Feature image by Flickr user Wayne England.

Embattled medical devices company Penumbra Inc. (NYSE: PEN) was quietly having an impressive 2021, market wise, before it got loud about it Monday, releasing aggressive revenue guidance ahead of its yet-to-be-scheduled Q4 earnings call. The company then followed up with a tour-de-force performance at the JP Morgan Healthcare Conference, where the sell side hosts were all too happy to ask CEO Adam Elsesser some more “great questions,” and give the executive room to do the only thing he really needs to do right now: control the narrative.

Penumbra has seen positive price action every single day of 2021 on average volume, decidedly pulling itself up off the mat and above its moving averages with an aggregate gain of +27.4% at Wednesday’s $223.01 closing price. The company’s news feed, which had been buried in a flurry of solicitations for investor claimants in class action lawsuits in the final month of 2020, was quiet until Monday the 11th, when the company released un-audited revenue guidance for Q4 and FY2020.

The pre-earnings revenue guidance is uncharacteristic of Penumbra, which typically releases the line items in its quarterlies and annuals all at once, in a press release that shows up at the same time as the filing, on the same day as the earnings call, but these are strange times.

The showpiece in the guidance was the Q4 revenue range projection of $162.5 million – $167.9 million, shown next to an aw-shucks non-GAAP projection of $172.5 million – $172.9 million that excludes the returns from the recall of the Jet 7 Xtra-Flex catheter. The intended messages were telegraphed in the lead bullet points: 1) this is a growing top line and 2) the recalled product is about 3% of our business.

The release’s very existence is a message to the market about how Penumbra plans to handle itself in 2021: The stock is a priority, and if the shorts want to control the narrative, they’re going to have to pry it away from management first.

Putting on an IR Clinic

Elsesser rolled the momentum from that release into a virtual presentation at the JP Morgan Healthcare Conference that took full advantage of its sell-side hosts to put the company’s self-portrait on the top of the stack in the investors’ memory. He took every opportunity available to talk up the vascular division, implicitly framing the neuro division as small relative to the expanding vascular division, and relative to the business as a whole, and framing the recall as being contained to neuro.

He came off excited to to kick off a new phase of growth with fresh vascular products. This tech-forward company is even launching a new VR product. Penumbra carried itself the way it wanted to be seen by its investor audience; as a Silicon Valley-based innovator and a pioneer in the field.

Presumably, the company didn’t omit the cost-of-sales and bottom-line from this most recent guidance because it would make it look good, and there’s no word on what portion of the $142 million in finished goods inventory was affected by the Jet 7 Xtra Flex recall, but there’s still a full two and a half months before the 2020 10-K is due on March 1st, 2021. During that period, expect Penumbra to mount an investor relations offensive that is more about volume than substance.

While we don’t expect that Penumbra will publicly acknowledge the very active and loud short attack that appears to have no intention of giving up its entrenched position, it’s almost certainly the reason behind this offensive. There’s no telling what the diligent conglomerate of indy researchers might publish next to further its case that Penumbra is a volatile time bomb with an un-observable clock and an unlimited downside, but Penumbra’s IR team can’t afford to worry about the whats and whens that are outside of its control.

The move here is to jam the channels. Expect new stories with new headlines that advance the same core message and keep coming no matter what. The company has a deeper war chest than the shorts, and a direct relationship with an audience conditioned to see things its way.

The most recent strike from the shorts came December 28th, before Penumbra managed to use the psychological reset of the New Year to grab the momentum, in the form of Marcus Aurelius’ attempt to impeach the company’s trials process. The report had merit, but was difficult to follow and easy to forget. In mid January, as far as the market hive mind is concerned, it’s ancient history.

Fighting the tide

The shorts’ case that Penumbra’s single-minded focus on sales and alleged cutting of corners to get products to market makes it vulnerable to future malfunctions and recalls, and the regulatory sanctions that come with them, is essentially an argument that Penumbra’s upside comes with a considerable amount of downside risk.

In a market that barely seems to even acknowledge risk, let alone discount it, that’s something of an uphill climb. To win this war of information and successfully turn the dominant Penumbra sentiment negative, the shorts are going to have to bring the risk into an imminent, near-term timeline, and do it in a way that sticks.

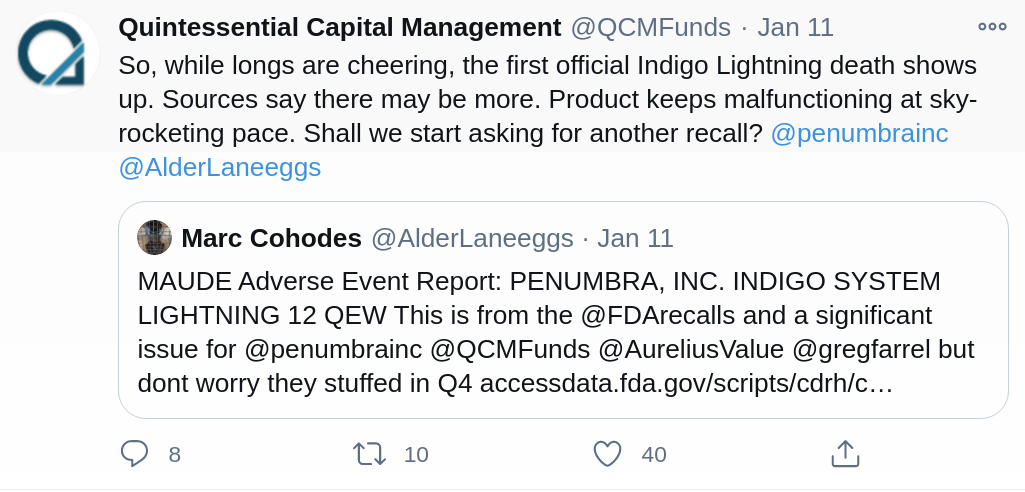

QCM pointed out on twitter Monday that the FDA’s MAUD system cataloged a death of a patient being treated with Penumbra’s lightning vascular catheter in November. The death hasn’t yet been conclusively blamed on Penumbra’s catheter or been shown to be a part of a pattern. If QCM has additional instances of such deaths or other relevant information, we expect to hear about it, and expect Penumbra to continue ignoring it and doing everything it can to drown it out.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.