The Red Lake mining district in Northwestern Ontario is best known for its high-grade gold deposits, with historical production exceeding 30 million ounces of gold, mostly from the iconic Campbell and Red Lake gold mines and ten smaller mines. A number of factors such as declining gold reserves, global economic instability, and a rise in the price of gold have led to a resurgence in gold exploration. Recent new discoveries in the Red Lake district, with Great Bear Resources (TSXV: GBR) leading the pack, have led to what amounts to another gold rush.

Geology

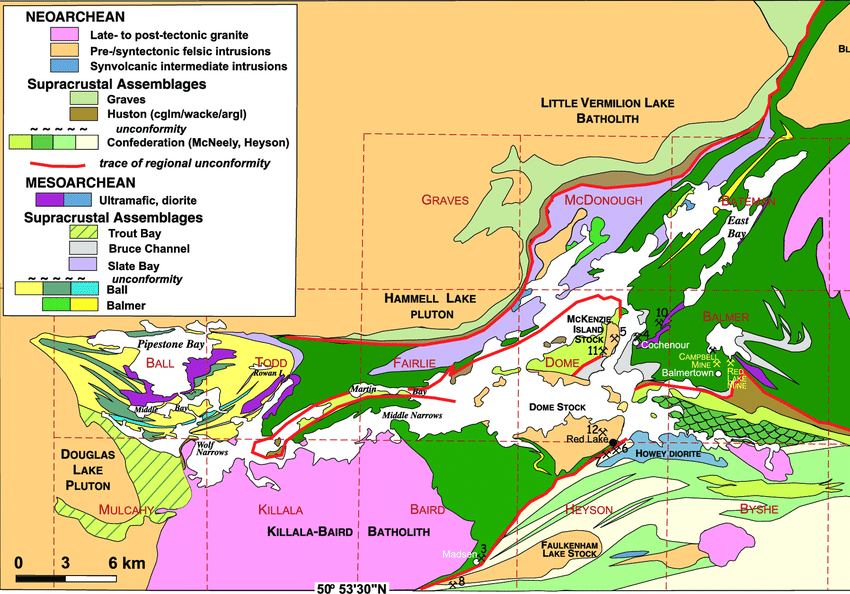

Commonly referred to as the Campbell-Red Lake gold deposit, the Campbell and Red Lake mines are located in the Red Lake Uchi Subprovince – Superior Province Greenstone Belt, considered to be one of Canada’s largest Archean gold deposits. The bedrock in Red Lake, primarily basalt, was formed 2.85 billion years ago during the early Neoarchean period, and gold has been dated back 2.7 billion years ago during the Uchiyan Phase of the region’s formation.

Most of the large gold deposits can be found in the east to west “mine trend”, while smaller deposits, usually found in quartz veins, are hosted in the “East Bay trend” that angles in a northeast to southwest direction.

The lesser explored part of the Red Lake district is known as the Birch-Uchi Greenstone Belt in the Uchi Subprovince of the Canadian Shield. The area is to the east of the main Red Lake mining camp, and is three times larger. Iron-hosted gold deposits have been found in what are known as folded iron formations. A prime example of this is Newmont (TSX: NGT) Goldcorp’s Musselwhite Mine.

The Birch-Uchi Greenstone Belt also contains volcanogenic massive sulphide (VMS) deposits hosted by felsic volcanic rocks. Aside from gold, VMS deposits have the potential for base metals mines such as copper, lead, zinc, and silver. The VMS deposits found here share characteristics similar to the Horne Mine near Rouyn-Noranda, Quebec, and the Kidd Creek copper mine near Timmins, Ontario, the world’s deepest base metal mine. Base metal sulphide mineralization is associated with several greenstone belts north of Red Lake.

Major Mines in the Red Lake Mining Camp

On March 31, 2020, the Australian gold miner Evolution Mining Ltd. completed the $375 million USD purchase of the Red Lake Mining complex from Newmont Goldcorp, with an additional $100 million tied to additional discoveries in the complex. The Red Lake Mining complex consists of the iconic Campbell and Red Lake Gold mines, and the nearby Cochenour Mine. This high-grade gold deposit has accounted for the production of 25 million ounces of gold since 1949, with an average grade of 20 g/t gold.

Evolution made this significant purchase in the belief that the current operations were under-capitalized. As such, in addition to upgrading the mines to reduce costs and increase productivity, they committed $50 million USD to a three year exploration budget to expand the mineral reserves. The thought is these measures would extend the mine life beyond the current expectation of 13 years.

It’s clear that with Evolution believing there is much more potential at Red Lake, it serves as an inspiration for a number of exploration companies to aggressively intensify their activity around Red Lake.

Newmont Goldcorp’s Musselwhite Mine, which initiated extraction in 1997, is located on the south shore of Lake Opapimiskan. It is essentially a fly-in/fly-out operation located almost 500 km north of Thunder Bay, Ontario and 300 km northeast of Red Lake by air.

Due to the remote location, Goldcorp had to build its own power infrastructure to support the mine. With estimated reserves of high-grade gold in excess of 2 million tonnes and an average grade of 5.4g/t gold, it is one of Canada’s richest gold mines. Despite the location the richness of it has more than justified the cost of operations. .

The main attraction of high-grade gold deposits is that they can provide high-margin operations for miners. In late 2019, PureGold Mining (TSXV: PGM) began construction of its underground operations at its PureGold Red Lake Mine. On June 24, 2020, PureGold updated investors on the progress of its construction activities and predicted that they expect their first gold pouring during the fourth quarter of 2020. The property is estimated to have a resource of 2 million ounces of high-grade gold, and the company estimates an operating cost of roughly $800 per ounce. The high margins make the PureGold Red Lake Mine a potentially very profitable operation.

The Catalyst for the new Red Lake Gold Rush

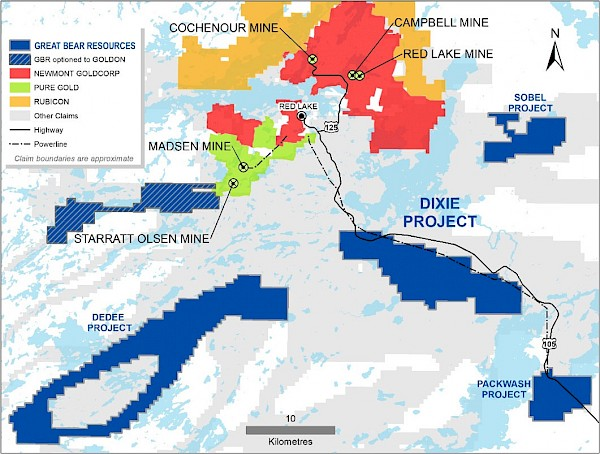

The current Red Lake gold rush can be attributed to the exciting high-grade gold discovery made by Great Bear Resources in 2017. Their flagship 100%-owned Dixie project, covers an area of 300 square kilometres and is situated 25 km southeast of the town of Red Lake. The property contains four separate projects;

Dixie Property

- 9,140 hectares

- 22 km of contiguous claims

- Multiple discoveries of high-grade gold over nine separate parts of the property, seven of which now comprise one 18 km target zone hosted by the LP Fault Zone

- 120 of 300 planned holes have been drilled to date

DeDee Property

- 15,300 hectares

- Western strike extension of the D2 axial plane that may control the new gold discoveries on the Dixie property

- Contains two folded greenstone belts similar to the structure of the folded greenstone belts on the Dixie property. According to some historical data, these may contain sulfides found in other parts of the property

Pakwash Property

- 3,200-hectares

- Southeast of the Dixie property

- Covers sections of a regional fault structure

- According to historical data, indications of gold bearing sediment anomalies

- No work undertaken by Great Bear yet

Sobel Property

- 3,200 hectares

- Located on strike extension of the D2 fold axial plane that could potentially be a control structure for the gold mineralization found at the Red Lake Gold mine.

All of Great Bear’s properties are easily accessible by a reliable road system. They continue to actively develop the Dixie Project with the goal of adding to the multiple deposits discovered to date.

Recent Exploration Activity

The main barrier to widespread exploration in the Red Lake Mining District is the difficulty in accessing prospective exploration targets. Therefore, much of the recent exploration activity is in reasonably close proximity to the Red Lake mining camp, which has a well established road network and a mining-friendly infrastructure.

The success of Great Bear’s Dixie Project has attracted a number of other junior explorers to stake claims and acquire properties in close proximity to the Dixie property.

On June 23, 2020, Portofino Resources (TSXV: POR) announced completion of a recent follow-up field program on their 5120 hectare South of Otter project, located 8 km east of the Dixie Project. Their field program identified promising new mineralization similar to the Dixie Property and other developmental deposits in the Birch-Uchi belt. Much of their current exploration work involves building upon historical geophysics, rock sampling, and drilling data. This all will assist Portofino in determining the viability of the project.

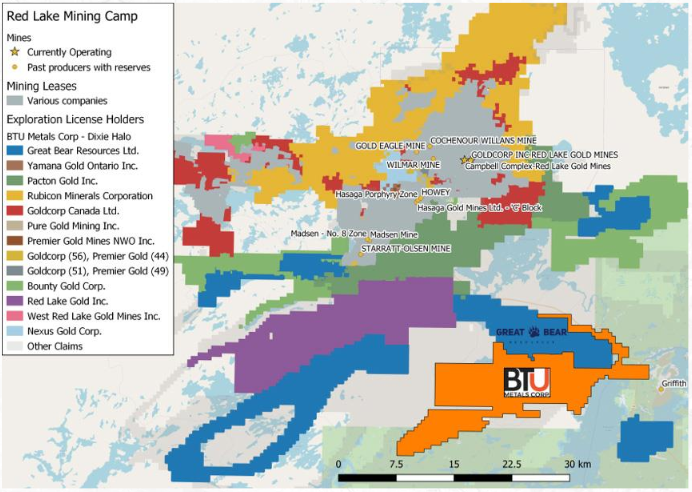

On July 6, 2020, BTU Metals Corp. (TSXV: BTU) updated investors with the results of their recent drill program. They also provided some guidance for their upcoming summer drilling program at their Dixie Halo project, which shares a 35 km border with Great Bear’s Dixie property. Indications are that some of the Great Bear discoveries follow a trend that crosses over into BTU’s property, fueling speculation and optimism that future drilling may produce comparable results. BTU is specifically exploring for high-grade gold mineralization within a VMS-type geological system that also contains copper and zinc.

On May 20, 2020, Falcon Gold Corp. (TSXV: FG) announced that it applied for an exploration permit for its Bruce Lake Gold Project, found 16 km west of the Dixie project. The Company plans to do line cutting, trenching and some drilling. A permit will allow the company to perform overburden trenching, line cutting, and diamond drilling to follow-up on gold targets identified by past work programs.

On June 30, 2020, as a result of previous drill results that identified massive sulfide mineralization that is consistent with banded iron formations, Infinite Ore Corp. (TSXV: ILI) announced a 10 hole drill program on their Red Lake Mining District Fredart property.

West Red Lake Gold Mines Inc. (CSE: RLG) has attracted investor interest in recent months as it begins a follow-up drilling program on its West Red Lake project, found 20 km west of the Red Lake mine complex. In January 2020, they had encouraging high-grade gold showings of 12.14 g/t over 13 metres. What makes this project interesting is that the property is host to three past producing gold mines, including the Rowan joint venture, 38% owned by Evolution Mining.

Adjacent to the West Red Lake Gold property is that of CR Capital Corp (TSXV: CIT), whom last week announced that they have entered into an option agreement to acquire the Mount Jamie North property in the Red Lake camp. The property lies 300 metres along strike from the former producing Mount Jamie Mine, with a total of three former producing mines lying along strike to the east of the property. The Mount Jamie North property consists of a total of 445 hectares through 30 mineral claims.

Great Bear’s Red Lake successes have attracted companies such as Prime Meridian (TSXV: PMR), which has optioned a 100% interest in the Bruce Lake project southeast of Great Bear’s Dixie property. Prime Meridian also optioned 100% interest in the Camping Lake project, adjacent to Great Bear’s Pakwash property, as well as claims adjacent to BTU’s Dixie Halo property.

The bulk of the activity continues to be around the Red Lake mining camp. The success and excitement of Great Bear’s discoveries, though, has now attracted the attention of a number of junior firms prepared to undertake exploration activity in the harsher areas of the region.

Newrange Gold Corp (TSXV: NRG) is conducting grassroots exploration in the Birch-Uchi Greenstone belt in the vicinity of the past-producing Argosy Mine. This mine extracted approximately 102,000 ounces of gold and 10,000 ounces of silver from 1934 until 1952 (when $35/oz gold made mining operations cost-prohibitive).

Newrange’s 3,850 hectare North Birch Project is in a geological setting identified as a sheared iron formation that contains quartz vein gold, similar to that of the Musselwhite Mine located 200 km to the northeast and just 4 km from the Argosy Mine. Early Access to the area is primarily by float plane or helicopter, although there are some existing logging roads and new roads are being built. Newrange will be conducting an airborne magnetic and electromagnetic survey during the summer of 2020. Induced Polarization and mapping will then help determine the best potential drill targets.

The largest known gold deposit in the Birch-Uchi belt, with indicated reserves of 4.7 million ounces, is the 41,943 hectare Springpole Gold Project owned by First Mining Gold Corp (TSX: FF). While not currently in production, it is considered to be one of the largest undeveloped gold projects in Canada. First Mining is preparing a pre-feasibility study to determine the economic viability of putting the property into production as an open pit mine.

Area Play

Whenever there is a new discovery that creates a good deal of excitement in the mining exploration industry, companies rush to the vicinity of the strike zone and stake claims as close to the strike as possible.

There are any number of reasons for this:

1) Attract promotional buzz for their stock.

2) Claim squatting enables a junior company to sit on claims in the hopes that activity in the area may compel a competitor to either acquire the claims or suggest a joint-venture.

3) A legitimate interest in exploring the property.

The “area play” phenomenon can create a quandary for investors.

- Does one focus on just the principal company responsible for the new discovery?

- Should one pay close attention to the companies that border on the strike property of properties?

- Does one take a chance on a company many miles from the strike, but still in the “area”?

The above are all perplexing questions and the answers are not simple or definitive.

High-Risk/High-Reward

Mining exploration is a high-risk/high-reward proposition at the best of times. A promising discovery that appears to be a guaranteed success can fizzle out over time as more exploration and development work cannot justify an economically sound extraction plan. It can take years to develop a promising property into a mine. And during that time, unexpected world events, social upheaval, market crashes, recessions, and commodity cycles can impact the performance of one’s investment portfolio – and the need for whatever the mine is producing.

Well-timed purchases of the shares of exciting exploration companies can generate incredible returns, and often over relatively short periods of time. Because of this excitement, even a kind of mania at times, mining exploration can attract huge interest. The term “blue sky” comes from the perception of unlimited upside of a promising exploration play. Obviously, however, nothing in the market is ever guaranteed, or even necessarily logical.

Where possible, it always behooves investors to do proper research into any prospective investment to better understand the risks, the potential, the experience of the management team, and the quality of the underlying project.

For investors interested in gold exploration, familiarity with the jurisdiction and specific exploration region can be very important. The Red Lake Mining District has a long and storied history of successful high-grade gold mining. As such, when companies report news from this area, a keen-eyed investor should look at it as perhaps presenting an opportunity and do their due diligence.

Information for this briefing was found via Sedar, and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

7 Responses

Straightup Resources Inc. (CSE: ST) is a new public company focused on advancing its flagship RLX and Belanger properties located in the Red Lake District of Ontario. The RLX property of Straightup Resources is prime ground adjacent Great Bear’s newly acquired Sobel project, the RLX Property was staked prior to Great Bear announcing its Sobel acquisition by the entity that vended both the RLX and Belanger properties into the new public company. The RLX property of Straightup offers the big elephant size gold discovery potential with D2 faults interpreted to run through, on-strike to the SE of the district’s largest gold deposit (Red Lake Gold Mines – Evolution Mining). The property is underexplored as it has overburden with little bedrock outcropping, which has limited past exploration efforts in favour of other areas in the Red Lake District. Straightup Resources’ technical team will be looking to target the contact zones of the volcanic assemblages that host the gold. A past operator has already drilled one hole (DDH-160-5-1 in the 80s) on RLX North that shows the geological contact between mafic/ultramafic vs. felsic intermediate rocks is present — a major geological contact similar to what provided a pathway for gold laden hydrothermal fluids for success at Great Bear Resources on its Dixie property. The Belanger property is more advanced, has mineralization at surface, and it brings opportunity for quick news flow with two immediate areas of interest; 1) the Hemming Showings are found in a deformation zone, tracking NE to SW near the middle of the property, that is measured to be at least 100 m wide and possibly a lot wider. The showing produced a selective grab sample which measured ~0.9 oz/t gold. There are a number of gold and base metal showings along that same line strike through the property. 2)The Williamson Showings are where three historic trenches were exposed by past operators; trench C has produced grab samples up to 25 g/t gold, trench E which is 550 m to the NE of trench C has produced selective grab samples of up to 60.44 g/t gold, selected copper grab samples were also pulled from the trenches measuring over 5% Cu. There are parallel deformation zones. Straightup Resources’ technical team will be looking at the underlying controls, the big picture, how the gold and copper are distributed, and will develop a predictive model. Already, from drill holes performed by past operator Kings Bay, it is suggesting some continuity to the copper and gold mineralization; DDH 14 & 15 both intersected over 7 g/t gold over narrow intercepts within the broader gold and copper mineralized envelope.

Hi, you may want to add GoldON Resources (GLD.V) to your database as well. They have four properties in Red Lake including the West Madsen project that is an option/JV with Great Bear and adjoins the Pure Gold Red Lake Mine property. Assay results are pending from a 7-hole drill program GoldON just completed at West Madsen.

Overlooking Battle North Gold (TSX: BNAU) you show your lack of knowledge of the region

Yes add Golden Goliath to the database. GNG might have the same gold outlook as Great Bear

The fact that you left out Battle North Gold (BNAU) shows your lack of knowledge of the region

Hi why you don’t mention about golden goliath (gng) because they make some interesting work on the kway property just surronding Btu metal properties. Go to see the last four news on gng web site. We don’t see the gng kwai claim on your map? Why?

Never heard of em’

Thanks for the heads up, we will add em to our database.