On Wednesday morning, PI Financial initiated coverage on Gage Growth Corp (CSE: GAGE) with a C$7.50 price target and buy rating. This is the third analyst to cover Gage, the others being Haywood Securities whom has a C$4.50 price target on the name, and another analyst with a C$6.50 price target.

PI Financial’s price target is based off of two main items, with the first being the multitude of tailwinds to look forward to in the U.S cannabis sector. Such tailwinds include, “new states creating adult-use cannabis markets and changes to federal regulations around cannabis (MORE Act, STATES Act, SAFE Act).” The second item meanwhile pertains to the Michigan market, Gage’s core market, which is expected to grow quicker than other states, which would “eventually result in GAGE trading at a premium to its peers.”

PI Financial says that the Michigan market has 300,000 patients, a population of 10 million, and has grown 892% from January 2020 to March 2021. The Michigan market is now sitting at a $1.8 billion run rate after the combined medical and recreational market hit $153.6 million for the month of April. This makes it the third-largest market for cannabis companies in the country.

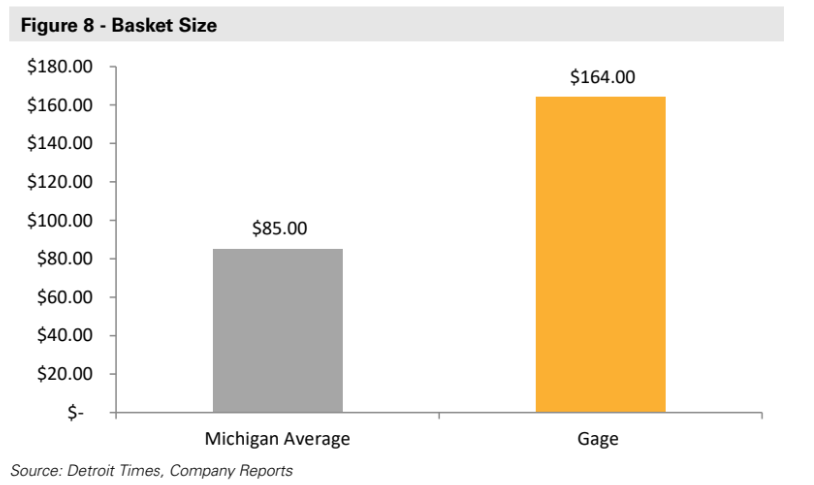

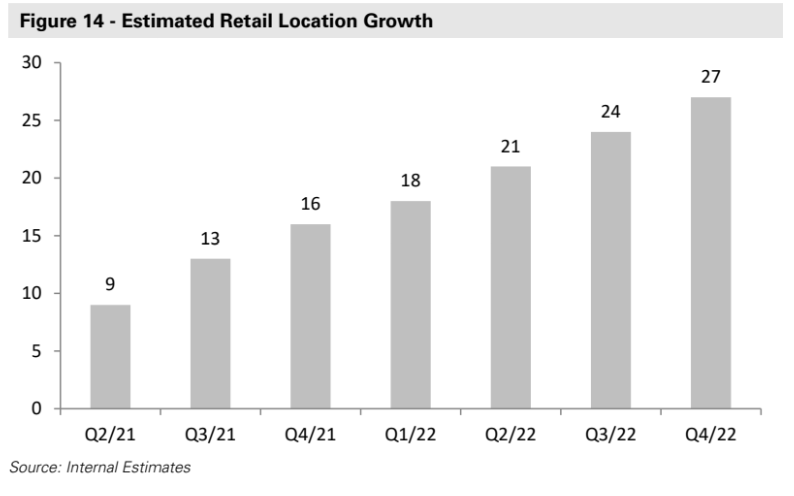

Gage Cannabis has 9 retail dispensaries, with 2 of them under the Cookies brand, along with the license to open 5 more. All nine locations “cover 90% of states population within a one-hour drive,” and have superior metrics compared to the Michigan average. Gage’s average basket is almost double the average at $164, and the company has four stores that are doing >$15 million per year in revenue.

The average monthly retail sales for all 9 stores are $1.1 million per month. Gage Cannabis has also “announced to the market an aggressive expansion plan to reach 20 retail locations by the end of 2021.”

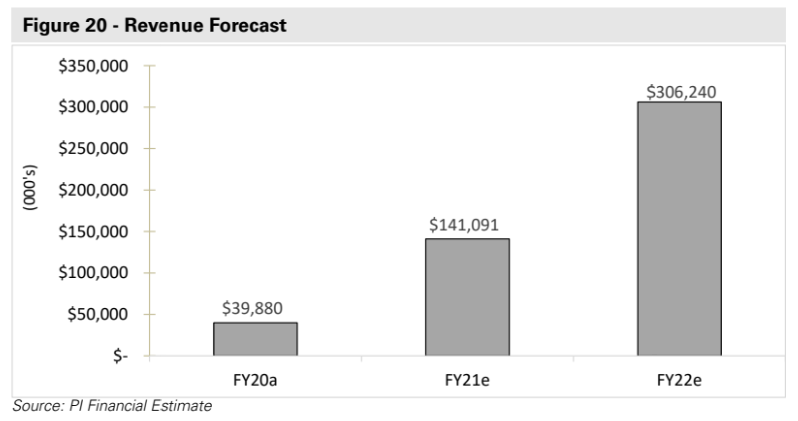

For the financial estimates, PI Financial believes the company will hit $141.1 million in revenue for the 2021 year, which will then slightly more than double to $306.24 million by 2022. They expect this revenue ramp due to the ramp-up in canopy and new stores opening. They specifically estimate that starting in the second half of 2022, Gage will start to sell cannabis wholesale.

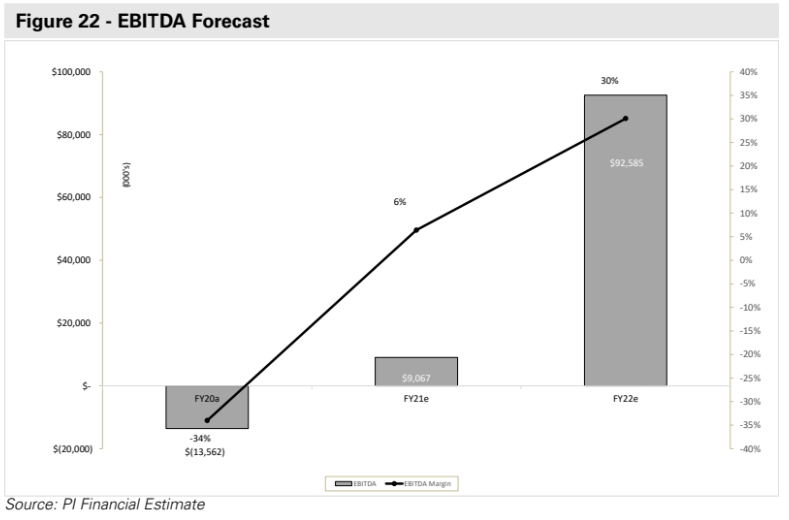

Finally, in terms of EBITDA, PI Financial believes that they will hit margins of 30% by 2022.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.