Vancouver-based Rockland Resources Ltd. (CSE: RKL) recently announced that it has entered into the battery metals sector through an option agreement to earn a 100% interest in the Elektra claystone lithium project in northern Sonora, Mexico. The Elektra Project is located adjacent to the massive high-grade Sonora Lithium Project, a 50/50 joint-venture between Bacanora Lithium Plc and Ganfeng Lithium, which is currently under construction with lithium production expected to commence in 2023.

Lithium is a critical element necessary for manufacturing Lithium-Ion batteries and demand, which is expected to quadruple by 2025, is currently exceeding supply. The world is quickly moving to reduce carbon emissions to meet the global warming targets established under the Paris Climate Accords, and many countries have mandated that gasoline-powered vehicles will be eliminated by 2030. This has led to a boom in global EV manufacturing, and that in turn has led to significant investment in the battery gigafactories that produce the technologies needed to power EVs.

Unlike hard rock and brine lithium deposits, Claystone lithium deposits have recently become more widely understood by geologists and are considered to be a significant source of near-term low-cost open-pit lithium production.

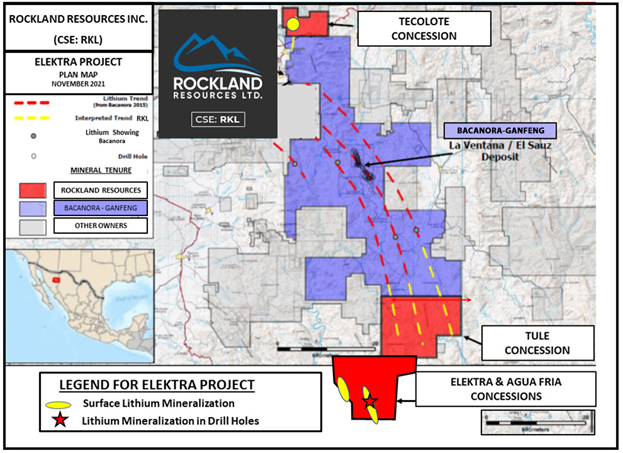

The 41,818 hectare Elektra Project comprises four exploration concessions in the northern portion of the prolific mining region of Sonora, Mexico, and are contiguous to the north and south of the Bacanora-Ganfeng Sonora Property, on trend with the mineralized lithium-bearing clay units found within volcanic sediments in the basins.

Only a small section of the Agua Fria target has been drill tested to date; the previous property owners conducted an initial RC (Reverse Circulation) drilling program in 2016-2017 on the target, which is located southwest of the Sonora Property. 16 holes were drilled and revealed significant lithium-bearing clay units in surface exposures, with intercepts returning values of 900 ppm Lithium (Li) over widths of up to 90 meters.

The best drill intercepts include:

- Hole AF 17-001 -1058 ppm Lithium over 33 meters at a depth of 3 meters, and also 1043 ppm Li over 21 meters at a depth of 54 meters.

- Hole AF 17-014 – 1050 ppm Li over 24 meters.

Members of the previous Elektra ownership group and technical team are still involved in the project, which will enable Rockland to fast-track its exploration activities.

Rockland also announced a $2.4 million non-brokered private placement of 12 million units at a price of $0.20 per unit in connection with the acquisition. Each unit will consist of one common share and one half of one transferable Share purchase warrant of the company, with each whole good for two years at an exercise price of $0.30 per shar. Proceeds from the private placement will be used to initiate exploration activities at the Elektra Project.

The acquisition of the Elektra Uranium Project represents Rockland’s entry into the battery metals sector and provides more asset diversification for the firm. If Rockland can discover significant high-grade lithium-bearing clay deposits at Elektra, this could create a potential takeout or joint-venture opportunity for the project in the future from Bacanora/Ganfeng or other larger players that may be looking for a strategic investment in the area.

With a tight capital structure of only 31.51 million shares outstanding and a small market capitalization of $6.93 million, Rockland is one option for investors looking for exposure to the lithium space.

FULL DISCLOSURE: Rockland Resources is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Rockland Resources on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.