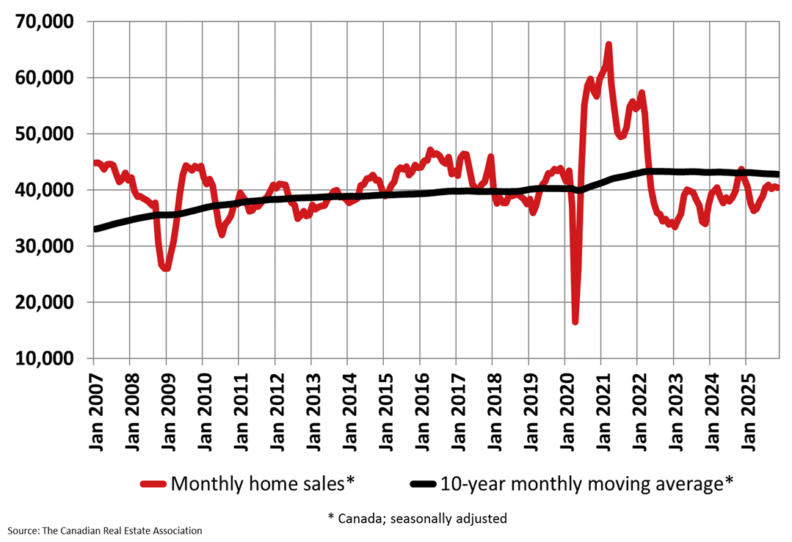

Canadian home sales declined 0.6% in November 2025 compared to the previous month as the mid-year housing rally shifted into a holding pattern, the Canadian Real Estate Association reported Sunday.

Sales activity remained well above April levels but largely unchanged since July, suggesting the market has stabilized after months of growth driven by falling interest rates. Year-over-year sales dropped 10.7% compared to November 2024.

The national average home price reached $682,219 in November, down 2% from the same month in 2024. The MLS Home Price Index fell 0.4% month-over-month and declined 3.7% year-over-year, suggesting sellers made price concessions to close deals before year-end.

“The mid-year rally in housing demand has veered into more of a holding pattern heading into 2026, coupled with what looks like some price concessions in November in order to get deals done before the end of the year,” said Shaun Cathcart, CREA’s senior economist.

Cathcart pointed to signals from the Bank of Canada that interest rates have likely reached their floor as a positive indicator for future activity. Fixed-rate borrowers who have been waiting for optimal rates may now enter the market, he said.

The sales-to-new listings ratio tightened to 52.7% in November compared to 52.2% in October. The long-term average stands at 54.9%, with readings between 45% and 65% indicating balanced market conditions.

New property listings declined 1.6% month-over-month in November. Combined with the smaller decrease in sales activity, market conditions tightened slightly.

Properties listed for sale totaled 173,000 at the end of November, up 8.5% from one year earlier but 2.5% below the long-term average for that time of year.

Market inventory measured 4.4 months nationally, unchanged since July and below the five-month long-term average. Readings below 3.6 months signal a seller’s market, while readings above 6.4 months indicate a buyer’s market.

“2025 was initially expected to be the year that housing markets came out of their interest rate-induced hibernation, but as we all know, the rug was pulled out from under that recovery by the economic shock of US tariffs,” said Valérie Paquin, CREA chair.

Paquin said attention now shifts to spring 2026 to see whether more normal levels of housing activity return. Interest rates have fallen further due to a softer economy, potentially supporting renewed buyer activity in the new year.

Information for this story was found via CREA, Bloomberg, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.