Ratings have spiked for QYOU Media’s (TSXV: QYOU) flagship channel, The Q India. The company reported this morning that its television channel has seen its rating rise 64% on a week over week basis, as measured in gross rating points by the Broadcast Audience Research Council, India’s equivalent of the Nielsen Rating service.

The increase in rating is based on actual viewer impressions delivered, in combination with time spent viewing. Notably, The Q India has seen an increase of 20% in time spent viewing, with the average time rising to 42 minutes per session, up from 35 minutes. Further, the company has seen significant improvement across three key ratings, including the following.

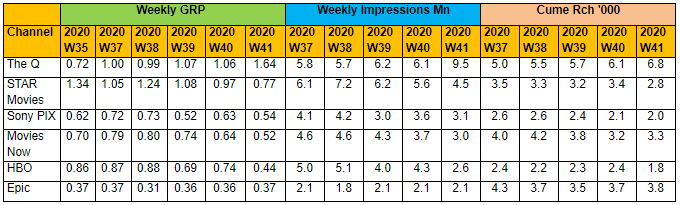

- Gross Rating Points, which has climbed from a 1.00 rating in Week 37, to that of a 1.64 rating in Week 41

- Impressions, or the number of times content has bee viewed, has grown from 5.8 million in Week 37 to 9.5 million in Week 41

- Cumulative Reach, which has risen to 6.8 million in Week 41, up from 5.0 million in Week 37

It should also be noted that ratings are based on television distribution only, and does not factor in the massive success The Q has seen on Snap India, or its recent addition to Amazon Fire TV, which all add additional viewership to The Q’s viewership figures.

Despite becoming a Broadcast Audience Research Council (BARC) rated channel just in the second quarter of 2020, the channel has seen massive success since this event. This latest increase in rating has moved it well past the ratings of household-name brands, including HBO, WB, Star Movies, SonyPix and more.

Growth is said to be driven by new hit programs that have recently launched on the channel, along with the company utilizing big data to mine viewership trends. This data enables the company to deliver more effective programming.

QYOU Media last traded at $0.065 on the TSX Venture.

FULL DISCLOSURE: QYOU Media is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover QYOU Media on The Deep Dive, with The Deep Dive having full editorial control. Additionally, the author personally holds shares of the company. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.