Earlier this week, PI Financial sent a note to investors giving their thoughts and estimates on the MSO’s first-quarter performance and what to expect in their earnings. Jason Zandberg, PI Financial’s analyst writes, “We think Q1/21 is going to be a strong quarter for all the US cannabis companies in our coverage list,” while stating that Jushi, Ayr Wellness will most likely outperform both consensus and PI Financial estimates.

Zandberg reflects on the first quarter news flow saying that the quarter was “largely dominated by the narrative surrounding potential legislative activity at the federal level regarding cannabis reform.” This narrative came after the Democrats took over the senate, resulting in rumours that legalization would be on the horizon. As the general cannabis community came down from a collective high to realize the U.S government doesn’t move fast for shit, the shares of these cannabis companies took a hit with the ETF MSOS having a peak to trough drawdown of 32%.

Zandberg recommends clients to be buying the dip, “ahead of the spring and summer months when the return of outdoor events in the US will be a catalyst for sale,” as well as his channel checks show that many retailers had record sales on 4/20. Interestingly, although Zandberg calls the movement on federal cannabis legalization hitting the Senate a major catalyst he writes, “we do not view a move at the federal level as essential considering the vast array of positive state-by-state catalysts and upward trends in cannabis sales across the US.”

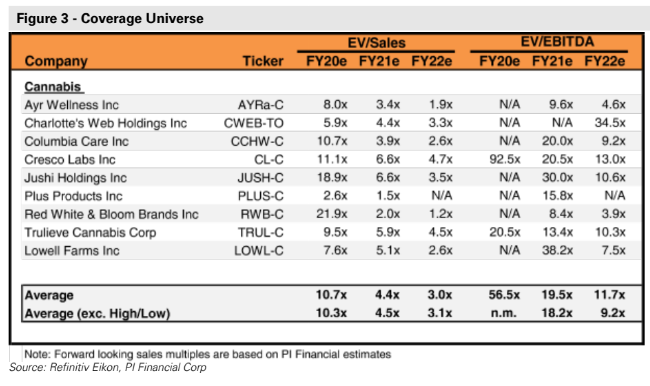

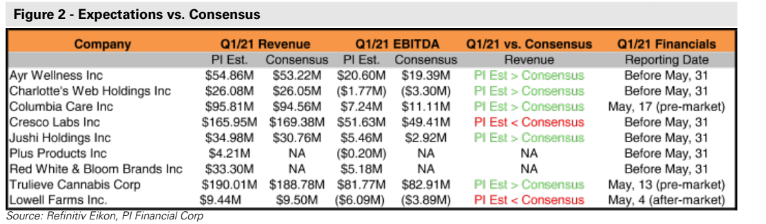

Below you can see the excellent cheat sheet that PI has made for these upcoming Q1 numbers. Most notably, PI’s revenue estimate for Jushi is almost 100% above the consensus estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

US Cannabis, Momentum, With Lots of Hurdles

The US Cannabis market has been a confusing ride for investors to comprehend. We have...