This month Riverside Resources (TSXV: RRI, OTC:RVSDF) will be spinning out it’s wholly owned silver asset in Durango, Mexico in the form of special bonus shares to its existing shareholders. The transaction is simple. Riverside shareholders will receive 17.5 million shares of Capitan Mining (TSXV: CAPT), with the new company raising an additional $3.5M cash for exploration, adding an additional 17.5 million shares at 20c. In simple terms, Riverside shareholders will receive around 0.27 shares of Capitan for every share they own of Riverside (assumes Riverside’s share count of 63.1M, see Sedar 3/31/2020).

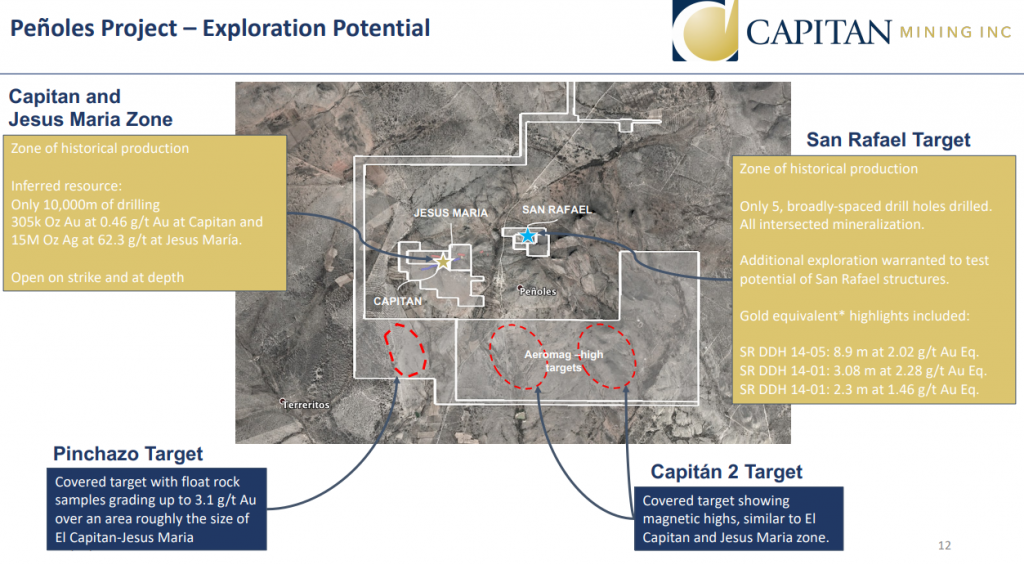

Capitan Mining is an advanced exploration story with over 10,000 metres of drilling on the Penoles Project having identified resources on Capitan Hill of 305,000 oz @ 0.46 g/t Au and Jesus Maria of 15,000,000 oz Ag @ 62.3 g/t Ag. In the company’s investor materials, they state that mineralization remains open at depth and along strike for both areas.

The post money valuation of Capitan is around $7M. This represents around $20/oz in the ground of gold and 45c/oz in the ground of silver, while the company also has a good cash treasury to immediately put to work expanding these resources.

A Project Generator with a History of Successful Transactions

Riverside has two recent transactions that have been successful projects for shareholders. In 2014, Riverside did a transaction with Croesus Gold Corp, who developed into Arizona Metals (CSE: AMC) for what ultimately became 7.3 M shares and a 2% net smelter royalty. From the day Arizona Metals first went public to today, the stock price has risen over 230%.

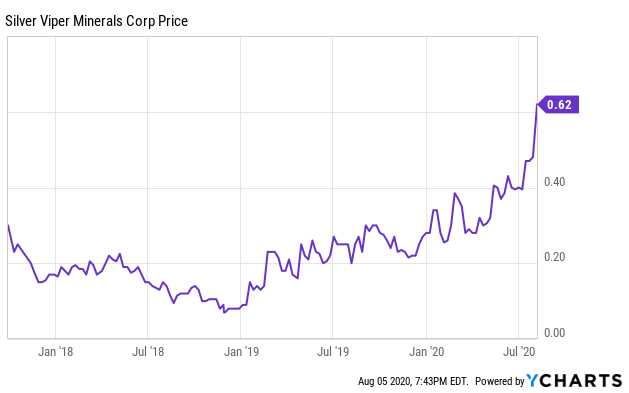

Another recent successful transaction for Riverside shareholders has been Silver Viper (TSXV: VIPR), which saw Riverside sell their silver asset known as the Clemente Project in Sonora, Mexico. The terms of the transaction included $750,000 cash, 2 million shares of Silver Viper, a 2% NSR, and a commitment to spend at least $4M on the project. Since going public, Silver Viper is up over 100%.

Why Capitan? Simple Answer, Silver is flying!

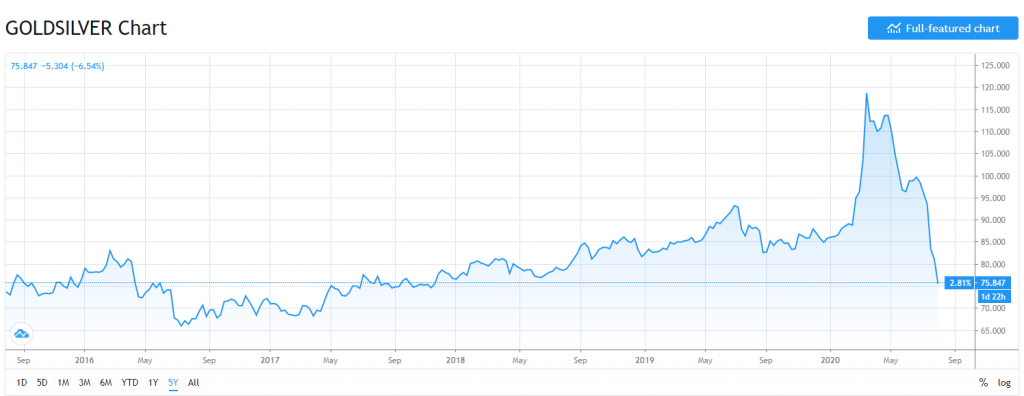

During the last great gold run in 2011, gold reached all time highs of $1800+, and silver reached a high of just under $50 in around the same period. This represented a gold to silver ratio of just over 30. At the time of publishing, gold now sits above $2000 with silver trading below $30, representing a ratio of around 76.

The recent decline in the ratio shows the appetite for silver has increased relative to gold, but still has a piece to go to reach the 2011 silver euphoria level, which saw silver prices increase 185% over a 1 year period.

The Case for Riverside

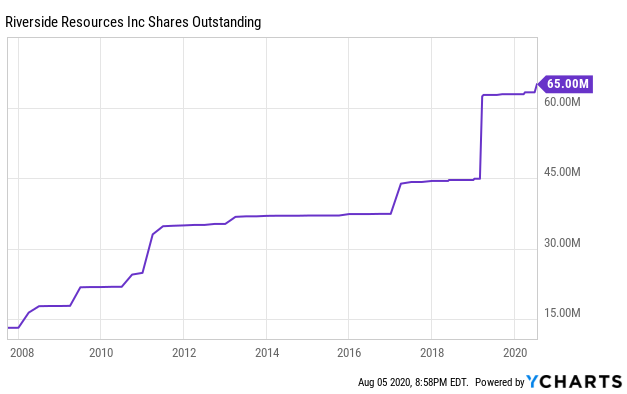

Riverside is a project generator that has managed to go over 14 years without blowing out their cap structure. For investors of Riverside, they are effectively owning stock in a company that could build them their very own precious metal portfolio as the company spins out more projects. At the Deep Dive, we hear about groups trying to pull off what Riverside is doing quite frequently, but very few groups are successful at executing spin outs. Consider this a tip of the cap to management.

The effective date for Riverside shareholders to be eligible for shares of Capitan Mining is August 13, 2020.

At market close Riverside shares last traded at 40c.

FULL DISCLOSURE: Riverside Resources is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Riverside Resources on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.

3 Responses

I see that Riverside gets a number of shares from the passing of these assets to other companies. Does anyone knowable gets these shares, what happens to them? And how do these shares benefit the shaegolders?

In the case of them selling the property, Riverside gets a portion of shares in another company. And they are then held by Riverside, who may down the road sell them to fund other new projects.

In the case of the spin out, shareholders of Riverside get the shares spun out. In the case of Capitan Mining, the remaining shares are owned by those who invested in the recent private placement.

Amazing