In a move surprising pretty well no one, Joe Biden has nominated Jay Powell for a second term as chair of the federal reserve. The appointment effectively means that investors and the general public can expect more of the same over the coming years as we continue to deal with inflation that few officials want to admit exists.

The announcement was made by Biden at 9:00 AM Eastern Time this morning, with the timing of the announcement effectively telling markets that Powell had secured the reappointment – a shock to the markets right before market open was expected to be unlikely.

Lael Brainard meanwhile, whom was viewed as being the best competitor to Powell for the role, has been selected as Vice-Chair of the Federal Reserve, replacing Richard Clarida.

In making the appointment, Biden continue to toe the line of inflation being a relative non-issue, commenting, “I’m confident that Chair Powell and Dr Brainard’s focus on keeping inflation low, prices stable, and delivering full employment will make our economy stronger than ever before.” Of course, climate talks worked their way into the announcement as well, with Biden continuing, “Together, they also share my deep belief that urgent action is needed to address the economic risks posed by climate change.”

No further appointments were made this morning, with many vacant positions remaining empty. Appointments are expected to be made in early December.

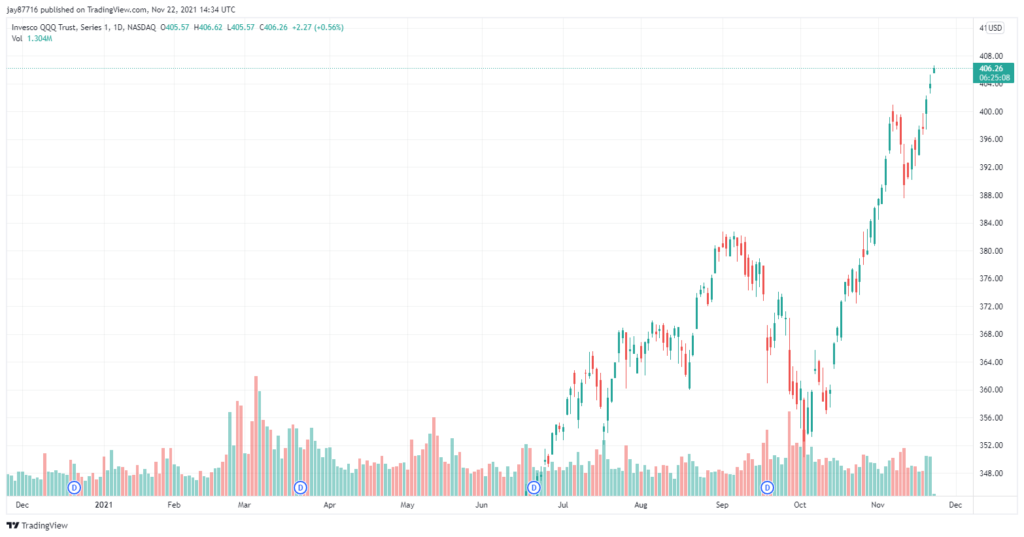

Markets are generally positive on the news, with the SPY up 0.47%, while the QQQ is up 0.56%.

Information for this briefing was found via the Federal Reserve and the Financial Times. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.