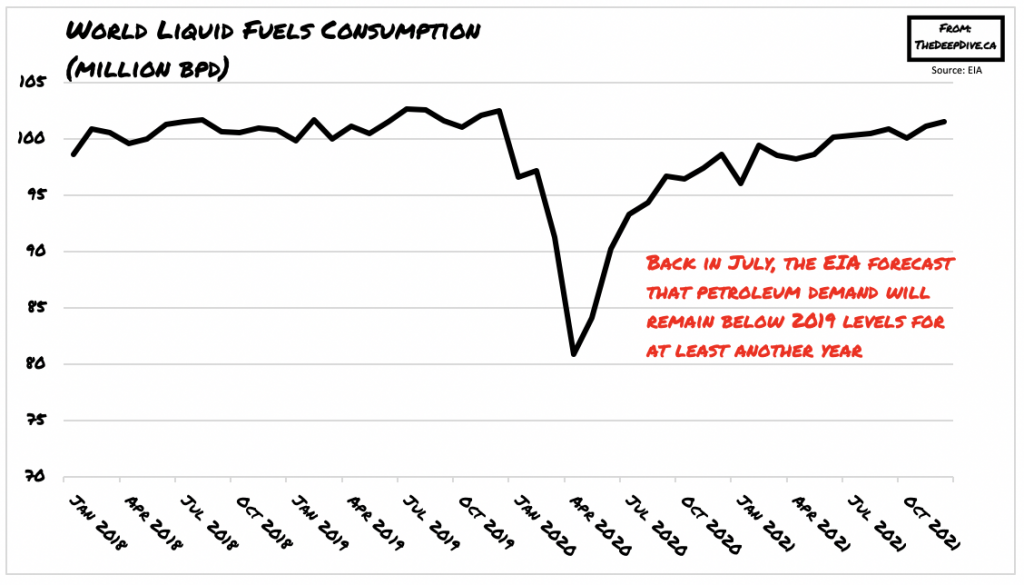

As the demand for crude oil collapsed amid the pandemic, OPEC had no choice but to reduce output as a means of restoring some form of balance in the market. Six months into the global pandemic however, the demand for crude oil and its products remains subdued, suggesting that OPEC will soon run out of options.

Over the past several months, the demand for oil was partially regained as countries began to ease coronavirus restrictions and reopen their economies, prompting some resurgence in travel – especially in the US, which experiences a heightened driving season during the summer. However, as threats of a second or even third pandemic wave become increasingly plausible, especially as the northern hemisphere enters the fall and winter season, travel will likely become unattractive once again, prompting yet another crude oil oversupply.

Moreover, as some western countries increasingly turn toward the electric vehicle market for a cleaner alternative to fossil fuels, the demand for crude oil will not only remain subdued for the duration of the pandemic, but also possibly into the long run as well. In fact, California has recently mandated that any new vehicles sold in the state must be emission-free by 2035. In the meantime, China is also expected to undergo a significant shift in its emission policies as well. According to Oxford Institute for Energy Studies, the country’s demand for oil over the next 20 years is expected to increase by an annual pace between 3 to 4 million bpd, after growing by double digit rates previously.

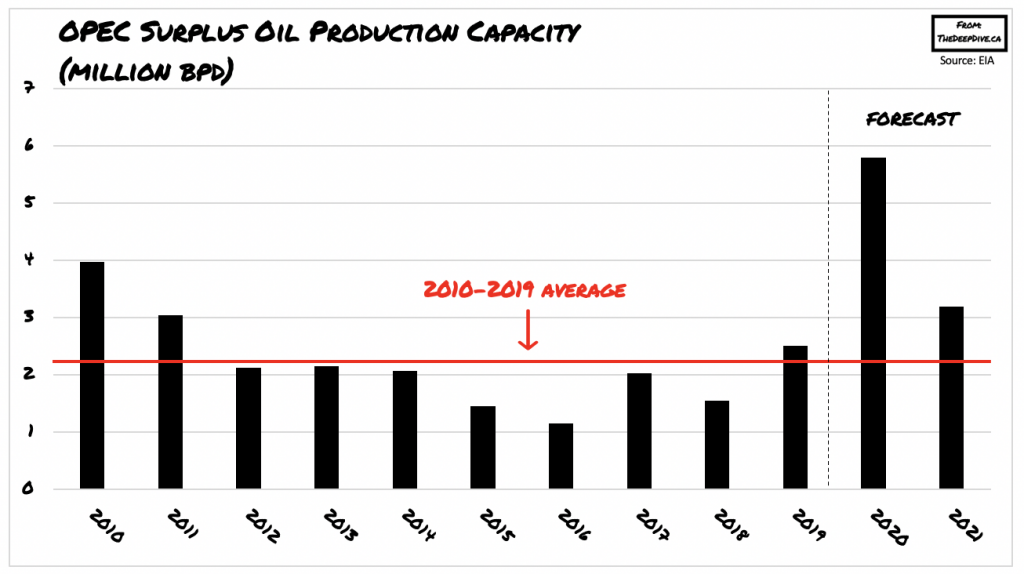

As the evidence suggests, demand remains so subdued that any additional output would continue to heavily saturate the market. However, to make matters worse for OPEC, Libya has decided to suddenly increase its oil output. Libya has thus far suffered from violent conflicts among its factions, which has resulted in the country’s oil ports being shut down for extended periods of time. However, several of those factions have reached a ceasefire that resulted in the reopening of these oil ports and their corresponding oil fields. As result, the National Oil Corporation expects to boost average daily output from 100,000 bpd to 260,000 bpd.

Libya’s decision to raise its crude oil output will certainly create more headaches for OPEC, as the cartel is slated to discuss further output reduction steps later this year. OPEC’s current plan is to decrease output by an average of 2 million bpd beginning in January 2021, but given the grim trajectory of global oil demand, OPEC members may not be able to come to a consensus; after all, some countries are in desperate need of oil revenues to survive the economic effects of the pandemic.

Although oil-rich countries such as Saudi Arabia have been known to boast that their economies are resilient to low oil prices, it appears that several Gulf nations are finally feeling the pressure of decreased oil demand. According to an increasing body of evidence, Gulf economies that are heavily reliant on oil production in order to maintain growth projections have actually been struggling with oil prices stuck below $40 per barrel. S&P Global Ratings has estimated that Gulf Cooperation Council (GCC) central government debt will skyrocket by a record-breaking $100 billion in 2020, while deficits are expected to reach approximately $490 billion over the next three years.

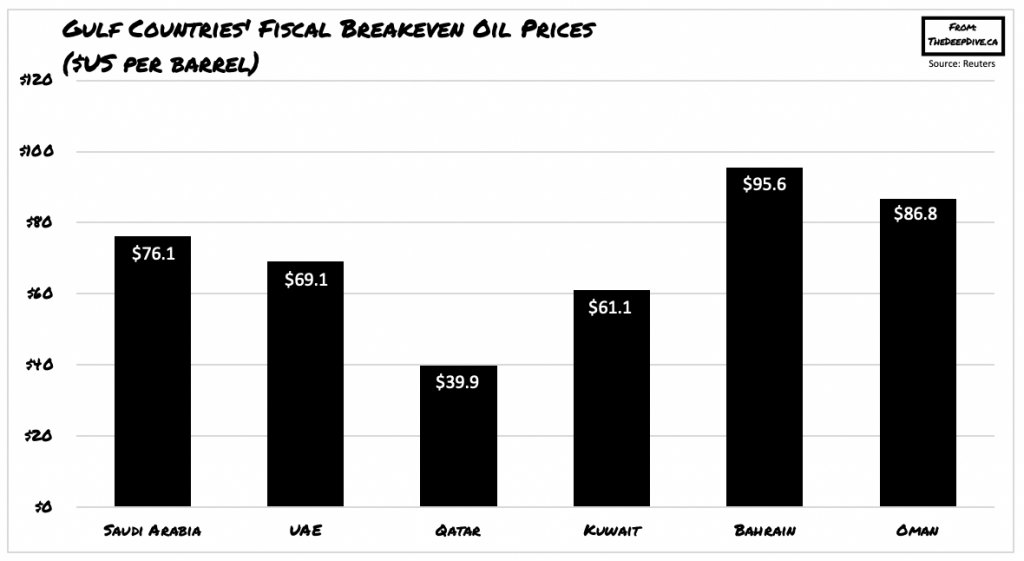

Although many of these oil-rich countries have very low production costs and are able to withstand harsh oil market slumps, the reality suggests that their breakeven points are considerably higher. As a result, countries such as Saudi Arabia would actually need oil prices to remain around $76 per barrel in order to breakeven for the current fiscal year, or otherwise risk running massive deficits of up to 11.4% of GDP. Indeed, Saudi Arabia’s economy is so reliant on oil production, that the commodity accounts for approximately 87% of the country’s budget revenues, 42% of GDP, and 90% of export earnings.

In comparison, the US had a fiscal deficit of 4.2% of GDP in 2019, but a deficit of 13.1% of GDP is expected in 2020 as a result of the pandemic. Nonetheless, the Congressional Budget Office anticipates that America’s deficit will return to normal levels in 2021, and then gradually increase over the next thirty years until the deficit is at 8.7% of GDP levels. The intriguing part however, is that Saudi Arabia strongly denies employing austerity measures, even though the country has recently announced the suspension of its living allowance, as well as employed spending cuts across non-priority areas.

Information for this briefing was found via the National Oil Corporation, the Oxford Institute for Energy Studies, S&P Global Ratings, and the Congressional Budget Office. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.