Thursday, Canaccord Genuity’s Doug Taylor lowered Patriot One’s (TSX: PAT) 12-month price target from C$1.15 to C$0.75 and reiterated his Hold recommendation on the stock. This is off the back of Patriot’s fourth-quarter results, which reflected a slower initial commercial ramp than originally anticipated.

Taylor comments in his opening brief, “Our forecast is reduced again to reflect a more conservative near-term outlook. [..] We continue to advise investors wait for clear signs that the commercial ramp is underway before building positions in Patriot One.”

Taylor adds that “Q4 fell short of our model again as COVID restrictions weighed on marketing.” Revenues came in at $0.4 million vs. Canaccord’s estimate of $3.2 million, which was all related to XTRACT and no PATSCAN revenue. Taylor estimated that XTRACT revenues would be $1.2 million, while PATSCAN revenue would have been $2 million.

OPEX for the fourth quarter was $5.3 million, above the estimated $4.5 million as the company continued to add to personnel and administrative expenses, which offset the reductions in R&D. Patriot One ended the quarter with $22.4 million in cash. Taylor believes that the company “has enough cash on hand in the near term to fund its operations and growth strategy.”

Taylor notes, “Product launches post Q4, but many end markets have other concerns.” As Patriot One announced, they have launched their PATSCAN MSG and the VRS products. Still, management noted delays and disruption to its sales, business development, and implementation activities due to the pandemic. Also, many of the companies’ initial target customer segments have been hit hard due to COVID-19 which will further impact operations.

Finally, Taylor closes out the note commenting that the search for a replacement CEO remains ongoing, with no replacement named. This is despite the announcement of Martin Cronin’s transition to an advisory role in August.

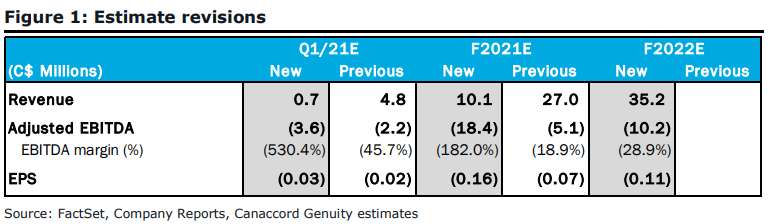

Doug Taylor has lowered his first fiscal quarter and fiscal 2021 estimates for Patriot One, while outling fiscal 2022 estimates. The changes can be viewed below.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.