Peloton Interactive, Inc. (NASDAQ: PTON) has had a rough start to the year, being down almost 25%. Trouble started on January 18th, when CNBC reported that Peloton has hired McKinsey to review the business’s cost structure, which may lead to job losses. Two days later, CNBC reported another scoop, in which they report that Peloton is going to halt production of its bikes and treadmills due to demand slowdowns.

Then after hours on January 20th, Peloton announced its preliminary second quarter results. Revenue is expected to be $1.14 billion, halfway between their $1.1 and $1.2 billion guidance. While adjusted EBITDA will come in the range of $(270) million to $(260) million, better than their previous guidance of $(350) million to $(325) million. Though, connected fitness subscriptions missed their guidance of 2.8 to 2.85 million as it’s expected to come in at 2.77 million.

Peloton currently has 31 analysts covering the stock with an average 12-month price target of US$54.12, or a 124% upside to the current stock price. Out of the 31 analysts, 6 have strong buy ratings, 9 have buys, 14 have holds and the last 2 have sell ratings on the stock. The street high sits at US$90, which represents a 272% upside to the current stock price, while the lowest price target comes in at US$24.

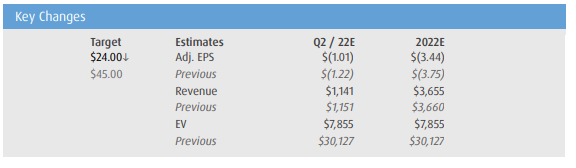

In BMO Capital Markets’ note, they reiterate their underperform rating and lower their 12-month price target to US$24 from US$45, stating the obvious by saying that COVID was the best thing to happen to Peloton.

BMO says that the recent company news flow echoes what analysts have been saying would happen, and comments that the company is “at the edge of an important precipice; a material strategic reset is likely required to stem meaningful cash-burn and faltering demand.” They expect this would impact revenue as connected fitness is still in the early innings.

On the company coming out and denying that they are halting all production of bikes and trends, BMO reads between the lines and says that using the word “all” seems “somewhat dilutive to that message.” Though they are not surprised at this outcome, with Peloton reporting $1.3 billion in inventory. They believe that Peloton now has built up supply based on COVID-19 demand, which is not the norm anymore.

Lastly, they add that the latest $1.15 billion raise at $46 a share, now looks good. They expect that this raise helps plug the hole created by -$561 million operating cash flow and -$648 million free cash flow. They expect in 2022 that Peloton burns over $1 billion in operating cash flow with an additional $400 million in CAPEX, which possibly gets reduced, though they add, “we have no reason to believe the operating cash burn stops this year.”

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.