On November 26, shares of Peloton Interactive, Inc. (NASDAQ: PTON), a leading seller of fitness equipment, was one of the few gainers (+5.7%) on a day when concerns about a new COVID variant, dubbed B.1.1.529 or Omicron, overwhelmed worldwide stock markets.

Full details of the extent of the transmissibility and vaccine resistance of Omicron, which has been detected in South Africa, Hong Kong, the UK, and Belgium, are not yet known, but fear caused investors to buy some stay-at-home stocks like Peloton, Zoom Video Communications, Inc. and DoorDash, Inc., which all surged in 2020 during the height of the COVID-19 pandemic.

How long investors stay with Peloton is debatable as it is unclear if it would benefit nearly as much from a potential second (shorter?) lockdown as it did in the first. In addition, the company’s fundamentals have deteriorated significantly, yet it still carries a premium valuation.

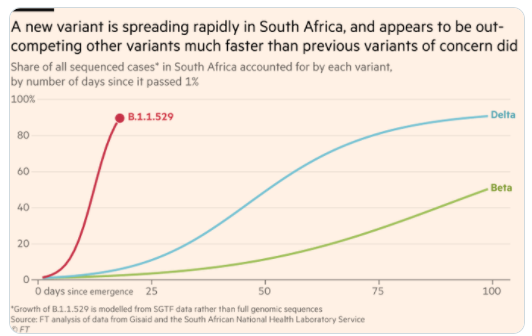

As an aside, initial indications suggest Omicron could potentially spread rapidly. The below graph shows how quickly the variant became the dominant strain in South Africa, a pace which was much more rapid than that of the Delta variant.

In early November, Peloton reported 1Q FY2022 (quarter ended September 30, 2021) earnings and slashed its guidance for the fiscal year ending June 30, 2022. The company now expects full year FY 2022 revenue of US$4.4 billion to US$4.8 billion, down markedly from the US$5.4 billion forecast it endorsed in July. In tandem, the company increased its FY 2022 EBITDA loss projection to US$425 million – US$475 million from US$325 million.

| (in millions of US $, except for shares outstanding) | FY22 Guidance | 2Q FY22 Guidance | Last 12 Months | 1Q FY22 | 4Q FY21 |

| Revenue | $4,600 | $1,150 | $4,069.2 | $805.2 | $936.9 |

| Operating Income | ($616.3) | ($359.7) | ($301.7) | ||

| Adjusted EBITDA | ($450) | ($338) | ($98.7) | ($233.7) | ($45.1) |

| Operating Cash Flow | ($612.8) | ($61.0) | ($599.0) | ||

| Cash/Marketable Securities | $924.2 | $1,606.8 | |||

| Debt, including Conv. Debt | $1,635.0 | $1,512.1 | |||

| Shares Outstanding (Millions) | 302.8 | 300.1 | |||

| Connected Fitness Subscriptions | 3,400,000 | 2,825,000 | 2,492,000 | 2,331,000 | |

| Connected Fitness Quarterly Workouts | 120,515 | 134,334 |

Furthermore, during the conference call discussing 1Q FY22 results, the company’s CFO explicitly stated that Peloton does not “see the need for additional capital raise based on our current outlook. As we mentioned, we’re taking significant steps to adjust our expenses across COGS and opex with this revised guidance, then we have a lot of levers to pull.”

Ten days later, the company announced plans to issue about US$1 billion of new equity. This action had two negative effects: it underscored the company’s high cash burn rate and erodes investor confidence in management guidance.

We also note that Peloton shares could be subject to significant tax-loss selling in December. The stock has lost about two-thirds of its value so far in 2021 and many U.S. investors could elect to sell shares in the fitness equipment manufacturer to offset capital gains in other securities.

Peloton’s current enterprise value (EV) is around US$14.75 billion, which equates to about 3.2x its projected FY 2022 revenues. During prior periods, that multiple might seem attractive. However, if the company were to meet the US$4.6 billion midpoint of its full year FY 2022 revenue, that would imply only 13% revenue growth from the US$4.069 billion revenue realized over the 12 months ended September 30, 2021. Attaching a 3.2x revenue multiple to such a diminished growth rate may be too high of a figure.

Equally difficult is predicting how the stock market will value the company’s projected cash flow deficits now that growth is slowing. Peloton’s adjusted EBITDA loss is US$98.7 million for the twelve months ended September 30, 2021. This shortfall is now expected to be 4.5 times this figure in the twelve-month period ending June 30, 2022.

It is of course possible that investors will, as they did in the COVID-19-induced financial crisis in 2020, turn to Peloton as a core “stay at home” investment — regardless of its valuation.

Peloton’s deteriorating fundamentals and rich valuation could make the stock’s counter-trend rally on November 26 short-lived. If investors decide the company is transitioning from a growth company to a more conventional valued one, the stock could have more downside risk.

Peloton Interactive, Inc. last traded at US$46.41 on the NASDAQ.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.