Sonoran Desert Copper (TSXV: SDCU) is a largely unknown junior resource firm, whom is focused on high-grade resource gold, palladium, and copper opportunities in well-known production districts in North America.

The company’s experienced management team has extensive experience in accessing a strong pipeline of projects that fit its strategic focus on building a business around production and cash flow, and developing its exploration projects to a point where the added value will attract potential merger and acquisition partners. PMR recently announced the acquisition of three mineral claims on the western shore of Pakwash Lake in the prolific Red Lake Mining District of Ontario.

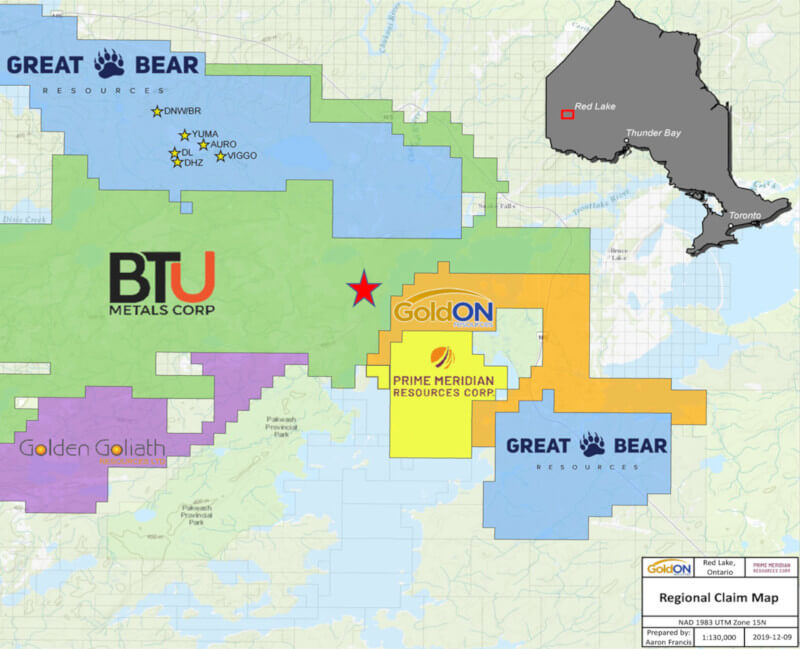

Prime Meridian’s 4,250 acre Bruce Lake Project is located southeast of the Great Bear Resources (TSXV:GBR) Dixie Project and southeast of the BTU Metals Corp. (TSXV:BTU) Dixie Halo Project. Meanwhile, PMR’s 6.250 acre Camping Lake Project lies directly to the southeast of the Great Bear’s Pakwash Project.

In an effort to expand its Red Lake footprint, PMR has an option to acquire a 100% interest in two claim blocks totaling 4,360 hectares in the Pakwash area. The new claims are directly contiguous with Great Bear Resources and south of BTU Metals’ TNT property. They are also contiguous to both the Company’s previously optioned claims and to that of GoldON’s (TSXV:GLD) Bruce Lake Project.

Prime Meridian is also positioning itself into the battery metals space, as the demand for metals that are needed for the rapidly expanding electric vehicle manufacturing industry are driving a race to discover new deposits that can potentially be mined. Demand for electric vehicles is rising as many governments worldwide are mandating a shift away from gasoline-powered vehicles to electric vehicles to reduce carbon emissions in an effort to combat climate change and meet the goals of the Paris Climate Agreement.

To this end, PMR holds a 100% interest in the 375 hectare Kelly Palladium Project, which is located 50 kms northeast of Sudbury, Ontario. The property is directly east of the prolific Sudbury Basin, which is host to high concentrations of palladium, platinum, copper, nickel, and gold.

Previous limited exploration of the Kelly property returned total PGM values of 5.1 g/t , which included 4.37g/t Palladium, 0.46 g/t Platinum, 0.27 g/t Gold, 0.82% Copper, and 0.46% Nickel. The Company views the Kelly Property to be a strategic asset going forward.

Sonoran Desert Copper is well-positioned in the Red Lake gold camp, with its Bruce Lake project situated potentially on trend next door to several exciting discovery properties. Any meaningful exploration results on the property could lead to a takeover or joint venture event.

The firm is reportedly seeking new projects that are production-ready, or advanced stage projects with near-term production potential. These types of assets would prevent the necessity of going to market for dilutive financings and help to somewhat de-risk the company. Exploration and development activities should enable the company to provide shareholders with a steady supply of news updates.

As a recently listed public company with only 85.4million shares outstanding, a small market capitalization of $4 million, and a tight capital structure, PMR represents a largely undiscovered opportunity for junior exploration investors.

Sonoran Desert Copper last traded at $0.045 on the TSXV.

FULL DISCLOSURE: Prime Meridian Resources is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Prime Meridian Resources on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.