PayPal’s mid-October launch of a new service which allows its U.S. users to shop with and speculate on cryptocurrencies seems to have had a significant positive effect on the trajectory of Bitcoin prices. PayPal’s program permits its U.S. customers to buy, sell or hold Bitcoin in their virtual wallets, which can also be used to purchase goods.

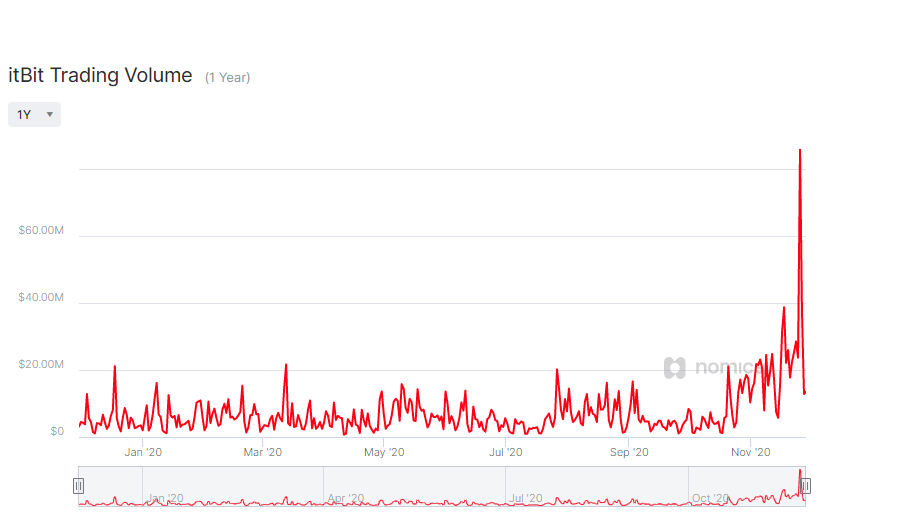

In more detail, PayPal engaged Paxos’ itBit exchange to manage its users’ Bitcoin transactions. In turn, the volume on the itBit exchange has soared over the last couple weeks to a daily average of around US$20 million from about US$3-4 million before the PayPal announcement.

If we assume that about 80% of this US$16 million differential is attributable to the PayPal program and factor in the average Bitcoin price of around US$14,500 over the past month, PayPal’s U.S. users alone created Bitcoin volume of about 880 coins per day over the past month (presumably mostly purchases). In comparison, only about 1,000 new Bitcoins (about 7 Bitcoins are mined every ten minutes, including transaction costs) are created each day by all worldwide miners combined. In other words, PayPal’s U.S. users may be effectively purchasing nearly all the new Bitcoin being mined.

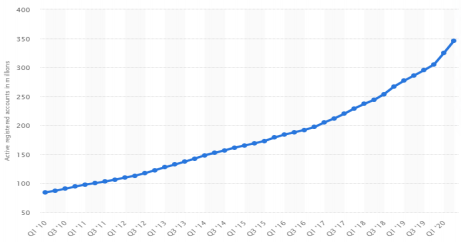

PayPal’s users’ influence on Bitcoin is likely to become even more pronounced over time when its 26 million worldwide merchants – one of the largest merchant networks in the world — linked to PayPal’s system will be fully able to accept Bitcoin as payment for their products. For the merchants, the Bitcoins they receive will be converted into their home currency at transaction settlement, so they will not have to accept long-term Bitcoin fluctuation risks.

Consider the following reasoning: in the third quarter of 2020, PayPal processed US$247 billion of transaction volumes from its user base, or about US$2.68 billion per day. It therefore appears that only about 0.5% (80% times US$16 million divided by US$2.68 billion) of PayPal’s daily transaction volume is denominated in Bitcoin.

If that volume were merely to double as users in other countries are eventually allowed to participate in the company’s Bitcoin shopping and speculation service, PayPal’s user base would be effectively purchasing 150% or more of all newly created Bitcoin. Furthermore, PayPal’s user base is likely to continue to expand. Total active users totaled 361 million at September 30, 2020, up from around 90 million ten years ago.

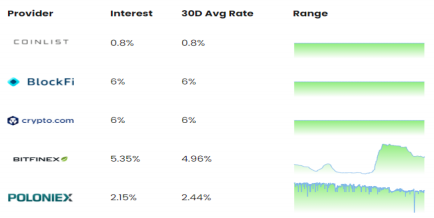

Bitcoin Lending Rates May Be Supporting Bitcoin Pricing

Bitcoin has appreciated about 75% over the past 2 ½ months. A major factor in the rise is investors’ fear of future inflation, which has driven substantial funds into inflation hedges like Bitcoin and gold. Another underappreciated reason for Bitcoin’s ascent – and one which does not appear to be going away any time soon – is investors’ search for yield. According to Bloomberg, about US$17.05 trillion of global debt now has a negative yield. This represents about 6.6% of all global debt, per the Institute for International Finance.

Bitcoin holders can earn as much as a 6% annual interest rate by loaning their holdings to various cryptocurrency exchanges, such as itBit noted above. The exchanges need these loaned Bitcoins to facilitate short sale transactions with other investors. The availability of such extraordinary lending returns may be a factor in Bitcoin’s appreciation over the past few months.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.