach for the average American.

The average cost of a 30-year mortgage in the US has risen to almost double the rate witnessed last year, and when coupled with historically high home prices, prospective homebuyers have either cancelled deals or left the real estate market altogether. Data shows that the average sale price of a new home increased another 7.4% from June 2021 to $402,400, marking the smallest increase since November 2020.

There were a total of 457,000 new homes listed for sale at the end of June, the most since 2008, with 91% of the units still either under construction or have yet to be started. With that in mind, it would take about 9.3 months to liquidate the supply of new homes at the current sales pace, up from the 8.4 months reported in May.

Information for this briefing was found via the Census Bureau. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.