On July 12, Osisko Gold Royalties (TSX: OR) announced their preliminary second-quarter deliveries, revenues, and margins. The company said it earned 22,240 ounces of gold equivalent ounces during the second quarter, making it the best quarterly delivery in the history of the company.

The company had preliminary revenues from their royalties and streams of C$51.5 million with a cost of sales of C$3.7 million, or a cash margin of C$47.8 million.

Osisko’s CEO, Sandeep Singh, commented, “Our royalty and streaming portfolio delivered records on a number of fronts in Q2 including GEO deliveries and absolute cash margins. We continue to expect further increases in deliveries in the second half of the year as ramp-ups at Mantos and Eagle progress towards nameplate capacity.”

Osisko Gold currently has 12 analysts covering the stock with an average 12-month price target of C$23.23, or an upside of 82%. Out of the 12 analysts, 3 have strong buy ratings, 8 analysts have buy ratings and a single analyst has a hold rating on the stock. The street high price target sits at C$27, which represents an upside of 111% to the current stock price.

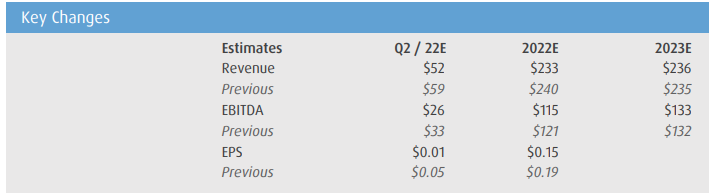

In BMO Capital Markets’ note on the results, they reiterate their market perform rating and C$17.00 12-month price target on the stock, saying that the results came in “a touch light.”

On the results, the royalties of 22,240 gold equivalent ounces came in below the visible alpha of 24,200, which attributed to revenues of C$51.5 million coming in slightly below their C$59.4 million estimates.

On the number of positive portfolio updates Osisko provided in their news release, BMO says that they have been “largely already reflected in our estimates.” While they note that Osisko Gold Royalties has reduced their exposure to Osisko Development Corp as their ownership has gone from 88% to 44.1%.

BMO says that they view this development as a positive as “not only because it improves the independence of the two companies, but also because the equity raised is funding the development of the San Antonio project, which is expected to start production in early Q3/22 and the Trixie project.”

Below you can see BMO’s updated estimate on the stock.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.