The soaring price of oil has garnered headlines for months as key evidence of commodity price and overall inflation. While West Texas Intermediate (WTI) crude oil, currently around US$110 per barrel, certainly has jumped — up around 10% and 67% in the last month and twelve months, respectively — the real energy commodity leader is natural gas.

Indeed, benchmark Henry Hub natural gas prices have increased about three times as much as oil. On May 25, natural gas reached about US$9 per thousand cubic feet (Mcf), up 31% in a month and 196% over the last year. Natural gas last traded at these levels in August 2008.

The bad news is there is no evident catalyst to bring natural gas prices down. Note the following three points.

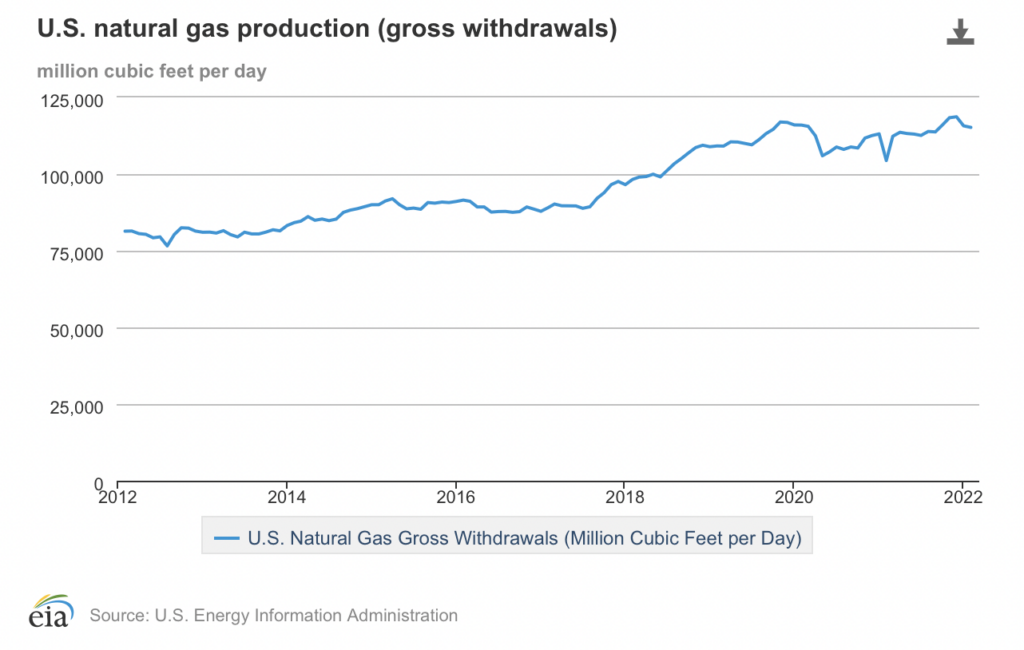

First, despite rising prices, overall natural gas production is not growing in the U.S. The most recent U.S. Energy Information Administration data shows that February monthly production was 115.2 billion cubic feet (Bcf), down from 115.7 Bcf in January and 118.7 Bcf In December 2021.

Second, the U.S. is exporting as much of this produced gas as is physically possible, leaving comparatively less for domestic consumption. Of course, this policy is designed to bring incremental natural gas to Europe, substituting for some of the gas normally supplied by Russia. On May 23, 13.3 Bcf per day (Bcf/d) was supplied to U.S. liquefied natural gas (LNG) export facilities, just above the plants’ aggregate theoretical peak capacity of 13.2 Bcf/d.

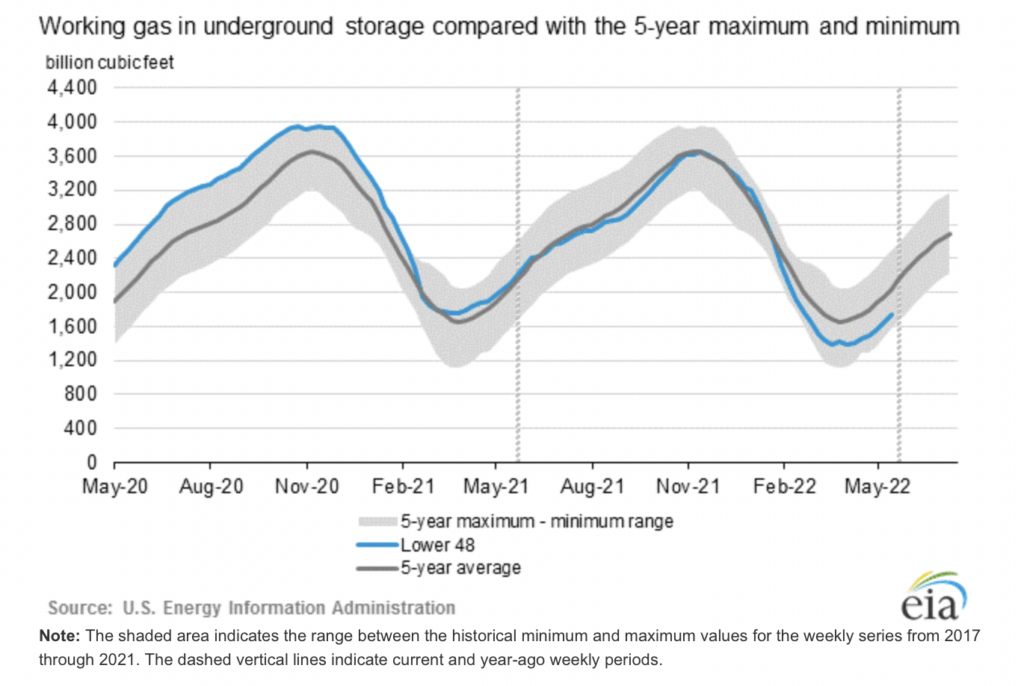

Third, the quantity of natural gas in storage in the U.S. is about 15% below the five-year historical average. As of May 13, 1,732 Bcf was held in storage, down from the expected level of 2,042 Bcf at this point in the year and from 2,090 Bcf in mid-May last year. Natural gas in storage builds from around March through early November and declines as the gas is used in the winter heating season.

Surprisingly, as U.S. natural gas prices are rising, European prices are falling (albeit from much higher levels). EU natural gas futures are trading at about 85 euros per megawatt-hour (Mwh), equivalent to about US$27 per Mcf, the lowest levels since Russia invaded Ukraine. Courtesy of the U.S. LNG exports described above, European gas storage levels have reached about 45% of maximum capacity in May, in line with historical averages.

Russia’s recent decision to cut off natural gas exports to Finland has had little effect on European gas prices. Russia’s gas exports accounted for only about 3% of the Nordic nation’s energy mix.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.