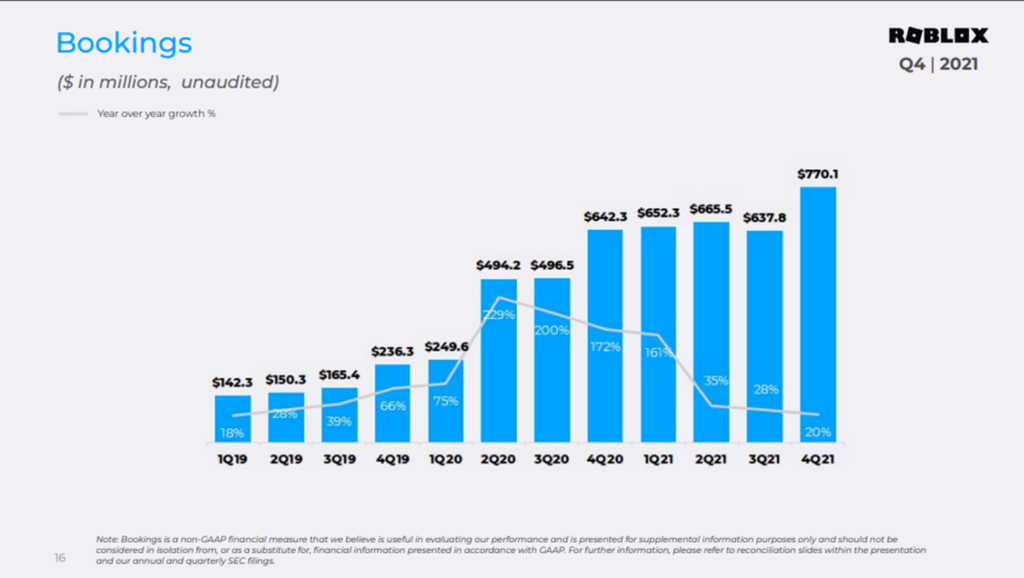

Roblox (NYSE: RBLX) reported on Tuesday its Q4 and full-year 2021 financial results. The gaming company reported bookings of US$770.1 million, missing the street estimates of US$782 million.

Nevertheless, this is an increase from both Q3 2021’s US$637.8 million and Q4 2020’s US$642.3 million figures. Corollary, its full-year 2021 bookings of US$2.7 billion is also a 45% increase over its 2020 figures. Bookings, as per the company, is defined as “revenue plus the change in deferred revenue during the period and other non-cash adjustments,” which in layman terms includes the use of virtual currencies.

After releasing its financials late on Tuesday, its shares plummet 20.89% post-closing bell.

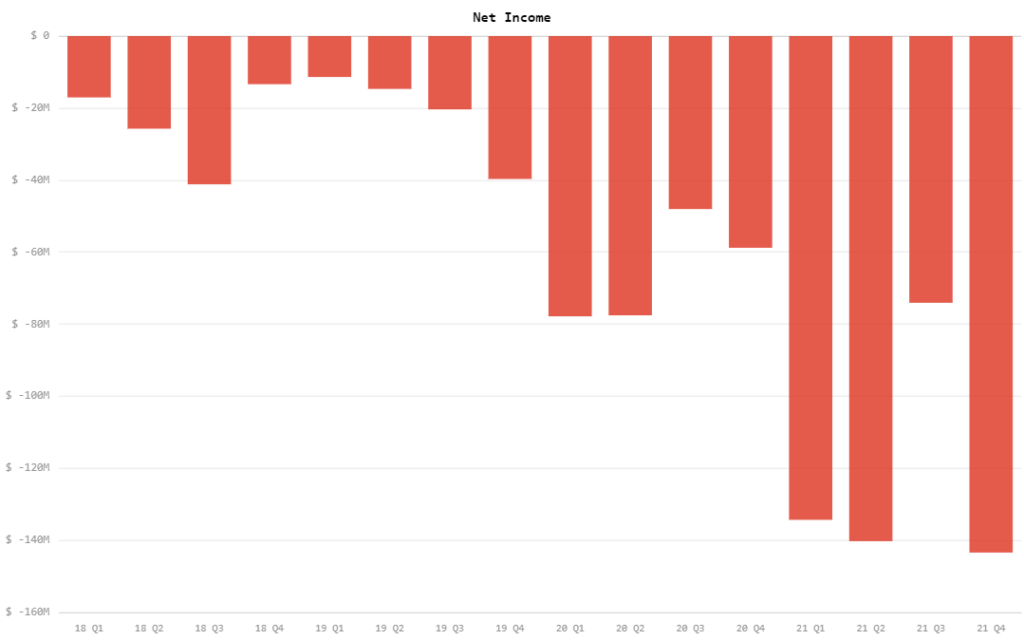

Revenue for the quarter ended at US$568.8 million, up from Q3 2021’s US$509.3 million and Q4 2020’s US$310.0 million. However, the firm also nearly doubled its operating expenses year-on-year, incurring US$708.4 million in total expenses for the quarter. This led the company to notch an operating loss of US$139.7 million compared to a loss of US$68.6 million for the year-ago period.

This further led the firm to record a net loss of US$143.3 million – its lowest yet – compared to last year’s US$58.7 million net loss. This translates to US$0.25 loss per share vis-a-vis last year’s US$0.30 loss per share, before the firm launched its IPO and diluted its shares.

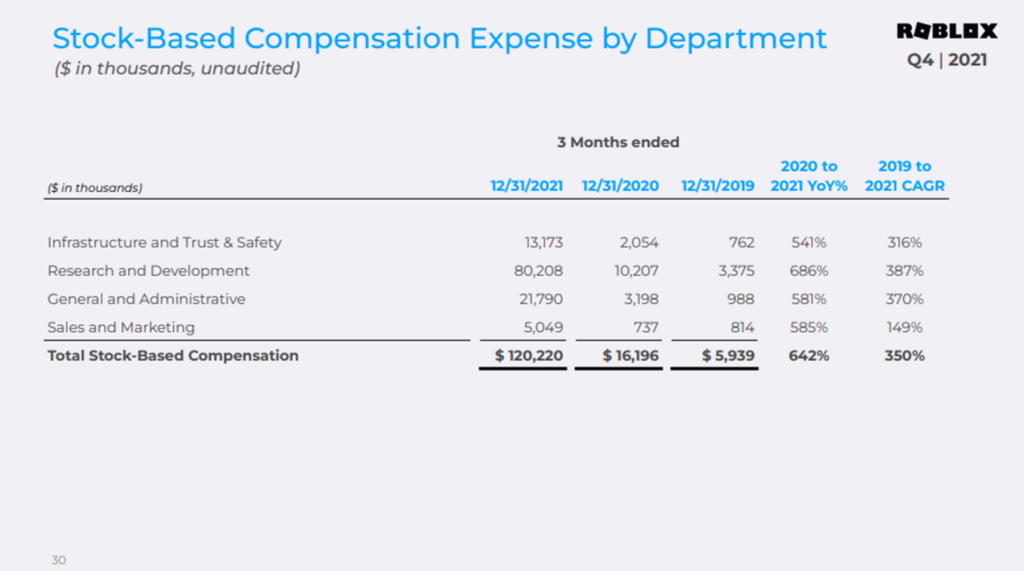

Calibrating for financial items, including the increased stock-based compensation of US$120.2 million compared to last year’s US$16.2 million, adjusted EBITDA for the quarter came in at US$168.0 million. This is an increase over Q3 2021’s US$135.7 million but a decrease from Q4 2020’s US$225.9 million.

“The foundation we put in place that allows us to invest in our business while continuing to generate strong cash flow is one of the most unique aspects of our business,” said CFO Michael Guthrie. “Our 2021 results demonstrate that the investments we were able to make in our technology and developer community are generating strong returns, and we will continue leaning into the business as we focus on the large, long-term growth opportunity ahead of us.”

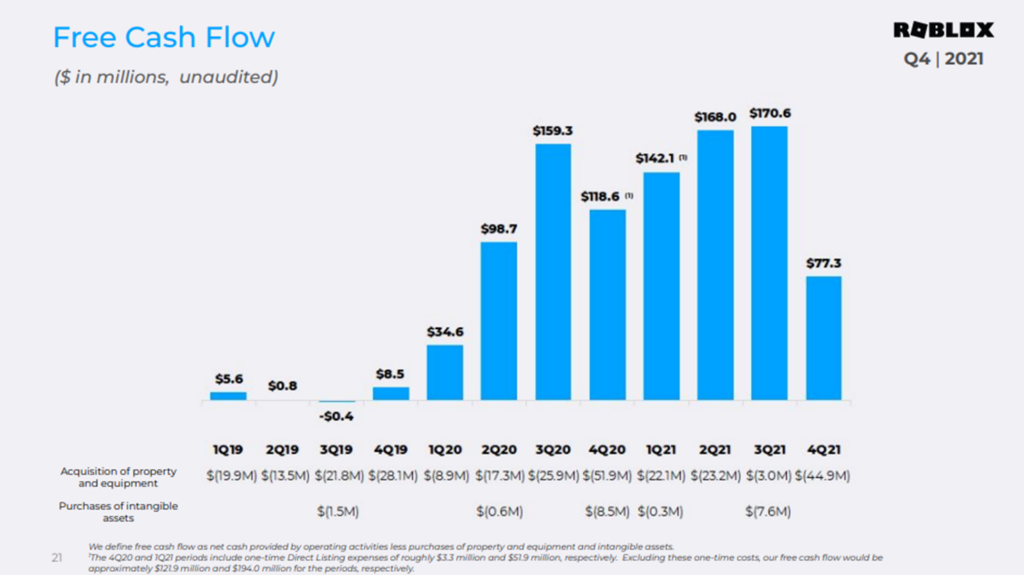

The firm recorded its lowest free cash flow since the second quarter of 2020 with US$77.3 million.

Further, the firm ended the quarter with US$3.00 billion in cash and cash equivalents, coming from a starting balance of US$1.93 billion. The cash inflow was heavily driven by US$990.0 million proceeds from issuing 2030 notes. This puts the balance of the current assets at US$3.75 billion while current liabilities ended at US$2.17 billion.

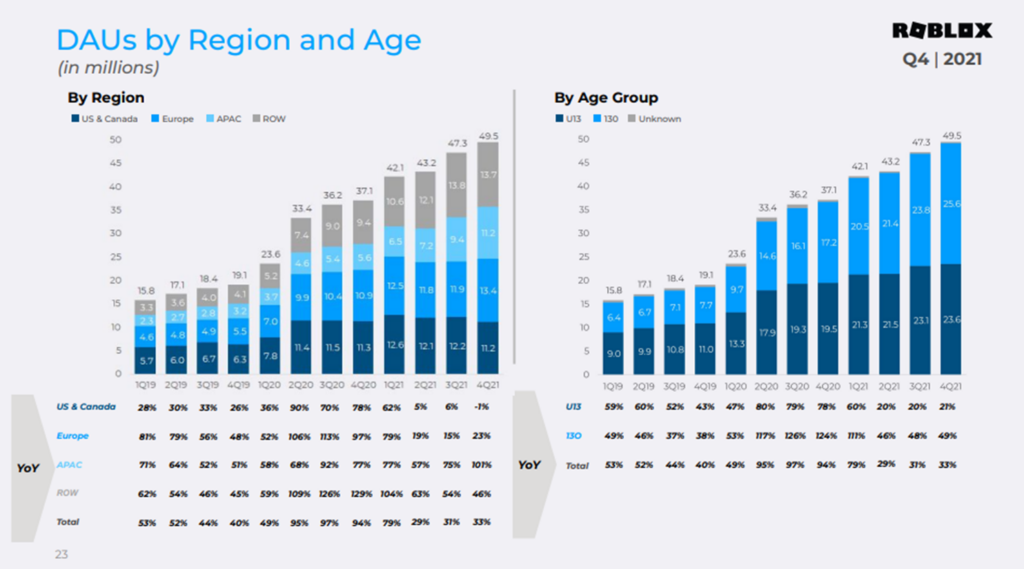

According to CEO David Baszucki, part of the firm’s strategy to widen its “nearly 55 million daily active users” base is continuing to “develop [its] technology to enable deeper forms of communication, immersion, and expression” in 2022. The gaming platform recently announced its partnership with National Football League for its metaverse football experience NFL Tycoons, based on the Super Bowl LVI.

The platform has seen an increasing trend of its user base, recording 49.5 million daily active users for the quarter. Around 23.6 million of these users are ages 13 and below, a 21% increase year-on-year.

However, BBC reported that the platform has become a venue for virtual age-inappropriate games and images, including BDSM activities and Nazi emblems. A Roblox spokesperson responded to the BBC by saying that “they know there is an extremely small subset of users who deliberately try to break the rules,” adding that it conducts “a safety review of every single image, video, and audio file uploaded.”

Gerber Kawasaki ETF portfolio manager Ross Gerber defended the firm by saying it is “the safest platform” that he allows his kids to play.

Roblox is the safest platform I let my kids on. This pre earnings news is BS. They do a great job keeping gaming safe and fun. $rblx

— Ross Gerber (@GerberKawasaki) February 15, 2022

Mad Money host Jim Cramer also previously advocated for the firm, noting that it is the “kind of stock [he’s] willing to plow through.” After the earnings release, he seems to have acknowledged the dip but claims it is “a terrific long story.”

OMG IT HAPPENED AGAIN LMFAO

— S&T (@rockstar_stocks) February 15, 2022

Jim Cramer said Roblox is the "kind of #stock I’m willing to plow through this period because it is such an original, terrific way to play the metaverse."

When he said this, $RBLX was trading around $85-$90.

Now, #RBLX plummeted to $59.50. pic.twitter.com/DsthoFsGHd

ouch–Roblox— but it is a terrific long term story

— Jim Cramer (@jimcramer) February 16, 2022

I can't get it out of my mind that Roblox seems almost contemptuous of those who want them to make money….

— Jim Cramer (@jimcramer) February 16, 2022

The firm also reported its key metric performance for January 2022, noting that bookings were US$220 – US$$223 million, up 2% – 3% year-over-year.

$RBLX calls pic.twitter.com/BXz8oXrv5e

— JAGUAR (@JaguarTradesX) February 15, 2022

Roblox last traded at US$54.90 on the NYSE, down 25.10% today.

Information for this briefing was found via the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.