Canadian home prices are slated for a major landslide drop of at least 17.5% from peak levels, thanks to the Bank of Canada’s relentlessly aggressive rate hikes that brought mortgage rates to nearly 5% within a span of eight months.

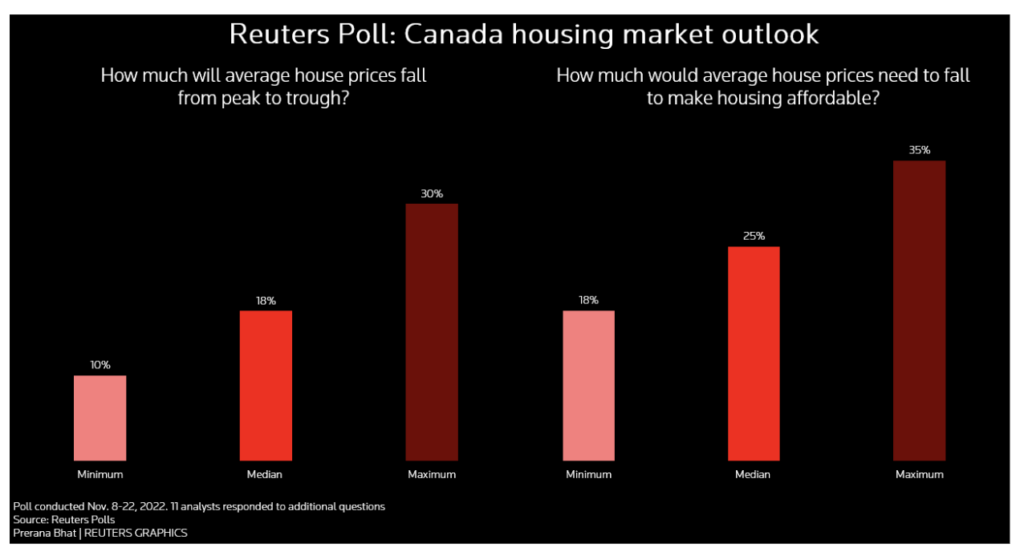

According to market analysts surveyed by Reuters in November, Canada’s housing market is barreling towards a major price correction, that could see a decline anywhere between 10% to 30%— which still might not be enough to bring real estate prices to sustainable pre-pandemic levels. “Our forecast for a 30% decline in house prices in conjunction with steady income growth, a stabilization in mortgage rates and stronger growth in housing supply…will cause house prices to return to an affordable range by late 2025,” said Oxford Economics director of Canada economics Tony Stillo.

A follow-up question in the survey found the consensus among those polled calls for a housing price decline of 25% from peak to trough in order to bring homeownership to affordable levels. The responses correspond to earlier comments made by Bank of Canada Senior Deputy Governor Carolyn Rogers, who said a major decline in real estate prices needs to occur in order to restore balance in the overheated market. “We have a unique situation where demand has cracked and buyers can’t qualify for, or afford, early-year prices. But, outside some areas, there’s not a bounty of listings to choose from, and sellers are still able to say ‘no thanks’,” explained BMO Capital Markets economist Robert Kavcic.

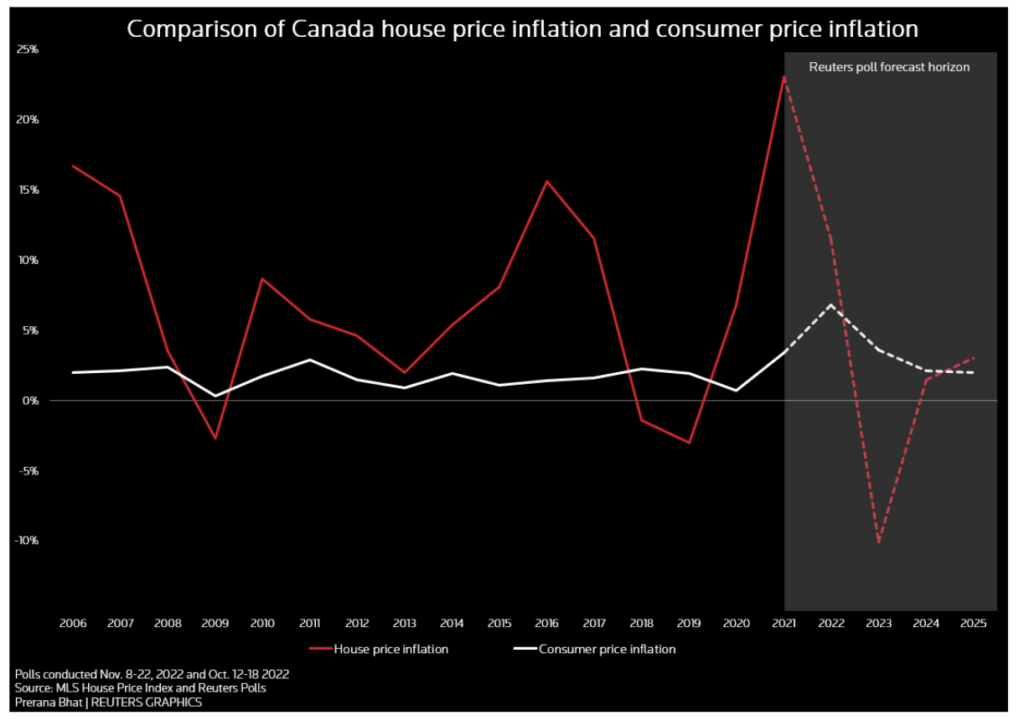

With inflation sitting at 6.9% for October— three times the central bank’s 2% target rate— borrowing costs will likely remain elevated for the time being, despite the dragging effect they have on the real estate market. Still, many regions across Canada remain priced substantially higher than pre-pandemic levels, particularly in Toronto and Vancouver, where prices boomed nearly 58% and 35%, respectively. Eleven of the survey’s respondents gave average housing prices a rating of 8, whereby 1 was substantially cheap and 10 extremely expensive.

The market analysts anticipate Toronto and Vancouver will see price drops of 11% and 9.3% next year, which likely won’t be enough to crash the real estate market. Prior to the pandemic, a 30% drop in home prices would be considered a detrimental crash; however, in the current economy where property prices surged 50% within a span of two years, “a 30% price correction will still leave home values above pre-pandemic levels,” explained Stillo.

Information for this briefing was found via Reuters and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.