Last week, Eight Capital launched coverage on a basket of psychedelic companies. This comes after they produced an industry primer during the summer months. The fourth company initiated on this note is Numinus Wellness Inc. (TSXV: NUMI), with a C$1.10 12-month price target and buy rating while referring to the firm as “a diversified operator.”

They call Numinus the clear leader among the diversified players in the space as it has a number of different operations.

Eight Capital expects Numinus Wellness to do multiple accretive acquisitions to bolster its leading position. They expect Numinus to do acquisitions for new clinics into new jurisdictions, to which they will “bolt on” higher-margin psychotherapy services.

They also expect that Numinus will leverage its position as a supplier of naturally derived psilocybin and its extraction/purification expertise to develop capsules for human use in clinical trials. This potentially means they will have replacements to alternate forms for the supply of psilocybin.

Eight Capital also believes that Numinus is the perfect commercialization partner for other companies, saying, “we believe Numinus’ differentiated capabilities in developing, testing, and administering psychedelics in a clinical setting render it well-positioned to serve as a commercialization partner that could see its psychedelic-assisted therapy regiment differentiated from the offerings of other PAP clinics.”

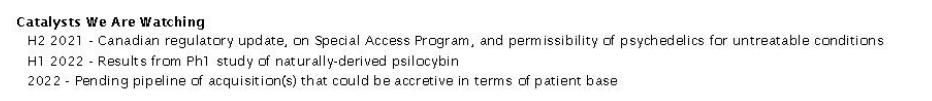

Below you can see Eight Capital’s catalysts they are watching.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.