Nvidia Corp (NASDAQ: NVDA) reported their fiscal third-quarter earnings on May 26th after market close. The company came slightly below the top line analyst estimates, which was $5.661 billion. The company had a gross margin of 64.1% and earnings per share of $3.66.

The companies average 12-month price target from its 43 analysts rose from $669.16 to $703.86, a modest 12% upside after a number of analysts raised their target prices and rating. Nvidia now has 11 analysts with a strong buy rating, 25 with a buy rating, six with a holding rating, and a single analyst with a sell rating. The street high comes in from Rosenblatt with an $800 price target.

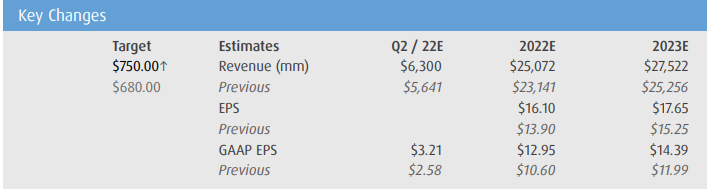

BMO Capital Market’s increased their 12-month price target from $680 to $750 off the back of Nvidia’s earnings and reiterated their outperform rating. Their analyst Ambrish Srivastava said that this quarter’s results showed overall strength and that the crypto boom is certainly helping out with sales.

For the earnings, Srivastava writes, “NVIDIA delivered a very strong set of results. Guidance is well above as well,” and commends the companies increased transparency around the impacted data center. He comments that the large increase in inventory purchases makes BMO believe that the strength will continue into the second half of this year.

Nvidia’s revenue came in at $5.66 billion, up 13% quarter over quarter. This beat BMO’s estimates which only called for a 9% quarter-over-quarter rise and PF EPS came in at $3.66 versus their $3.30 estimate. Gross margins came in line with expectations. Gaming sales came in at 49% of the companies total revenue but generally came in line with BMO’s $2.75 billion estimates. Srivastava adds, “While the company is unable to quantify the gaming demand from crypto, it reported $155M in revenues from the new CMP product line.”

Below you can see BMO’s new 2022-2023 full year estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.