On Tuesday, PI Financial released their fourth quarter 2021 earnings review on their cannabis sector. Though they say that the fourth quarter results “were not eye-popping,” they did show quarter-over-quarter improvements in revenue. They do seem somewhat surprised at the bear market these names have found themselves in, saying that fundamentally, most of the largest cannabis names have “healthy balance sheets and good growth prospects.”

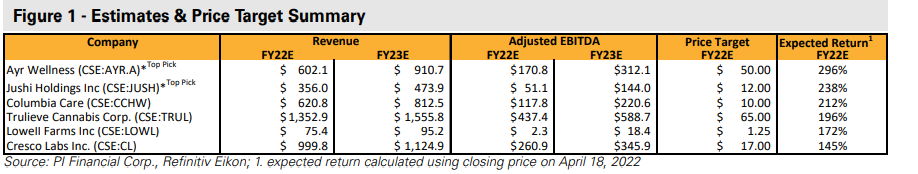

PI has slashed a number of their price targets on names in the sector, saying, “We are still very bullish on this sector but recognize that trading multiples aren’t what they once were.” Most notably they cut Cresco Labs’ (CSE: CL) price target from C$23 to C$17, Ayr Wellness (CSE: AYR) from C$65 to C$50, and Trulieve Cannabis (CSE: TRUL) from C$85 to C$65.

In the note, PI Financial reiterates their top picks as being Ayr Wellness and Jushi Holding (CSE: JUSH), saying that those are the best-positioned names in high-growth states, have leading operating metrics, and a “diversified and robust M&A pipelines.”

PI Financial says that over the quarter, the large-cap US MSOs have seen their FY22 EV/Sales multiple decline from 4.0x to 3.4x, while the mid-cap US names have seen an expansion in their sales multiple, going from 2.6x to 3.4x. One can only assume that the recent announcements of small and mid-cap US multi state operator M&A deals have helped the tier get a slight rerating higher.

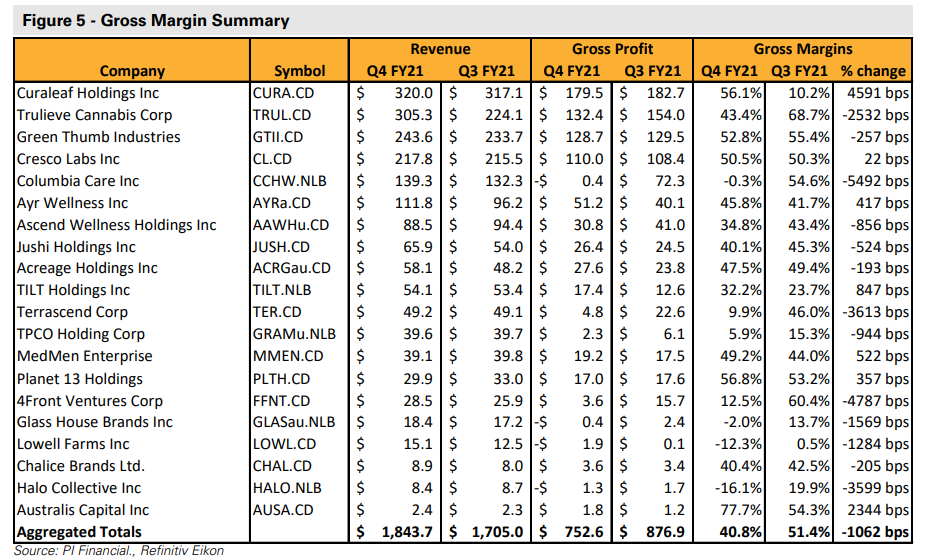

For the reported company top-line growth, PI Financial says that the average quarter-over-quarter revenue growth was 8.1%, compared to 3.5% from Q2 to Q3. Trulieve was the largest percent increase at 36.2%, thanks to their acquisition of Harvest Health closing, while Curaleaf Holdings (CSE: CURA) only saw a 0.9% quarter-over-quarter percentage growth.

On the first-quarter expectations, PI Financial believes that overall growth will be fairly weak but believes that it will be supplemented with growth during the second half of the year.

It seems like the only quarter-over-quarter growth seen in the fourth quarter was revenue, as both EBITDA and gross margins saw declines under an aggregate. For EBITDA, 5 companies reported lower EBITDA while seven saw increases. Though the decreases came in much heavier, most notably Jushi Holdings saw a 76.4% decrease, while Planet 13 (CSE: PLTH) saw a 46.8% decrease in reported EBITDA.

PI says that the worse than expected numbers are primarily a function of companies switching from IFRS to GAAP accounting. They say that though EBITDA is not a non-accounting term, expenses under IFRS and US GAAP are treated differently.

Similarly, gross margins saw a quarter-over-quarter decline. The aggregate gross margin declined from 51.4% in the third quarter to 40.8% in the fourth quarter. PI says that mergers and acquisitions have caused some of this, “as the acquired inventory is valued at acquired levels and not at the true production cost.” While another factor is inflation as many of the key input costs have risen, while specific states are starting to see an oversupply of cannabis.

Lastly, PI Financial calls the US MJ sector undervalued and believes that what continues to put pressure on the equities is the lack of movement on federal legalization. “We have seen many false starts over the past few years when a prominent cannabis bill passes in the US House of Representatives only to be blocked in Senate.” They say that these events usually put short-term pressure on the equities.

Below you can see PI Financials updated 2022 and newly minted 2023 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.