Last Month, Beacon Securities initiated coverage on NG Energy (TSXV: GASX) with a buy rating and a C$2.50 12-month price target, a 61% upside. They initiated on the stock when it was at C$0.72. This is the first analyst to initiate coverage on the company.

Kirk Wilson, Beacon Securities’ analyst, headlines the coverage by referring to NG Energy as, “Colombia’s Next Large Independent Natural Gas Producer.” Wilson comments that their assets’ location is very key as the three blocks that the company has assembled are near natural gas fields that are either producing or soon will be producing. He writes, “Of note is the SN-9 Block that borders Canacol Energy’s main producing blocks in Colombia where numerous wells have tested between 20-40 mmcf/d.”

Wilson also expects that Colombia’s demand will continue to grow as it’s the main fuel for electrical generation. On the other hand, supply is expected to go down. He writes, “These dynamics combine for a natural gas price that has been at a premium for many years and should stay that way…or head higher.”

Wilson provides many reasons why he likes NG Energy. The first is that the initial drilling success provides base value. He says that the Aruchara-1 well on the Maria Conchita Block provides U$49 million in reserves, which would equal roughly a C$0.68 NAV on a fully diluted basis.

The second and third reason go hand in hand. He reiterates that the three blocks are located close to either producing or soon to be producing natural gas fields, and those fields could produce 100 mmcf/d by the end of 2022. Production in 2020 is to go from a current figure of zero production, climb to 12 mmcf/d by the end of Q2 2021, and more than triple by the end of the year to an estimated 40 mmcf/d. Furthermore, Wilson outlines that production could climb to 100 mmcf/d by the end of next year, making the company one of the largest independent natural gas producers in Colombia.

The next few reasons why they like this name is because the cash flow created at these above-mentioned levels are U$10 million through to US$85 million by the end of the year. He says this cash flow, “should get NG to a self-funding level by the end of this forecast period.” He then says that the management and board have worked together on several different mining and oil and gas companies.

Wilson says that the economics on the new drill is quite impressive, writing, “Based on reported drill results from Canacol on is gas fields immediately east, GASX’s wells on the SN-9 Block have the potential for 20-40 mmcf/d of initial production.” He believes this well should generate an IRR of 185%.

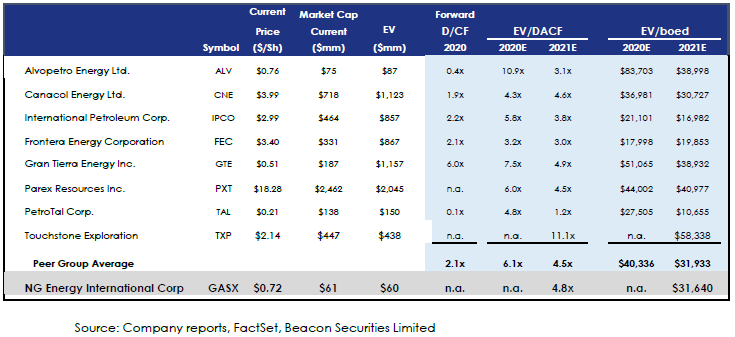

The price target provided is based on 3.0x enterprise value to debt adjusted cash flow figure for Beacon’s 2022 forecasts.

FULL DISCLOSURE: Canacom Group, the parent company of The Deep Dive has been compensated to provide coverage on this company. The company has been compensated to cover this story on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.