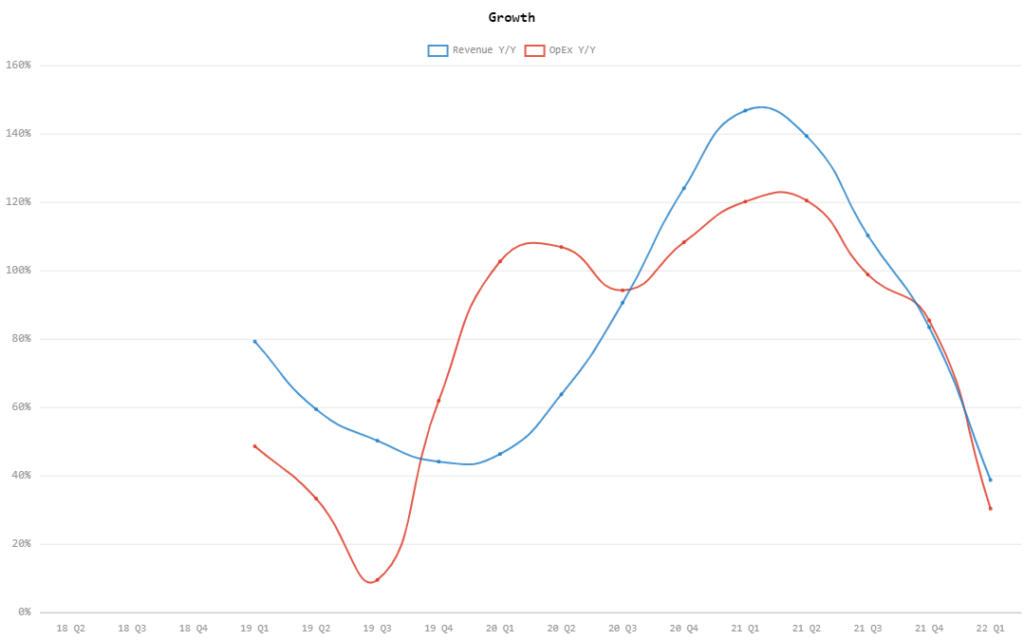

Roblox (NYSE: RBLX) reported on Tuesday its Q1 2022 financial results. The gaming company reported bookings of US$631.2 million, worse than the expected 0.9% year-on-year decline.

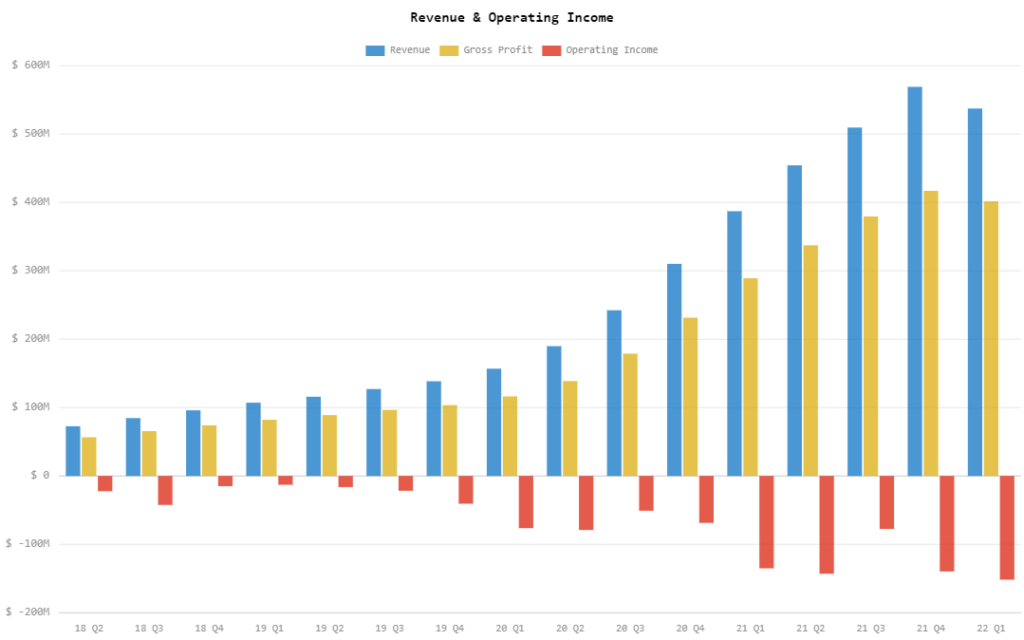

The topline figure is also a drop from Q4 2021’s US$770.1 million and Q1 2021’s US$652.3 million. Revenue for the quarter also declined to US$537.1 million from last quarter’s US$568.8 million but rose from last year’s US$387.0 million. This differentiates in a sense that bookings include “change in deferred revenue during the period and other non-cash adjustments,” which in layman’s terms includes the use of virtual currencies.

This could be interpreted that while there is an increase in revenue year-on-year, there is a decline in bookings–hence, a decline in the firm’s virtual currency Robux.

After releasing its financials late on Tuesday, its shares plummet as much as 10% post-closing bell.

The firm also saw a spike in its operating expenses, incurring US$688.7 million during the quarter vis-a-vis US$522.0 million last year. This led the company to notch an operating loss of US$151.7 million, wider than last quarter’s US$139.7 million and last year’s US$135.1 million operating losses, respectively.

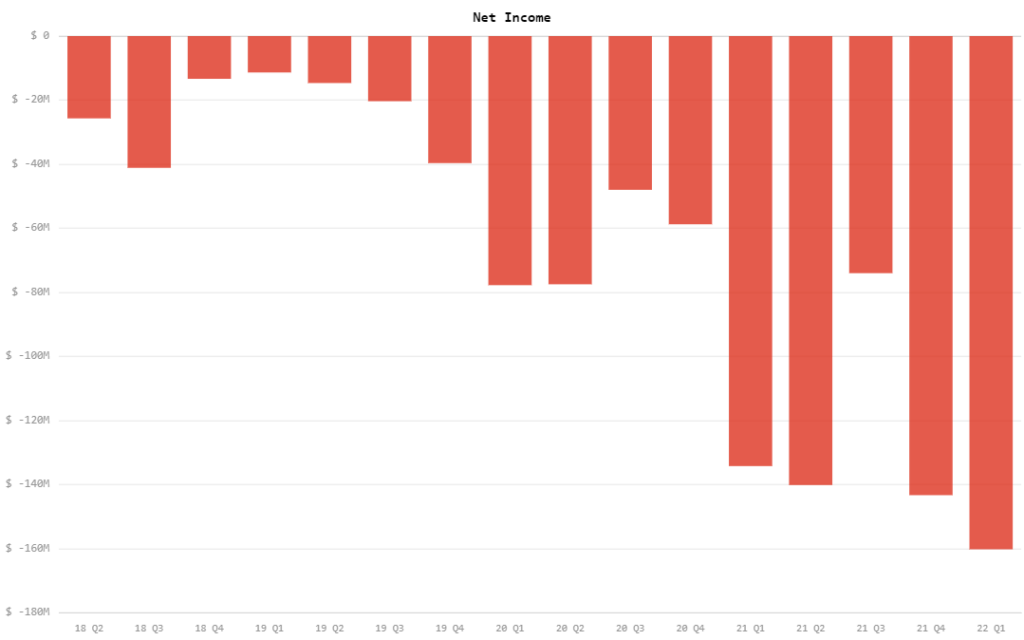

This further led the firm to record a net loss of US$162.0 million, even lower than last quarter’s record US$143.3 million net loss, and lower than last year’s US$134.2 million net loss. This translates to US$0.27 loss per share, missing the expected US$0.19 loss per share.

Calibrating for financial items, including the stock-based compensation of US$112.3 million, adjusted EBITDA for the quarter came in at US$67.9 million. This is a decline from last quarter’s US$168.0 million and last year’s US$190.2 million.

“We remained focused on delivering our innovation roadmap to unlock the full potential of the Roblox platform and drive long-term returns for investors,” said CEO David Baszucki. “Over the past two quarters, we have launched a number of notable innovations including spatial voice and layered clothing that will continue driving user growth, engagement and monetization.”

The firm recorded a free cash flow of US$104.6 million, up from last quarter’s record-low US$77.3 million but down from last year’s US$142.1 million.

Further, the firm ended the quarter with US$3.13 billion in cash and cash equivalents, coming from a starting balance of US$3.00 billion. This puts the balance of the current assets at US$3.75 billion while current liabilities ended at US$2.17 billion.

Bookings continue to decline post Q1 2022 in which the firm saw the number drop to between US$221 – US$224 million for April 2022, an 8% – 10% drop year-on-year.

Roblox last traded at US$23.19 on the NYSE.

Information for this briefing was found via Seeking Alpha and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.