The rapid collapse of SVB Financial Group (NASDAQ: SIVB), the 16th biggest bank in the U.S., and the potential implications of the biggest bank failure in the U.S. since the financial crisis in 2008-2009 have trumped all other financial news over the past few days. A chief reason for SIVB’s failure was many depositors’ decisions to withdraw funds over the last three quarters of 2022, January and February of this year, and especially on March 8th and 9th.

The rapid pace of withdrawals at Silicon Valley Bank was due in large part to the mercurial nature of the bank’s depositors. Those deposits are heavily weighted toward technology, private equity, and venture capital firms. For example, the streaming platform Roku, Inc. (NASDAQ: ROKU) had US$487 million of cash, 26% of its total cash balance, deposited at SVB.

As such, about 87% – 93% (depending upon the source) of SVB’s deposits are so large that they are uninsured by Federal Deposit Insurance Corporation (FDIC) deposit insurance. The FDIC insures individual or corporate accounts up to US$250,000 per account and up to US$500,000 for joint accounts.

Two vexing challenges facing the banking industry are: 1) the aggregate dollar amount of deposits is likely to fall further; and 2) funding costs for banks are poised to continue to rise. These factors suggest that the chances of another smaller bank failure is non-zero.

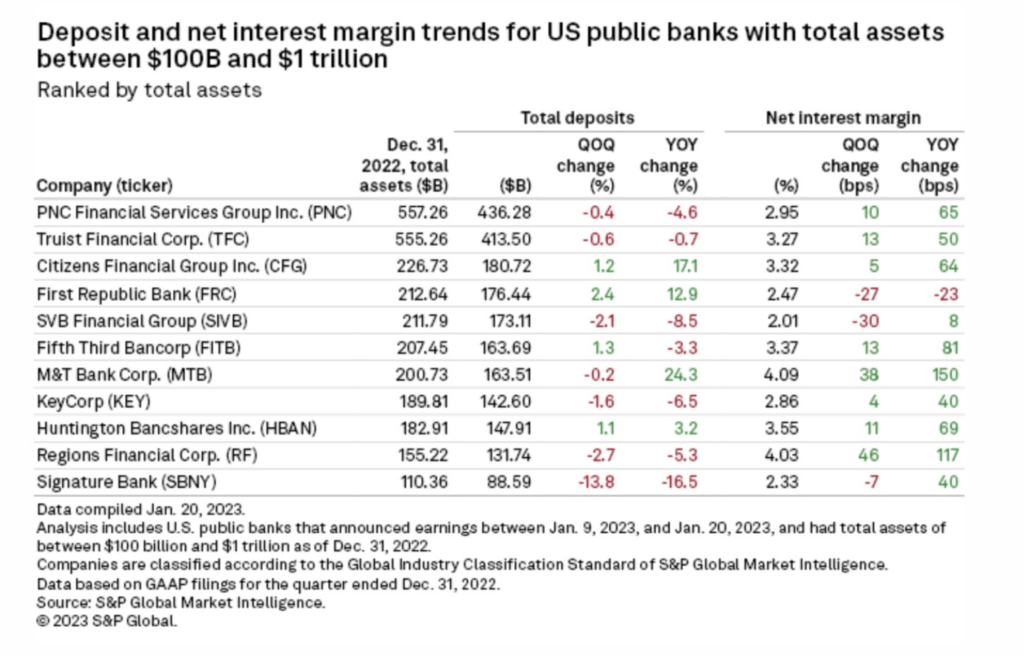

More than a handful of regional banks saw their deposits decline in the fourth quarter of 2022. Note especially that SIVB’s deposits fell in that quarter, along with six other selected regional banks.

Banks’ funding costs rose significantly in the second half of 2022 as the Fed continued its historic pace of overnight rate increases. Deposit costs have risen about 100 basis points (bp) since the first quarter of 2022 as banks have been forced to pay much higher rates on savings accounts and especially on expensive certificates of deposit. The low point in cost of funds in this cycle was just 0.15% in 4Q 2021.

Indeed, many banks have made a concerted effort to raise interest rates on customer deposits quite aggressively to keep the funds. Nevertheless, total U.S. banking deposits declined more than US$166 billion in 4Q 2022 from 3Q 2022, according to S&P Global Market Intelligence.

Moreover, funding costs are likely to move still higher over the coming months. The Fed funds futures market is projecting around 75 bp of additional tightening over the next handful of months. That figure was around 100 bp before the SIVB news.

Curinos, a consulting and data firm, reports that 23% of money market deposits held by middle market customers at banks have yields below 75 bps. Many of those customers will likely demand higher compensation from banks or move funds to outside managers over the next few months.

In summary, declining deposit trends at banks, coupled with the need to pay higher rates to entice depositors, could pressure weaker regional banks for some time. Given all this, another failure cannot be ruled out, particularly for a bank with a high proportion of uninsured deposits.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.