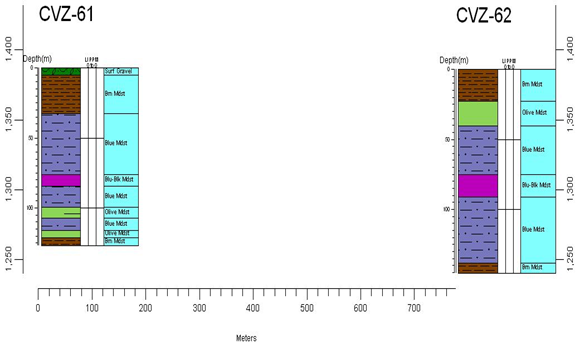

Noram Ventures (TSXV: NRM) this morning provided further results from its ongoing drill program at its lithium claystone property in the Clayton Valley of Nevada known as Zeus. Drilling is said to have intersected the longest intersection to date of mineralization on the recently completed hole CVZ-62.

The intersection of claystone measured at a total of 116 metres, with mineralization beginning at 22 metres and continuing through to 138 metres. The core itself was drilled to a total depth of 145 metres, with the intersection being noteworthy for being the longest interval to date of any drilling conducted on the property.

Mineralization found thus far in the latest completed drill hole is encouraging for the company, given that the prior hole, CVZ-61, was one of the thickest intervals found to date on the property at 91 metres of claystone. This latest hole as a result is expected to have notable implications for resource tonnage calculations given that the current program continues to find stronger mineralization.

Speaking to the deposit as a whole, current geologists for both Noram Ventures and Cypress Developments, whom is located next door to Zeus, believe that the deposit is part of the Clayton Valley playa lakebed. As a result, the deposit is currently believed under the current model to be a “blanket-like layer” of mineralization ranging from 60 to 100 metres (200 – 300 feet) thick. The mineralization is believed to be extended across the boundary line for the two properties, while remaining not yet fully defined.

Noram Ventures last traded at $0.47 on the TSX Venture.

FULL DISCLOSURE: Noram Ventures is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Noram Ventures on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.